Royalty streaming and mezzanine financing are two distinct investment strategies offering unique risk and return profiles. Royalty streaming provides investors with a percentage of revenue generated by an asset, ensuring consistent cash flow without equity dilution, while mezzanine financing combines debt and equity features, often involving subordinated debt with equity warrants to enhance returns. Explore the advantages and use cases of each to determine the best fit for your investment portfolio.

Why it is important

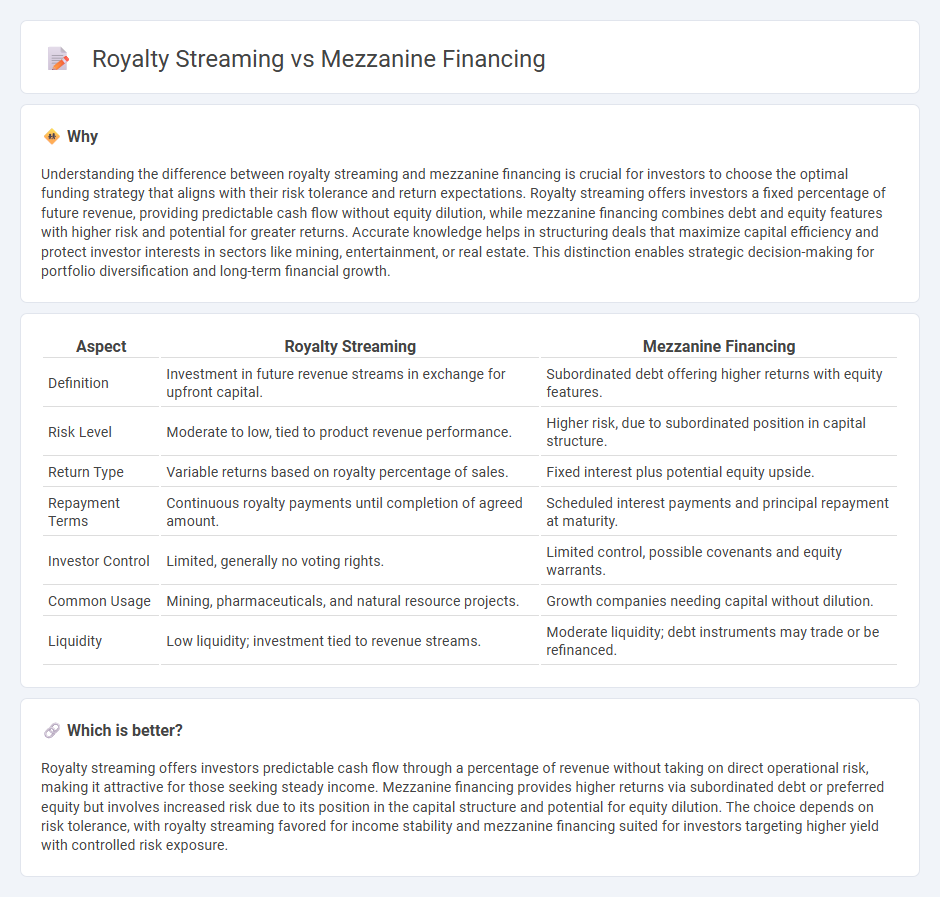

Understanding the difference between royalty streaming and mezzanine financing is crucial for investors to choose the optimal funding strategy that aligns with their risk tolerance and return expectations. Royalty streaming offers investors a fixed percentage of future revenue, providing predictable cash flow without equity dilution, while mezzanine financing combines debt and equity features with higher risk and potential for greater returns. Accurate knowledge helps in structuring deals that maximize capital efficiency and protect investor interests in sectors like mining, entertainment, or real estate. This distinction enables strategic decision-making for portfolio diversification and long-term financial growth.

Comparison Table

| Aspect | Royalty Streaming | Mezzanine Financing |

|---|---|---|

| Definition | Investment in future revenue streams in exchange for upfront capital. | Subordinated debt offering higher returns with equity features. |

| Risk Level | Moderate to low, tied to product revenue performance. | Higher risk, due to subordinated position in capital structure. |

| Return Type | Variable returns based on royalty percentage of sales. | Fixed interest plus potential equity upside. |

| Repayment Terms | Continuous royalty payments until completion of agreed amount. | Scheduled interest payments and principal repayment at maturity. |

| Investor Control | Limited, generally no voting rights. | Limited control, possible covenants and equity warrants. |

| Common Usage | Mining, pharmaceuticals, and natural resource projects. | Growth companies needing capital without dilution. |

| Liquidity | Low liquidity; investment tied to revenue streams. | Moderate liquidity; debt instruments may trade or be refinanced. |

Which is better?

Royalty streaming offers investors predictable cash flow through a percentage of revenue without taking on direct operational risk, making it attractive for those seeking steady income. Mezzanine financing provides higher returns via subordinated debt or preferred equity but involves increased risk due to its position in the capital structure and potential for equity dilution. The choice depends on risk tolerance, with royalty streaming favored for income stability and mezzanine financing suited for investors targeting higher yield with controlled risk exposure.

Connection

Royalty streaming and mezzanine financing are connected as alternative investment strategies providing capital to companies without diluting equity ownership. Royalty streaming allows investors to receive a percentage of revenues or production, often in resource sectors, while mezzanine financing offers subordinated debt with equity kickers, balancing risk and return for growth-stage businesses. Both methods bridge the capital gap between senior debt and equity, enhancing portfolio diversification for investors seeking higher yields.

Key Terms

Subordinated Debt

Mezzanine financing involves subordinated debt that blends debt and equity characteristics, offering higher returns due to increased risk beneath senior debt in capital structure. Royalty streaming, while not classified as debt, provides upfront capital in exchange for a percentage of future revenue or production, avoiding dilution but lacking typical debt repayments. Explore the nuances of subordinated debt impact in both financing options to optimize capital strategy.

Equity Kicker

Mezzanine financing often includes an equity kicker, providing lenders with additional returns through warrants or options linked to the borrower's equity, enhancing compensation beyond interest payments. Royalty streaming, while primarily based on revenue-sharing agreements, typically lacks a direct equity kicker but offers investors steady cash flow tied to production or sales volumes. Explore in-depth comparisons to understand which financing structure best aligns with your investment goals and risk appetite.

Revenue-Based Payments

Mezzanine financing typically involves debt with warrants, offering fixed interest payments plus equity upside, while royalty streaming provides a percentage of revenue generated without ownership dilution. Revenue-based payments in royalty streaming are directly tied to sales performance, aligning lender returns with company success, contrasting with mezzanine's fixed or variable interest regardless of revenue fluctuations. Explore detailed comparisons to understand how revenue-based payments influence financing strategies and risk profiles.

Source and External Links

What is Mezzanine Financing? - PGIM Private Capital - Mezzanine financing is a hybrid capital resource that falls between senior debt and equity, combining features of both to fund growth, acquisitions, recapitalizations, and other strategic initiatives.

What is Mezzanine Financing - Mezzanine financing offers flexible repayment terms adapted to a company's cash flow, is typically unsecured and subordinated to senior debt, and is often treated as equity on the balance sheet to improve leverage.

Mezzanine Financing - Overview, Rate of Return, Benefits - Mezzanine financing fills the gap between senior debt and equity, is usually unsecured or structured as preferred stock, and offers investors higher returns (typically 12-20%) through periodic cash payments or payment-in-kind interest.

dowidth.com

dowidth.com