Viticulture land acquisition offers a unique investment opportunity focused on agricultural productivity, sustainable growth, and long-term value appreciation in the premium wine market. Mining rights investment revolves around extracting valuable minerals and resources, often delivering high returns but with increased regulatory risks and market volatility. Explore detailed insights to make informed decisions between viticulture land and mining rights investments.

Why it is important

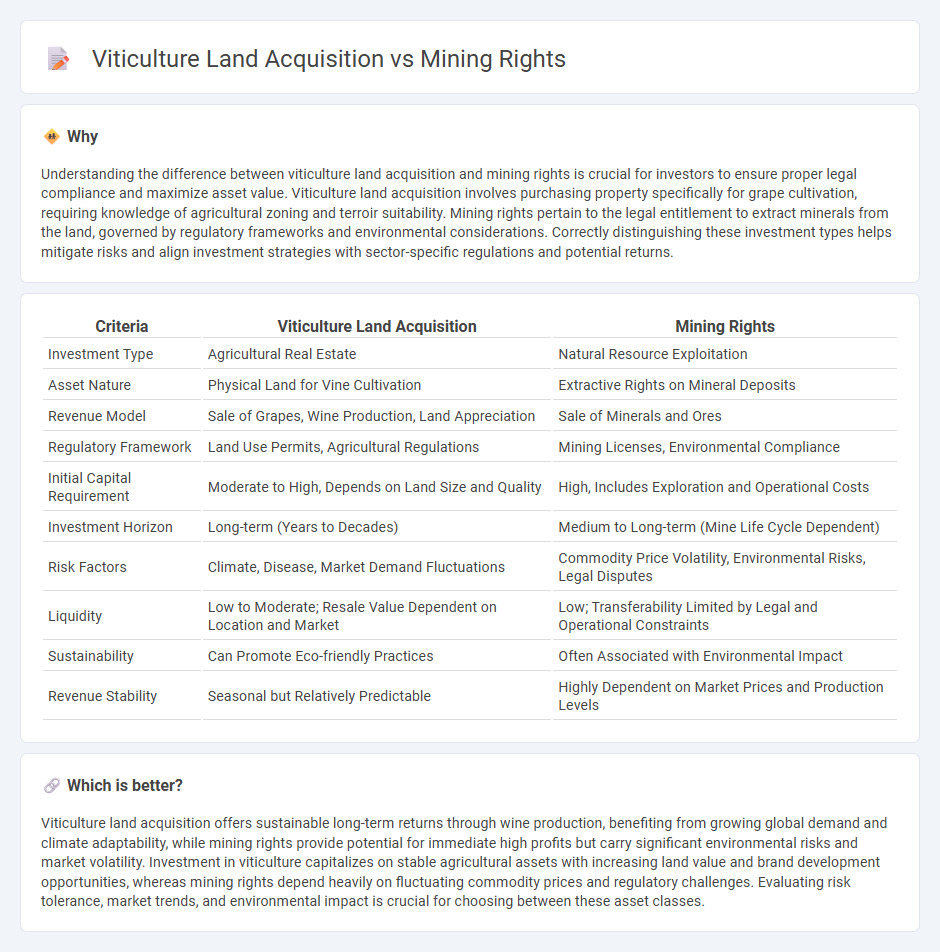

Understanding the difference between viticulture land acquisition and mining rights is crucial for investors to ensure proper legal compliance and maximize asset value. Viticulture land acquisition involves purchasing property specifically for grape cultivation, requiring knowledge of agricultural zoning and terroir suitability. Mining rights pertain to the legal entitlement to extract minerals from the land, governed by regulatory frameworks and environmental considerations. Correctly distinguishing these investment types helps mitigate risks and align investment strategies with sector-specific regulations and potential returns.

Comparison Table

| Criteria | Viticulture Land Acquisition | Mining Rights |

|---|---|---|

| Investment Type | Agricultural Real Estate | Natural Resource Exploitation |

| Asset Nature | Physical Land for Vine Cultivation | Extractive Rights on Mineral Deposits |

| Revenue Model | Sale of Grapes, Wine Production, Land Appreciation | Sale of Minerals and Ores |

| Regulatory Framework | Land Use Permits, Agricultural Regulations | Mining Licenses, Environmental Compliance |

| Initial Capital Requirement | Moderate to High, Depends on Land Size and Quality | High, Includes Exploration and Operational Costs |

| Investment Horizon | Long-term (Years to Decades) | Medium to Long-term (Mine Life Cycle Dependent) |

| Risk Factors | Climate, Disease, Market Demand Fluctuations | Commodity Price Volatility, Environmental Risks, Legal Disputes |

| Liquidity | Low to Moderate; Resale Value Dependent on Location and Market | Low; Transferability Limited by Legal and Operational Constraints |

| Sustainability | Can Promote Eco-friendly Practices | Often Associated with Environmental Impact |

| Revenue Stability | Seasonal but Relatively Predictable | Highly Dependent on Market Prices and Production Levels |

Which is better?

Viticulture land acquisition offers sustainable long-term returns through wine production, benefiting from growing global demand and climate adaptability, while mining rights provide potential for immediate high profits but carry significant environmental risks and market volatility. Investment in viticulture capitalizes on stable agricultural assets with increasing land value and brand development opportunities, whereas mining rights depend heavily on fluctuating commodity prices and regulatory challenges. Evaluating risk tolerance, market trends, and environmental impact is crucial for choosing between these asset classes.

Connection

Viticulture land acquisition and mining rights intersect through shared considerations of land valuation, regulatory compliance, and resource management. Investors assess both agricultural potential and mineral deposits to maximize asset value and ensure sustainable land use. Strategic acquisition enables diversification by combining profitable agricultural production with lucrative mining operations on the same property.

Key Terms

Mineral Royalty Agreements

Mineral Royalty Agreements play a pivotal role in mining rights, allowing companies to extract valuable minerals while compensating landowners, contrasting with viticulture land acquisition which prioritizes soil suitability and climate for grape cultivation. Mining agreements often involve complex negotiations around royalty rates, land use restrictions, and environmental impact, unlike viticulture where the focus remains on terroir and vineyard management practices. Explore more about how these distinct land acquisition strategies shape economic and environmental outcomes.

Appellation Control

Appellation Control strictly regulates land use to maintain wine region authenticity, prioritizing viticulture land acquisition over mining rights within protected areas. Mining activities are often restricted or prohibited in Appellation d'Origine Controlee (AOC) zones to preserve soil quality and terroir characteristics essential for premium wine production. Explore the nuances of how these regulations impact land management and economic interests in winemaking regions.

Environmental Impact Assessment

Mining rights acquisition requires a comprehensive Environmental Impact Assessment (EIA) to evaluate potential risks such as soil degradation, water contamination, and habitat disruption, which can severely affect ecosystems. In contrast, viticulture land acquisition involves an EIA that emphasizes sustainable water use, pesticide management, and soil preservation, ensuring minimal environmental footprint while supporting agricultural productivity. Explore further to understand the distinct regulatory frameworks and environmental safeguards governing these land use types.

Source and External Links

What is a Mining Right? - A mining right is a legal entitlement granted by Congress under statute that allows a person to prospect and extract minerals from federal lands, distinct from permits and not hindered unreasonably by surface management agencies like the Forest Service.

What are Mineral Rights and How Do They Work - Mineral rights grant owners the authority to explore, develop, and extract minerals below the surface, including the use of surface land for access, and these rights can be leased, sold, or inherited independently of surface ownership.

Mineral Rights vs. Surface Rights: What's the Difference and Why it Matters - Mineral rights specifically allow ownership and extraction of underground resources and are considered dominant over surface rights, enabling mineral owners to access and use the surface reasonably for mineral development despite separate surface ownership.

dowidth.com

dowidth.com