Rare streetwear flipping involves buying limited-edition clothing and sneakers at retail prices and reselling them at a higher value on secondary markets, driven by high demand and cultural trends. Luxury watch flipping focuses on acquiring sought-after timepieces from brands like Rolex and Patek Philippe, which appreciate over time due to craftsmanship and brand prestige. Discover the key differences and strategies that can maximize your returns in these unique investment markets.

Why it is important

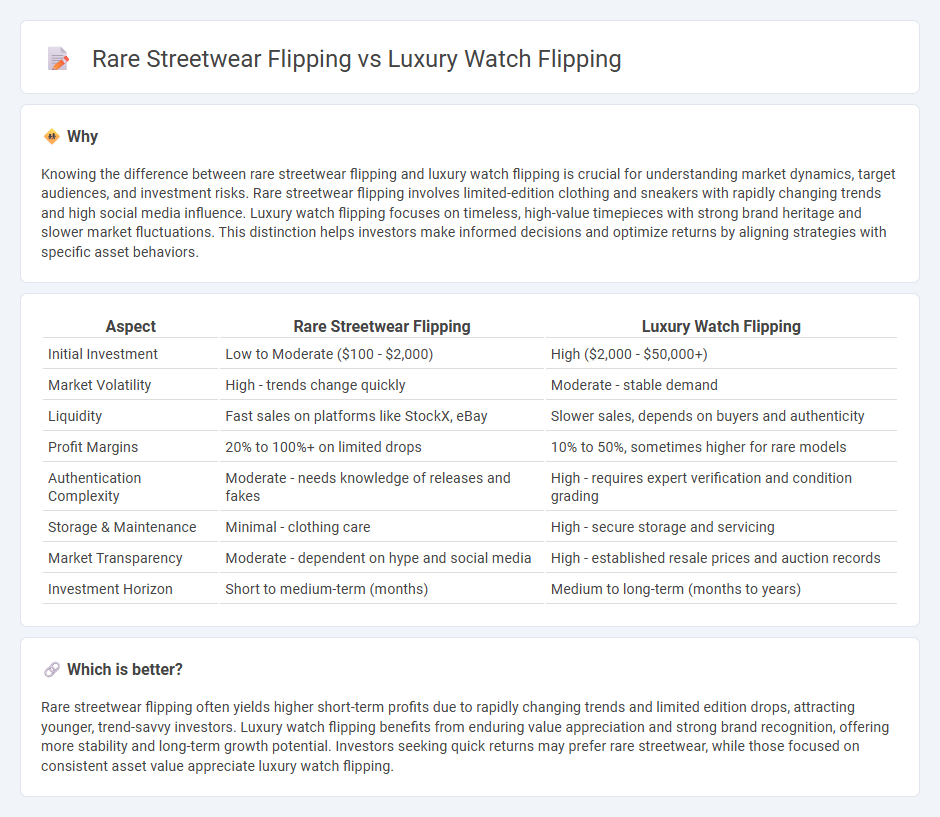

Knowing the difference between rare streetwear flipping and luxury watch flipping is crucial for understanding market dynamics, target audiences, and investment risks. Rare streetwear flipping involves limited-edition clothing and sneakers with rapidly changing trends and high social media influence. Luxury watch flipping focuses on timeless, high-value timepieces with strong brand heritage and slower market fluctuations. This distinction helps investors make informed decisions and optimize returns by aligning strategies with specific asset behaviors.

Comparison Table

| Aspect | Rare Streetwear Flipping | Luxury Watch Flipping |

|---|---|---|

| Initial Investment | Low to Moderate ($100 - $2,000) | High ($2,000 - $50,000+) |

| Market Volatility | High - trends change quickly | Moderate - stable demand |

| Liquidity | Fast sales on platforms like StockX, eBay | Slower sales, depends on buyers and authenticity |

| Profit Margins | 20% to 100%+ on limited drops | 10% to 50%, sometimes higher for rare models |

| Authentication Complexity | Moderate - needs knowledge of releases and fakes | High - requires expert verification and condition grading |

| Storage & Maintenance | Minimal - clothing care | High - secure storage and servicing |

| Market Transparency | Moderate - dependent on hype and social media | High - established resale prices and auction records |

| Investment Horizon | Short to medium-term (months) | Medium to long-term (months to years) |

Which is better?

Rare streetwear flipping often yields higher short-term profits due to rapidly changing trends and limited edition drops, attracting younger, trend-savvy investors. Luxury watch flipping benefits from enduring value appreciation and strong brand recognition, offering more stability and long-term growth potential. Investors seeking quick returns may prefer rare streetwear, while those focused on consistent asset value appreciate luxury watch flipping.

Connection

Rare streetwear flipping and luxury watch flipping both leverage scarcity and high demand to generate significant returns on investment. These markets capitalize on limited edition releases, brand prestige, and cultural trends, creating an ecosystem where timing, authenticity, and market knowledge are crucial for maximizing profits. Investors in both domains benefit from understanding resale value fluctuations and digital platforms facilitating peer-to-peer transactions.

Key Terms

**Luxury watch flipping:**

Luxury watch flipping involves buying high-demand timepieces from brands like Rolex, Patek Philippe, and Audemars Piguet at retail or secondary market prices, then reselling them for significant profits driven by scarcity and brand prestige. Market dynamics such as limited releases, waiting lists, and growing collector interest increase the value of luxury watches over time. Explore how strategic watch flipping can generate lucrative returns and insights into market trends.

Authentication

Authenticating luxury watches requires expertise in verifying serial numbers, movement types, and brand-specific markers, making it essential to avoid counterfeit risks in flipping. Rare streetwear authentication involves examining materials, stitching quality, and provenance through authorized retailers or trusted resale platforms to ensure genuine merchandise. Explore in-depth authentication techniques to maximize profitability and trust in both luxury watch and rare streetwear flipping markets.

Provenance

Luxury watch flipping thrives on precise Provenance, with detailed service histories and original documentation significantly boosting resale value. Rare streetwear flipping depends heavily on verified authenticity, limited edition releases, and traceable ownership to justify premium pricing. Explore how Provenance shapes market trust and profitability in both luxury watch and rare streetwear flipping sectors.

Source and External Links

Guide: How To Start Flipping Watches For Profit - This guide explains that the most profitable watches to flip are often older limited editions, recommends starting with brands like Seiko, and advises checking prices on eBay and Chrono24 to confirm potential profit margins before buying.

Important Rules to Buying and Selling Affordable & Luxury Watches - A video sharing key rules and strategies for flipping watches, including spotting undervalued pieces due to poor listing descriptions, with an example of flipping a minute repeater watch for a $4,000 profit.

How to make fast money flipping luxury watches in NYC ... - Instagram - A recent Instagram reel showcasing methods to quickly profit by flipping luxury watches, particularly in the New York City market.

dowidth.com

dowidth.com