Whiskey cask investment offers high-growth potential through the aging process that increases the value of rare and limited-edition casks, while timberland investment provides steady, long-term returns driven by sustainable forest management and timber sales. Whiskey casks have shown significant appreciation in niche markets, whereas timberland investments benefit from both capital gains and periodic income from harvesting. Explore the distinct advantages and risks of whiskey cask and timberland investments to diversify your portfolio effectively.

Why it is important

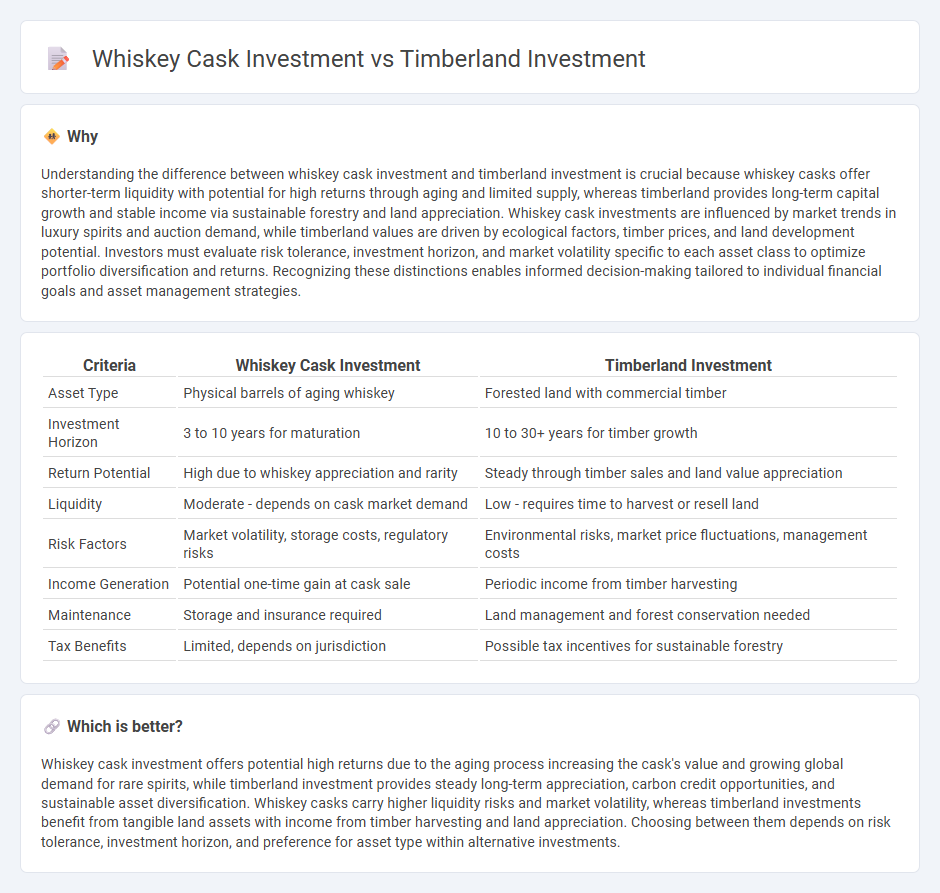

Understanding the difference between whiskey cask investment and timberland investment is crucial because whiskey casks offer shorter-term liquidity with potential for high returns through aging and limited supply, whereas timberland provides long-term capital growth and stable income via sustainable forestry and land appreciation. Whiskey cask investments are influenced by market trends in luxury spirits and auction demand, while timberland values are driven by ecological factors, timber prices, and land development potential. Investors must evaluate risk tolerance, investment horizon, and market volatility specific to each asset class to optimize portfolio diversification and returns. Recognizing these distinctions enables informed decision-making tailored to individual financial goals and asset management strategies.

Comparison Table

| Criteria | Whiskey Cask Investment | Timberland Investment |

|---|---|---|

| Asset Type | Physical barrels of aging whiskey | Forested land with commercial timber |

| Investment Horizon | 3 to 10 years for maturation | 10 to 30+ years for timber growth |

| Return Potential | High due to whiskey appreciation and rarity | Steady through timber sales and land value appreciation |

| Liquidity | Moderate - depends on cask market demand | Low - requires time to harvest or resell land |

| Risk Factors | Market volatility, storage costs, regulatory risks | Environmental risks, market price fluctuations, management costs |

| Income Generation | Potential one-time gain at cask sale | Periodic income from timber harvesting |

| Maintenance | Storage and insurance required | Land management and forest conservation needed |

| Tax Benefits | Limited, depends on jurisdiction | Possible tax incentives for sustainable forestry |

Which is better?

Whiskey cask investment offers potential high returns due to the aging process increasing the cask's value and growing global demand for rare spirits, while timberland investment provides steady long-term appreciation, carbon credit opportunities, and sustainable asset diversification. Whiskey casks carry higher liquidity risks and market volatility, whereas timberland investments benefit from tangible land assets with income from timber harvesting and land appreciation. Choosing between them depends on risk tolerance, investment horizon, and preference for asset type within alternative investments.

Connection

Whiskey cask investment and timberland investment are connected through their shared reliance on natural assets that appreciate over time due to limited supply and increasing demand. Both asset classes benefit from aging processes--whiskey casks mature spirits that gain value, while timberlands grow trees that increase timber volume and worth. These investments offer diversification by combining tangible, long-term holdings influenced by environmental factors and market trends in luxury goods and sustainable materials.

Key Terms

Asset Liquidity

Timberland investment offers moderate asset liquidity through sale or lease of forest land, but transactions can be time-consuming due to property size and regulatory considerations. Whiskey cask investment provides higher liquidity with smaller transaction units and established secondary markets, allowing quicker asset turnover and potential resale before maturation. Explore detailed comparisons to determine which investment aligns better with your liquidity needs.

Maturation Period

Timberland investments typically require long-term holding periods of 10 to 30 years to realize substantial value growth, reflecting the natural growth cycle of trees and market demand for sustainable wood products. Whiskey cask investments have a more defined maturation period of 3 to 12 years, during which the spirit develops flavor, directly impacting cask value based on rarity and quality. Explore the maturation differences further to determine which asset aligns with your investment horizon and risk appetite.

Market Volatility

Timberland investment offers lower market volatility due to its tangible asset nature and steady demand driven by global timber supply and construction trends. Whiskey cask investment experiences higher volatility influenced by factors like aging processes, limited supply, and fluctuating collector interest in rare casks. Explore the risk and return profiles of these unique asset classes for a comprehensive investment strategy.

Source and External Links

Timberland - Overview, How to Diversify, Benefits of Investing - Timberland investments involve putting money into managed tree plantations or natural forests, offering predictable growth and diversification opportunities.

Timberland - J.P. Morgan Asset Management - Investing in timberland provides benefits like inflation risk management, regular income, and enhanced portfolio diversification.

BTG Pactual Timberland Investment Group - This group delivers sustainable timberland investments to institutional investors, focusing on sustainable forestry practices and substantial sustainability performance.

dowidth.com

dowidth.com