Fine art micro-shares allow investors to own fractional interests in valuable artworks, diversifying portfolios with tangible cultural assets. Real estate crowdfunding pools capital from multiple investors to finance property projects, offering access to real estate markets with lower entry costs. Explore the advantages and risks of these innovative investment options to determine which aligns best with your financial goals.

Why it is important

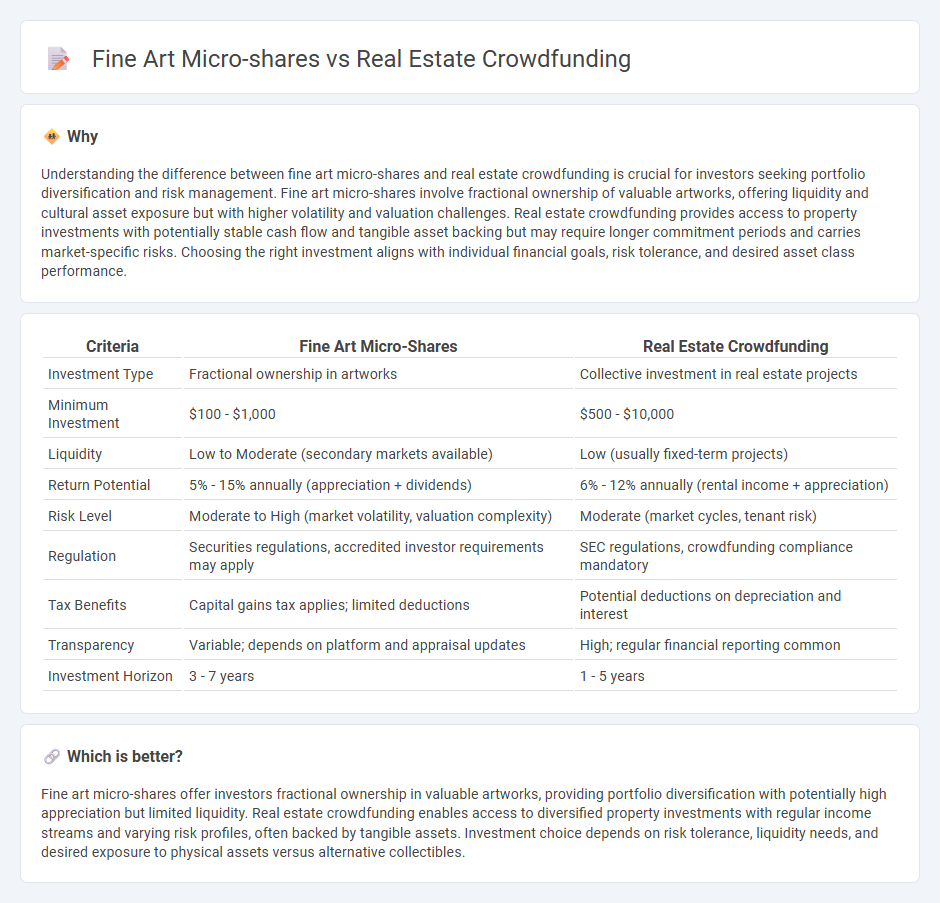

Understanding the difference between fine art micro-shares and real estate crowdfunding is crucial for investors seeking portfolio diversification and risk management. Fine art micro-shares involve fractional ownership of valuable artworks, offering liquidity and cultural asset exposure but with higher volatility and valuation challenges. Real estate crowdfunding provides access to property investments with potentially stable cash flow and tangible asset backing but may require longer commitment periods and carries market-specific risks. Choosing the right investment aligns with individual financial goals, risk tolerance, and desired asset class performance.

Comparison Table

| Criteria | Fine Art Micro-Shares | Real Estate Crowdfunding |

|---|---|---|

| Investment Type | Fractional ownership in artworks | Collective investment in real estate projects |

| Minimum Investment | $100 - $1,000 | $500 - $10,000 |

| Liquidity | Low to Moderate (secondary markets available) | Low (usually fixed-term projects) |

| Return Potential | 5% - 15% annually (appreciation + dividends) | 6% - 12% annually (rental income + appreciation) |

| Risk Level | Moderate to High (market volatility, valuation complexity) | Moderate (market cycles, tenant risk) |

| Regulation | Securities regulations, accredited investor requirements may apply | SEC regulations, crowdfunding compliance mandatory |

| Tax Benefits | Capital gains tax applies; limited deductions | Potential deductions on depreciation and interest |

| Transparency | Variable; depends on platform and appraisal updates | High; regular financial reporting common |

| Investment Horizon | 3 - 7 years | 1 - 5 years |

Which is better?

Fine art micro-shares offer investors fractional ownership in valuable artworks, providing portfolio diversification with potentially high appreciation but limited liquidity. Real estate crowdfunding enables access to diversified property investments with regular income streams and varying risk profiles, often backed by tangible assets. Investment choice depends on risk tolerance, liquidity needs, and desired exposure to physical assets versus alternative collectibles.

Connection

Fine art micro-shares and real estate crowdfunding are connected through their shared model of fractional ownership, allowing investors to buy smaller portions of high-value assets. Both investment methods leverage technology platforms to democratize access, expanding opportunities beyond traditional high-net-worth investors. This fractional approach diversifies portfolios by providing exposure to alternative asset classes with potentially lower entry costs and varied risk profiles.

Key Terms

Liquidity

Real estate crowdfunding platforms typically offer lower liquidity compared to fine art micro-shares due to longer investment horizons and limited secondary markets. Fine art micro-shares benefit from more active secondary trading platforms, enabling quicker asset liquidation and enhanced portfolio flexibility. Explore the nuances of liquidity in these alternative investments for informed decision-making.

Fractional ownership

Real estate crowdfunding platforms enable investors to purchase fractional ownership in properties, offering diversification and accessibility to high-value assets without full capital investment. Fine art micro-shares allow collectors to acquire small stake percentages in valuable artworks, providing liquidity and entry into the art market traditionally dominated by wealthy individuals. Explore more about the benefits and risks of fractional ownership in these emerging investment sectors.

Platform fees

Real estate crowdfunding platforms typically charge platform fees ranging from 1% to 3% of the invested amount, along with annual asset management fees between 0.5% and 2%. Fine art micro-shares platforms often impose lower entry fees but can have higher ongoing costs due to appraisal, storage, and insurance fees, which may total 3% to 5% annually. Explore detailed comparisons of fee structures to determine the most cost-effective investment strategy for your portfolio.

Source and External Links

Crowdfunding real estate: What to know - Real estate crowdfunding enables investors to pool money online to buy shares of residential or commercial properties they can't afford alone, helping diversify portfolios with less effort and providing access to investments for both accredited and nonaccredited investors.

Crowdfunding - Crowdfunding in real estate involves pooling money via platforms like Crowdstreet, Fundrise, and YieldStreet to fund projects and earn passive income, simplifying traditional real estate investment and portfolio building.

Arrived | Easily Invest in Real Estate - Arrived offers a platform for investing in rental properties starting at $100, providing passive rental income, property appreciation potential, and professional property management, making real estate investment more accessible and diversified.

dowidth.com

dowidth.com