Sports card fractionalization allows multiple investors to own shares of high-value collectible cards, leveraging blockchain technology for secure and transparent transactions. Rare coin fractional ownership distributes investment in precious metal coins, providing access to historically significant assets without full individual purchase. Discover how these innovative investment models diversify portfolios and democratize access to exclusive collectibles.

Why it is important

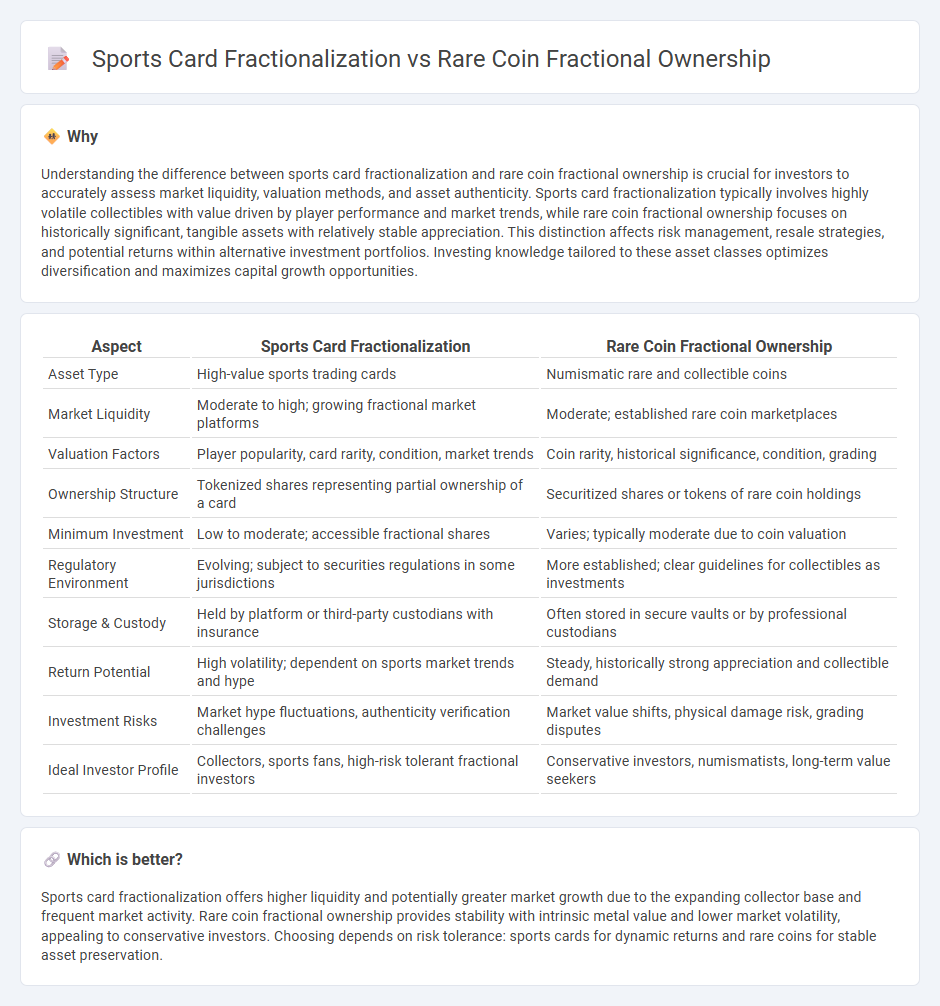

Understanding the difference between sports card fractionalization and rare coin fractional ownership is crucial for investors to accurately assess market liquidity, valuation methods, and asset authenticity. Sports card fractionalization typically involves highly volatile collectibles with value driven by player performance and market trends, while rare coin fractional ownership focuses on historically significant, tangible assets with relatively stable appreciation. This distinction affects risk management, resale strategies, and potential returns within alternative investment portfolios. Investing knowledge tailored to these asset classes optimizes diversification and maximizes capital growth opportunities.

Comparison Table

| Aspect | Sports Card Fractionalization | Rare Coin Fractional Ownership |

|---|---|---|

| Asset Type | High-value sports trading cards | Numismatic rare and collectible coins |

| Market Liquidity | Moderate to high; growing fractional market platforms | Moderate; established rare coin marketplaces |

| Valuation Factors | Player popularity, card rarity, condition, market trends | Coin rarity, historical significance, condition, grading |

| Ownership Structure | Tokenized shares representing partial ownership of a card | Securitized shares or tokens of rare coin holdings |

| Minimum Investment | Low to moderate; accessible fractional shares | Varies; typically moderate due to coin valuation |

| Regulatory Environment | Evolving; subject to securities regulations in some jurisdictions | More established; clear guidelines for collectibles as investments |

| Storage & Custody | Held by platform or third-party custodians with insurance | Often stored in secure vaults or by professional custodians |

| Return Potential | High volatility; dependent on sports market trends and hype | Steady, historically strong appreciation and collectible demand |

| Investment Risks | Market hype fluctuations, authenticity verification challenges | Market value shifts, physical damage risk, grading disputes |

| Ideal Investor Profile | Collectors, sports fans, high-risk tolerant fractional investors | Conservative investors, numismatists, long-term value seekers |

Which is better?

Sports card fractionalization offers higher liquidity and potentially greater market growth due to the expanding collector base and frequent market activity. Rare coin fractional ownership provides stability with intrinsic metal value and lower market volatility, appealing to conservative investors. Choosing depends on risk tolerance: sports cards for dynamic returns and rare coins for stable asset preservation.

Connection

Sports card fractionalization and rare coin fractional ownership both utilize blockchain technology to divide high-value collectibles into smaller, tradable shares, increasing accessibility for investors. Fractional ownership reduces the entry barrier by allowing multiple individuals to hold partial stakes in rare assets, enhancing liquidity in traditionally illiquid markets. This innovative approach leverages digital platforms to democratize investment, enabling broader participation in niche asset classes with potential for appreciation.

Key Terms

**Rare coin fractional ownership:**

Rare coin fractional ownership allows multiple investors to buy shares in valuable coins, making high-value numismatic assets accessible without full purchase. This method leverages secure blockchain technology to ensure transparent ownership records and liquidity in a typically illiquid market. Explore how rare coin fractional ownership can diversify your investment portfolio and enhance asset accessibility.

Numismatic value

Rare coin fractional ownership leverages the intrinsic numismatic value rooted in historical significance, rarity, and metal content, ensuring tangible asset backing for investors. Sports card fractionalization primarily capitalizes on market demand and player memorabilia popularity, often lacking the intrinsic intrinsic value seen in coins. Explore deeper insights into asset-backed investment differences between rare coins and sports cards.

Coin grading

Rare coin fractional ownership benefits significantly from professional coin grading services like PCGS and NGC, which authenticate and encapsulate coins to preserve their condition and value. Sports card fractionalization similarly relies on third-party grading companies such as PSA and Beckett to determine card authenticity, condition, and encapsulation, providing investor confidence. Explore how grading impacts valuation and security in asset fractionalization to make informed investment decisions.

Source and External Links

Should You Own A Fractional Share Of A Rare Collectible? - This article discusses the concept of owning fractional shares of rare collectibles, such as coins, highlighting both the historical and modern approaches to this investment strategy.

OpenCoins Launches Dual Asset Tokens, Redefining Rare Coin Investment With Blockchain Technology - OpenCoins introduces a modern way to invest in rare coins through blockchain technology, offering fractional ownership options via digital tokens.

Fractional ownership... of baseball cards... ? This can't be good. - While not directly about rare coins, this discussion touches on the broader concept of fractional ownership in collectibles, including some skepticism about its benefits.

dowidth.com

dowidth.com