Secondaries in venture capital involve purchasing existing shares from early investors or employees in a startup, providing liquidity without diluting ownership, while syndicate investing pools capital from multiple investors to collectively invest in new startup rounds, spreading risk and leveraging collective expertise. Both strategies offer unique advantages in venture capital; secondaries provide access to mature assets with potentially lower risk, whereas syndicates enable entry into early-stage opportunities with higher growth potential. Explore these investment approaches further to determine which suits your portfolio strategy best.

Why it is important

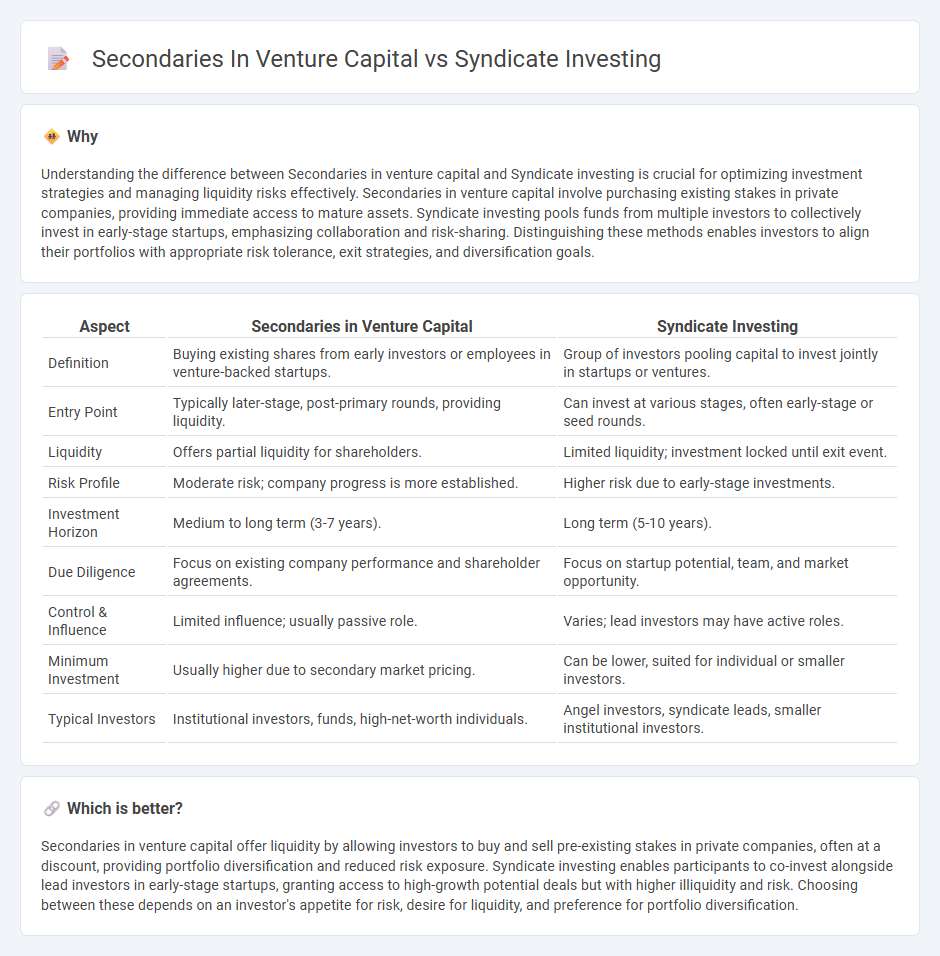

Understanding the difference between Secondaries in venture capital and Syndicate investing is crucial for optimizing investment strategies and managing liquidity risks effectively. Secondaries in venture capital involve purchasing existing stakes in private companies, providing immediate access to mature assets. Syndicate investing pools funds from multiple investors to collectively invest in early-stage startups, emphasizing collaboration and risk-sharing. Distinguishing these methods enables investors to align their portfolios with appropriate risk tolerance, exit strategies, and diversification goals.

Comparison Table

| Aspect | Secondaries in Venture Capital | Syndicate Investing |

|---|---|---|

| Definition | Buying existing shares from early investors or employees in venture-backed startups. | Group of investors pooling capital to invest jointly in startups or ventures. |

| Entry Point | Typically later-stage, post-primary rounds, providing liquidity. | Can invest at various stages, often early-stage or seed rounds. |

| Liquidity | Offers partial liquidity for shareholders. | Limited liquidity; investment locked until exit event. |

| Risk Profile | Moderate risk; company progress is more established. | Higher risk due to early-stage investments. |

| Investment Horizon | Medium to long term (3-7 years). | Long term (5-10 years). |

| Due Diligence | Focus on existing company performance and shareholder agreements. | Focus on startup potential, team, and market opportunity. |

| Control & Influence | Limited influence; usually passive role. | Varies; lead investors may have active roles. |

| Minimum Investment | Usually higher due to secondary market pricing. | Can be lower, suited for individual or smaller investors. |

| Typical Investors | Institutional investors, funds, high-net-worth individuals. | Angel investors, syndicate leads, smaller institutional investors. |

Which is better?

Secondaries in venture capital offer liquidity by allowing investors to buy and sell pre-existing stakes in private companies, often at a discount, providing portfolio diversification and reduced risk exposure. Syndicate investing enables participants to co-invest alongside lead investors in early-stage startups, granting access to high-growth potential deals but with higher illiquidity and risk. Choosing between these depends on an investor's appetite for risk, desire for liquidity, and preference for portfolio diversification.

Connection

Secondaries in venture capital involve the buying and selling of pre-existing investor stakes, providing liquidity and enabling portfolio diversification. Syndicate investing aggregates capital from multiple investors to participate in venture rounds, often allowing easier access to secondaries through collective bargaining power. The connection lies in syndicates facilitating secondary transactions by pooling resources, increasing deal flow, and creating opportunities for investors to enter or exit venture positions efficiently.

Key Terms

Pooling Capital

Syndicate investing in venture capital involves multiple investors pooling capital to collectively fund startups, allowing access to larger deals and diversified risk. Secondaries in venture capital involve purchasing pre-existing stakes from early investors or employees, providing liquidity and entry to mature ventures without participation in initial funding rounds. Explore the detailed advantages and mechanisms behind pooling capital in both strategies to optimize your venture investment portfolio.

Liquidity

Syndicate investing in venture capital allows participation in early-stage deals through collective groups, offering limited liquidity until a liquidity event occurs. Secondaries provide immediate liquidity opportunities by enabling the purchase or sale of existing shares in private companies, often before IPO or exit. Explore detailed comparisons to understand how liquidity impacts your investment strategy in venture capital.

Pro Rata Rights

Syndicate investing allows venture capitalists to pool resources and access early-stage deals, leveraging pro rata rights to maintain ownership percentages during follow-on rounds. Secondaries involve buying existing shares from early investors or employees, offering liquidity without dilution risk but often lacking pro rata rights for new funding rounds. Explore how these strategies impact portfolio growth and capital efficiency in venture capital.

Source and External Links

Syndicate Investing - Syndicate investing is a form of venture capital where a group of investors pool resources to finance startups or projects, sharing risks and leveraging collective expertise to access larger deals and enhance returns.

What is a syndicate? - A syndicate is a group of investors who pool capital via Special Purpose Vehicles (SPVs) to invest in startups, gaining access to deals and leveraging the lead investor's expertise without obligation to participate in every deal.

Investor Syndicates: How Do They Work? - Startup syndicates operate by appointing a lead investor who sources deals and manages the investment through SPVs, with other investors contributing funds and sharing profits, facilitated through platforms such as AngelList.

dowidth.com

dowidth.com