NFT domain names represent a rising digital asset class leveraging blockchain technology for unique, tradable web identities, offering high liquidity and speculative growth potential. Hedge funds, managed portfolios pooling diverse assets, provide professional risk management and access to alternative strategies for wealth preservation and consistent returns. Explore the distinct advantages and risks of investing in NFT domain names versus hedge funds to make informed financial decisions.

Why it is important

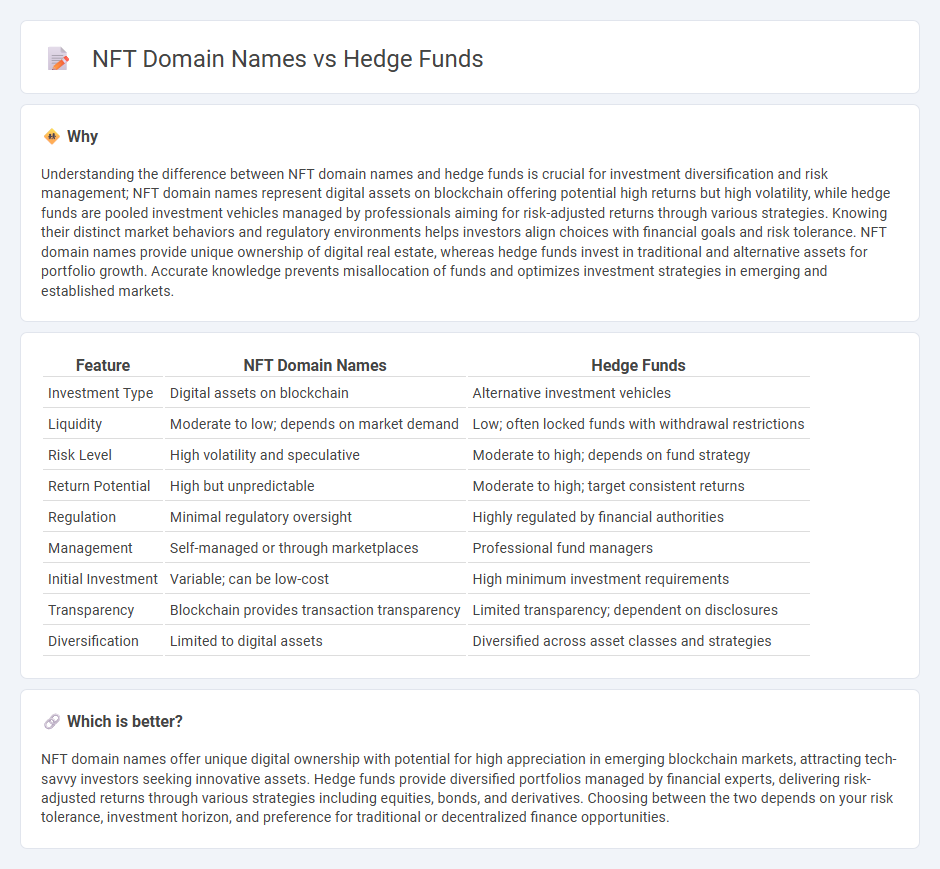

Understanding the difference between NFT domain names and hedge funds is crucial for investment diversification and risk management; NFT domain names represent digital assets on blockchain offering potential high returns but high volatility, while hedge funds are pooled investment vehicles managed by professionals aiming for risk-adjusted returns through various strategies. Knowing their distinct market behaviors and regulatory environments helps investors align choices with financial goals and risk tolerance. NFT domain names provide unique ownership of digital real estate, whereas hedge funds invest in traditional and alternative assets for portfolio growth. Accurate knowledge prevents misallocation of funds and optimizes investment strategies in emerging and established markets.

Comparison Table

| Feature | NFT Domain Names | Hedge Funds |

|---|---|---|

| Investment Type | Digital assets on blockchain | Alternative investment vehicles |

| Liquidity | Moderate to low; depends on market demand | Low; often locked funds with withdrawal restrictions |

| Risk Level | High volatility and speculative | Moderate to high; depends on fund strategy |

| Return Potential | High but unpredictable | Moderate to high; target consistent returns |

| Regulation | Minimal regulatory oversight | Highly regulated by financial authorities |

| Management | Self-managed or through marketplaces | Professional fund managers |

| Initial Investment | Variable; can be low-cost | High minimum investment requirements |

| Transparency | Blockchain provides transaction transparency | Limited transparency; dependent on disclosures |

| Diversification | Limited to digital assets | Diversified across asset classes and strategies |

Which is better?

NFT domain names offer unique digital ownership with potential for high appreciation in emerging blockchain markets, attracting tech-savvy investors seeking innovative assets. Hedge funds provide diversified portfolios managed by financial experts, delivering risk-adjusted returns through various strategies including equities, bonds, and derivatives. Choosing between the two depends on your risk tolerance, investment horizon, and preference for traditional or decentralized finance opportunities.

Connection

NFT domain names represent digital assets that hedge funds increasingly include in their portfolios to diversify investments and capitalize on blockchain technology. These domain names, secured via blockchain, offer hedge funds unique opportunities for asset appreciation and intellectual property protection in the rapidly evolving digital economy. Incorporating NFT domains aligns with hedge funds' strategic goals to leverage emerging markets and drive long-term growth through innovative asset classes.

Key Terms

Leverage

Hedge funds utilize financial leverage to amplify investment returns by borrowing capital, often managing assets valued in billions, with leverage ratios varying widely depending on strategy and risk tolerance. NFT domain names, although not leveraging traditional financial borrowing, offer alternative leverage through digital asset ownership and blockchain technology, enabling potential value appreciation and unique market positioning in the rapidly growing decentralized web ecosystem. Explore the strategic differences between these leverage models to better understand their impact on investment and asset growth.

Liquidity

Hedge funds offer high liquidity through tradable assets like stocks and bonds, enabling quick entry and exit in financial markets. NFT domain names provide liquidity via blockchain technology by allowing seamless ownership transfer and decentralized trading on digital marketplaces. Explore more about how liquidity dynamics differ between hedge funds and NFT domain names to enhance your investment strategy.

Ownership

Hedge funds typically hold diversified portfolios managed by professionals to maximize returns, emphasizing financial ownership and asset control. NFT domain names represent digital property ownership secured on a blockchain, granting users exclusive rights and verifiable provenance. Explore the unique advantages and ownership dynamics of these assets to understand their value and potential.

Source and External Links

Hedge Funds: Overview, Recruitment, Careers & Salaries - Hedge funds are investment firms that pool capital from institutional and accredited investors to pursue a wide range of alternative strategies--such as short selling, derivatives, and event-driven investing--aiming to deliver absolute returns regardless of market conditions.

Hedge Funds | Investor.gov - Hedge funds are private, unregistered investment pools that use flexible and often complex strategies to seek positive returns, typically catering only to sophisticated or institutional investors and operating with less regulatory oversight than mutual funds or ETFs.

Hedge fund - Wikipedia - Hedge funds are pooled investment vehicles that employ diverse and sometimes highly leveraged strategies, often charging both a management fee and a performance fee, and while originally designed to hedge risk, many now pursue aggressive growth with the potential to amplify both gains and losses.

dowidth.com

dowidth.com