Investment strategies vary widely, with spice trading offering historical value rooted in global commerce and cultural exchange, while art investing provides unique opportunities through aesthetic appreciation and potential long-term capital growth. Spice trading involves tangible commodities influenced by supply chain dynamics and geopolitical factors, whereas art investing depends on market trends, provenance, and rarity. Explore deeper insights into these distinctive investment avenues to optimize your portfolio diversification.

Why it is important

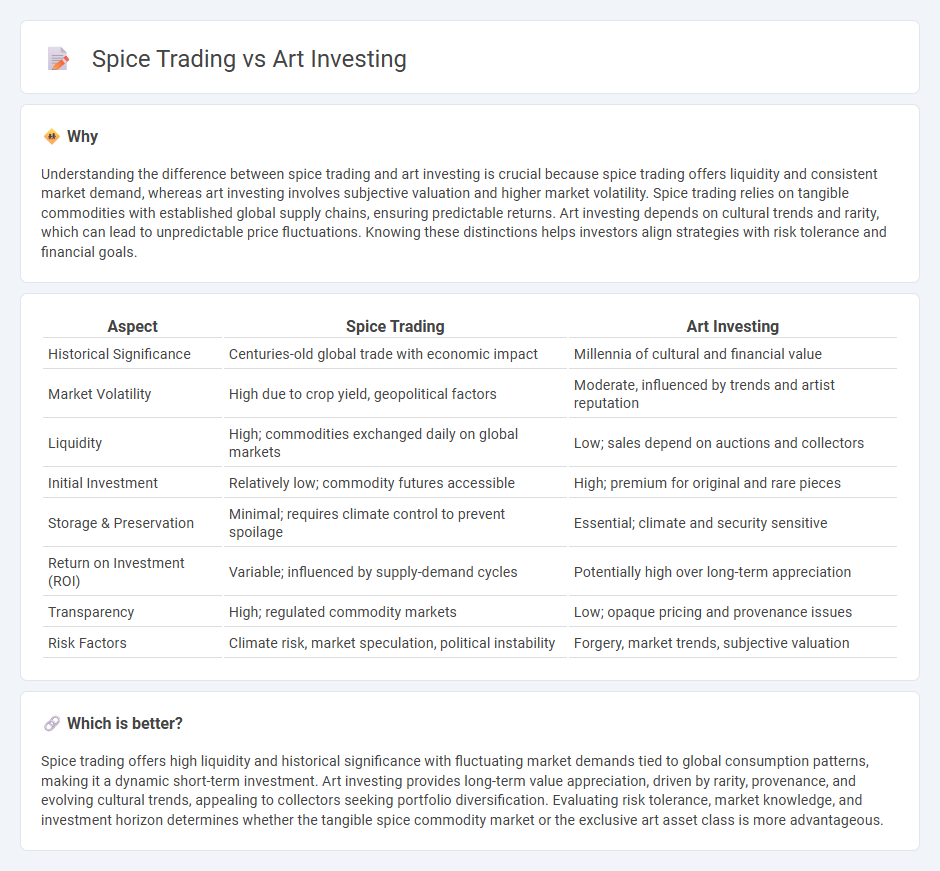

Understanding the difference between spice trading and art investing is crucial because spice trading offers liquidity and consistent market demand, whereas art investing involves subjective valuation and higher market volatility. Spice trading relies on tangible commodities with established global supply chains, ensuring predictable returns. Art investing depends on cultural trends and rarity, which can lead to unpredictable price fluctuations. Knowing these distinctions helps investors align strategies with risk tolerance and financial goals.

Comparison Table

| Aspect | Spice Trading | Art Investing |

|---|---|---|

| Historical Significance | Centuries-old global trade with economic impact | Millennia of cultural and financial value |

| Market Volatility | High due to crop yield, geopolitical factors | Moderate, influenced by trends and artist reputation |

| Liquidity | High; commodities exchanged daily on global markets | Low; sales depend on auctions and collectors |

| Initial Investment | Relatively low; commodity futures accessible | High; premium for original and rare pieces |

| Storage & Preservation | Minimal; requires climate control to prevent spoilage | Essential; climate and security sensitive |

| Return on Investment (ROI) | Variable; influenced by supply-demand cycles | Potentially high over long-term appreciation |

| Transparency | High; regulated commodity markets | Low; opaque pricing and provenance issues |

| Risk Factors | Climate risk, market speculation, political instability | Forgery, market trends, subjective valuation |

Which is better?

Spice trading offers high liquidity and historical significance with fluctuating market demands tied to global consumption patterns, making it a dynamic short-term investment. Art investing provides long-term value appreciation, driven by rarity, provenance, and evolving cultural trends, appealing to collectors seeking portfolio diversification. Evaluating risk tolerance, market knowledge, and investment horizon determines whether the tangible spice commodity market or the exclusive art asset class is more advantageous.

Connection

Spice trading and art investing are connected through their shared historical role as lucrative alternative investments that capitalize on rare, culturally significant assets with fluctuating market values. Both markets rely heavily on provenance, authenticity, and global demand to drive prices, attracting investors seeking diversification beyond traditional stocks and bonds. The appreciation potential in spice trading mirrors that of art investing, where rarity and historical appeal significantly enhance asset value over time.

Key Terms

Art Investing:

Art investing offers unique opportunities to diversify portfolios with tangible assets that often appreciate over time, influenced by factors such as artist reputation, provenance, and market trends in contemporary and historical art. Unlike spice trading, which involves commodity fluctuations and supply-demand volatility, art investment benefits from cultural value and growing interest in alternative assets among high-net-worth individuals. Discover more about how art investing can enhance your financial strategy and long-term wealth growth.

Provenance

Provenance plays a crucial role in both art investing and spice trading, ensuring authenticity and enhancing value by tracing the historical origin and ownership of the asset. In art investing, detailed provenance documentation verifies the artwork's legitimacy, reducing the risk of fraud and significantly impacting market value. Explore the importance of provenance to maximize returns in these diverse investment markets.

Valuation

Art investing relies heavily on subjective valuation driven by artist reputation, provenance, and market trends, making prices highly volatile. Spice trading, in contrast, depends on commodity market dynamics, including supply-demand, geopolitical factors, and quality grades, resulting in more quantifiable valuation metrics. Explore deeper insights into the valuation mechanisms of art and spice markets to enhance investment strategies.

Source and External Links

Masterworks: Invest in Art - App Store - Masterworks is a platform that allows everyday investors to buy shares in multi-million dollar artworks by famous artists like Picasso and Banksy, offering an alternative investment with potential financial returns and portfolio diversification by trading art shares.

Invest in Art - Own Shares in Masterpieces - Yieldstreet provides fractional ownership in a diversified pool of contemporary and blue-chip artworks, enabling investors to grow capital with historical returns outperforming the S&P 500, though these investments carry significant risks and are generally illiquid.

Investing in art: What to know about turning a passion into ... - Art investing offers benefits like portfolio diversification, inflation protection, and potential high returns but involves risks such as illiquidity, maintenance costs, and market trend fluctuations; building a well-curated collection with historical and cultural significance can mitigate some risks.

dowidth.com

dowidth.com