Play-to-earn gaming revolutionizes investment by allowing players to earn cryptocurrency or digital assets through gameplay, creating new opportunities for decentralized income streams. Metaverse real estate offers ownership of virtual land and properties within digital worlds, presenting a novel asset class with potential for value appreciation and monetization through virtual commerce and experiences. Explore the future of digital investment by learning more about these innovative financial landscapes.

Why it is important

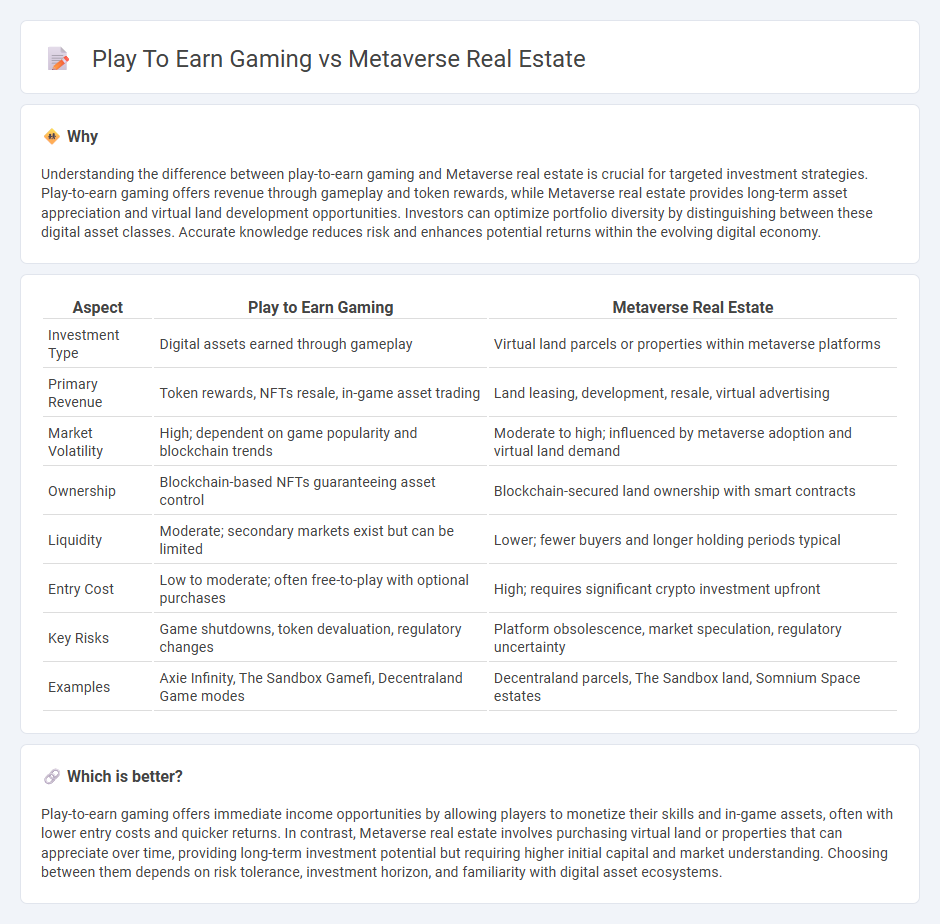

Understanding the difference between play-to-earn gaming and Metaverse real estate is crucial for targeted investment strategies. Play-to-earn gaming offers revenue through gameplay and token rewards, while Metaverse real estate provides long-term asset appreciation and virtual land development opportunities. Investors can optimize portfolio diversity by distinguishing between these digital asset classes. Accurate knowledge reduces risk and enhances potential returns within the evolving digital economy.

Comparison Table

| Aspect | Play to Earn Gaming | Metaverse Real Estate |

|---|---|---|

| Investment Type | Digital assets earned through gameplay | Virtual land parcels or properties within metaverse platforms |

| Primary Revenue | Token rewards, NFTs resale, in-game asset trading | Land leasing, development, resale, virtual advertising |

| Market Volatility | High; dependent on game popularity and blockchain trends | Moderate to high; influenced by metaverse adoption and virtual land demand |

| Ownership | Blockchain-based NFTs guaranteeing asset control | Blockchain-secured land ownership with smart contracts |

| Liquidity | Moderate; secondary markets exist but can be limited | Lower; fewer buyers and longer holding periods typical |

| Entry Cost | Low to moderate; often free-to-play with optional purchases | High; requires significant crypto investment upfront |

| Key Risks | Game shutdowns, token devaluation, regulatory changes | Platform obsolescence, market speculation, regulatory uncertainty |

| Examples | Axie Infinity, The Sandbox Gamefi, Decentraland Game modes | Decentraland parcels, The Sandbox land, Somnium Space estates |

Which is better?

Play-to-earn gaming offers immediate income opportunities by allowing players to monetize their skills and in-game assets, often with lower entry costs and quicker returns. In contrast, Metaverse real estate involves purchasing virtual land or properties that can appreciate over time, providing long-term investment potential but requiring higher initial capital and market understanding. Choosing between them depends on risk tolerance, investment horizon, and familiarity with digital asset ecosystems.

Connection

Play-to-earn gaming integrates blockchain technology, enabling players to monetize in-game assets and tokens transferable to Metaverse real estate markets. Ownership of virtual land in the Metaverse allows investors to develop, trade, and lease properties, creating continuous revenue streams linked to gaming ecosystems. The symbiotic relationship between play-to-earn platforms and Metaverse real estate accelerates digital asset valuation growth, attracting significant investment inflows and driving the expansion of virtual economies.

Key Terms

Metaverse real estate:

Metaverse real estate offers a unique digital asset class where virtual land parcels are bought, sold, and developed, providing long-term investment opportunities unlike the transactional nature of play-to-earn gaming rewards. Prominent platforms like Decentraland, The Sandbox, and Somnium Space enable users to create immersive experiences, monetize content, and build virtual communities with tangible economic potential. Explore how digital property ownership is revolutionizing virtual economies and reshaping the future of online interaction.

Virtual Land Ownership

Virtual land ownership in the metaverse offers users tangible asset control with potential for appreciation, while play-to-earn gaming centers on earning rewards through gameplay without necessarily granting land rights. Metaverse real estate involves buying, selling, and developing parcels in virtual worlds like Decentraland or The Sandbox, emphasizing long-term investment and community building. Explore how virtual land ownership shapes your digital economy and gaming experience further.

NFT (Non-Fungible Token)

Metaverse real estate leverages NFTs to represent unique virtual land parcels, providing verifiable ownership and scarcity within digital worlds, while play-to-earn gaming uses NFTs as in-game assets, enabling players to trade and monetize virtual items. These distinct applications of NFTs drive different economic models: metaverse real estate emphasizes long-term investment and digital property development, whereas play-to-earn gaming focuses on active user engagement and earning potential through gameplay. Explore how NFT technology transforms virtual economies and unlocks new opportunities in both sectors.

Source and External Links

Metaverse Real Estate: The New World in the Future of Property - Metaverse real estate refers to digital land and properties on platforms like Decentraland, Cryptovoxels, Somnium Space, and The Sandbox, where ownership is represented by blockchain-based NFTs and can be bought, developed, and sold like physical real estate.

How to Become a Metaverse Real Estate Agent | Coursera - Buying or selling metaverse real estate is done directly through digital platforms using cryptocurrency, often with the help of tech-savvy agents who provide insights into virtual property values, development trends, and platform-specific dynamics.

Metaverse Real Estate: Is the Virtual Reality Property Worth the Cost? - Metaverse properties are purchased with cryptocurrency, with prices ranging widely and some high-profile sales reaching hundreds of thousands of dollars, while the investment focus is on digital location and development potential rather than physical utility.

dowidth.com

dowidth.com