Crowdlending platforms enable investors to directly fund loans to individuals or businesses, often yielding higher returns through peer-to-peer lending models, while robo-advisors use automated algorithms to create and manage diversified investment portfolios based on user risk profiles. Crowdlending offers more control over individual loan choices but carries higher default risk, whereas robo-advisors provide convenience, professional portfolio management, and typically lower risk through broad market exposure. Explore the advantages and potential drawbacks of each to determine the best fit for your investment strategy.

Why it is important

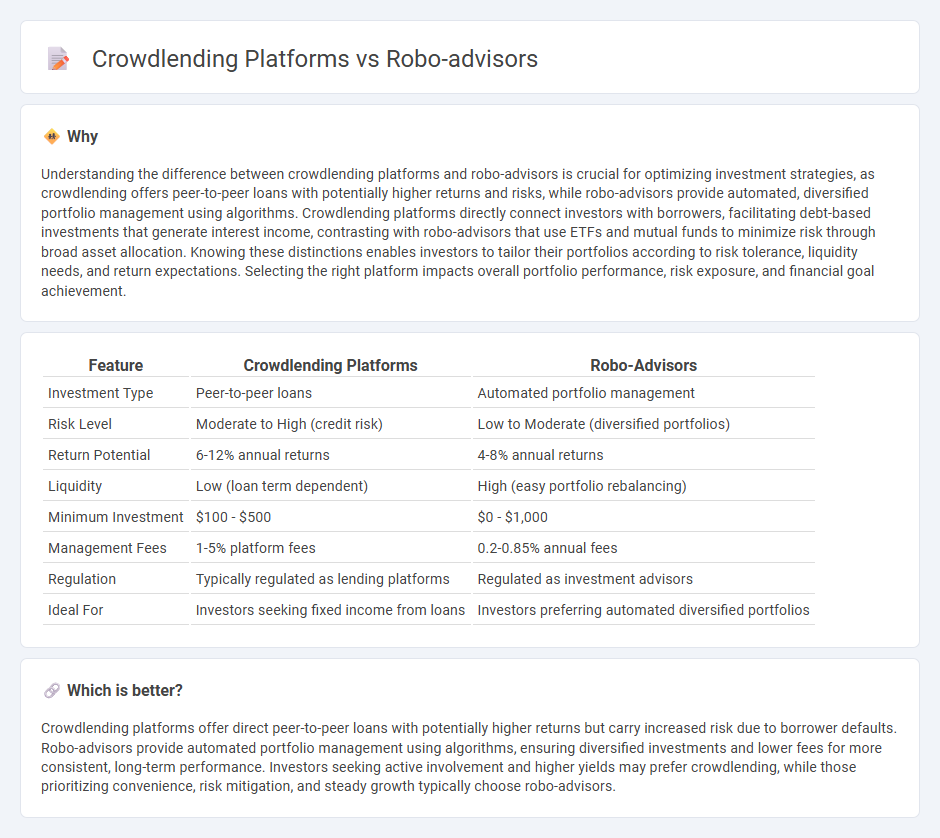

Understanding the difference between crowdlending platforms and robo-advisors is crucial for optimizing investment strategies, as crowdlending offers peer-to-peer loans with potentially higher returns and risks, while robo-advisors provide automated, diversified portfolio management using algorithms. Crowdlending platforms directly connect investors with borrowers, facilitating debt-based investments that generate interest income, contrasting with robo-advisors that use ETFs and mutual funds to minimize risk through broad asset allocation. Knowing these distinctions enables investors to tailor their portfolios according to risk tolerance, liquidity needs, and return expectations. Selecting the right platform impacts overall portfolio performance, risk exposure, and financial goal achievement.

Comparison Table

| Feature | Crowdlending Platforms | Robo-Advisors |

|---|---|---|

| Investment Type | Peer-to-peer loans | Automated portfolio management |

| Risk Level | Moderate to High (credit risk) | Low to Moderate (diversified portfolios) |

| Return Potential | 6-12% annual returns | 4-8% annual returns |

| Liquidity | Low (loan term dependent) | High (easy portfolio rebalancing) |

| Minimum Investment | $100 - $500 | $0 - $1,000 |

| Management Fees | 1-5% platform fees | 0.2-0.85% annual fees |

| Regulation | Typically regulated as lending platforms | Regulated as investment advisors |

| Ideal For | Investors seeking fixed income from loans | Investors preferring automated diversified portfolios |

Which is better?

Crowdlending platforms offer direct peer-to-peer loans with potentially higher returns but carry increased risk due to borrower defaults. Robo-advisors provide automated portfolio management using algorithms, ensuring diversified investments and lower fees for more consistent, long-term performance. Investors seeking active involvement and higher yields may prefer crowdlending, while those prioritizing convenience, risk mitigation, and steady growth typically choose robo-advisors.

Connection

Crowdlending platforms and robo-advisors are connected through their use of technology to democratize investment opportunities and optimize portfolio management. Crowdlending platforms enable investors to fund loans directly to businesses or individuals, while robo-advisors use algorithms to allocate investments across diverse assets, including crowdlending opportunities. Integrating crowdlending into robo-advisor portfolios enhances diversification, risk management, and potential returns for investors.

Key Terms

Automation

Robo-advisors utilize advanced algorithms and artificial intelligence to automate investment portfolio management, ensuring continuous rebalancing and personalized financial planning with minimal human intervention. Crowdlending platforms automate the process of matching borrowers with investors, streamlining loan origination, credit assessment, and repayment tracking using data-driven technology. Explore the key differences and benefits of automation in both models to optimize your investment strategy.

Risk assessment

Robo-advisors utilize advanced algorithms and machine learning to assess risk by analyzing vast datasets, including market trends and individual investor profiles, ensuring personalized portfolio management. Crowdlending platforms primarily evaluate borrower creditworthiness through credit scores, financial history, and loan purpose, emphasizing default risk mitigation. Explore detailed comparisons to understand how each approach optimizes risk assessment and investment outcomes.

Returns

Robo-advisors typically offer returns ranging from 4% to 8% annually by using algorithm-driven portfolio management and diversified assets such as ETFs and bonds. Crowdlending platforms, on the other hand, can deliver higher returns of 8% to 12%, driven by peer-to-peer lending in sectors like small businesses and real estate but carry increased credit risk. Explore detailed comparisons to understand which investment aligns best with your financial goals and risk tolerance.

Source and External Links

Robo-advisor - Wikipedia - Robo-advisors are automated financial advisers that provide personalized investment management online using algorithms with minimal human intervention, offering accessible and lower-cost wealth management primarily through ETFs based on clients' risk tolerance and goals.

What is a robo advisor? | Fidelity Investments - Robo-advisors use technology to automate investing by collecting personal financial information and risk tolerance to create and maintain diversified portfolios, typically rebalancing automatically over time to keep clients on track.

The Best Robo-Advisors of 2025 - Morningstar - Robo-advisors blend automation and investment management by using algorithms to provide semitailored asset allocation with low fees, positioning themselves between traditional wealth managers and DIY platforms, often including additional financial planning tools and human advisor access.

dowidth.com

dowidth.com