Carbon credits trading enables investors to buy and sell emission allowances, directly supporting projects that reduce greenhouse gases, while sustainable agriculture funds focus on financing eco-friendly farming practices that promote soil health and biodiversity. Both investment types address environmental impact but differ in their approaches: carbon credits target atmospheric carbon reduction, whereas sustainable agriculture funds invest in long-term land stewardship and food security. Explore the distinct benefits and opportunities in carbon credits trading and sustainable agriculture funds to enhance your green investment portfolio.

Why it is important

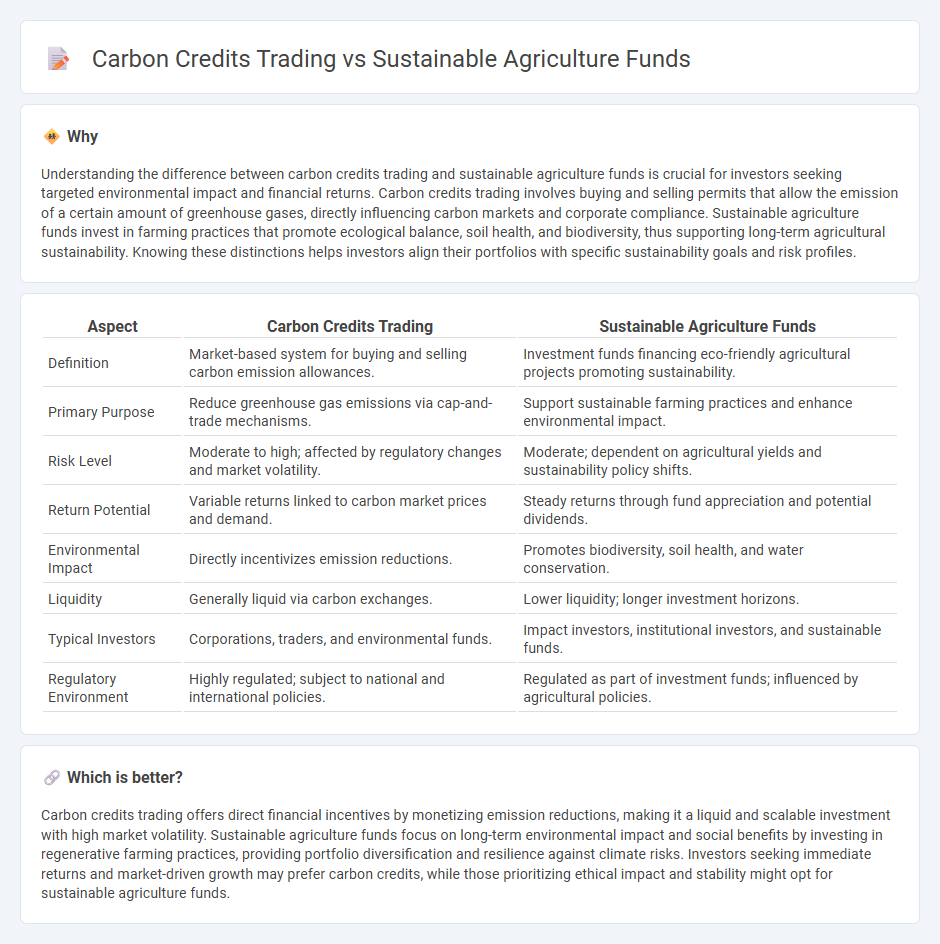

Understanding the difference between carbon credits trading and sustainable agriculture funds is crucial for investors seeking targeted environmental impact and financial returns. Carbon credits trading involves buying and selling permits that allow the emission of a certain amount of greenhouse gases, directly influencing carbon markets and corporate compliance. Sustainable agriculture funds invest in farming practices that promote ecological balance, soil health, and biodiversity, thus supporting long-term agricultural sustainability. Knowing these distinctions helps investors align their portfolios with specific sustainability goals and risk profiles.

Comparison Table

| Aspect | Carbon Credits Trading | Sustainable Agriculture Funds |

|---|---|---|

| Definition | Market-based system for buying and selling carbon emission allowances. | Investment funds financing eco-friendly agricultural projects promoting sustainability. |

| Primary Purpose | Reduce greenhouse gas emissions via cap-and-trade mechanisms. | Support sustainable farming practices and enhance environmental impact. |

| Risk Level | Moderate to high; affected by regulatory changes and market volatility. | Moderate; dependent on agricultural yields and sustainability policy shifts. |

| Return Potential | Variable returns linked to carbon market prices and demand. | Steady returns through fund appreciation and potential dividends. |

| Environmental Impact | Directly incentivizes emission reductions. | Promotes biodiversity, soil health, and water conservation. |

| Liquidity | Generally liquid via carbon exchanges. | Lower liquidity; longer investment horizons. |

| Typical Investors | Corporations, traders, and environmental funds. | Impact investors, institutional investors, and sustainable funds. |

| Regulatory Environment | Highly regulated; subject to national and international policies. | Regulated as part of investment funds; influenced by agricultural policies. |

Which is better?

Carbon credits trading offers direct financial incentives by monetizing emission reductions, making it a liquid and scalable investment with high market volatility. Sustainable agriculture funds focus on long-term environmental impact and social benefits by investing in regenerative farming practices, providing portfolio diversification and resilience against climate risks. Investors seeking immediate returns and market-driven growth may prefer carbon credits, while those prioritizing ethical impact and stability might opt for sustainable agriculture funds.

Connection

Carbon credits trading incentivizes the reduction of greenhouse gas emissions by assigning a monetary value to carbon savings, which directly benefits sustainable agriculture funds focused on eco-friendly farming methods. Sustainable agriculture funds invest in practices that improve soil health, reduce chemical use, and sequester carbon, generating measurable reductions in carbon footprint aligned with carbon credit standards. This symbiotic relationship enables investors to support environmental impact through sustainable agriculture projects that qualify for carbon credits, enhancing financial returns while promoting climate-resilient farming.

Key Terms

Sustainable agriculture funds:

Sustainable agriculture funds invest in environmentally friendly farming practices, promoting soil health, water conservation, and reduced chemical use to support long-term agricultural productivity and climate resilience. These funds target companies and projects that implement regenerative techniques, organic farming, and agroforestry, thereby fostering biodiversity and carbon sequestration. Explore how sustainable agriculture funds drive green investment and contribute to climate goals.

ESG (Environmental, Social, and Governance)

Sustainable agriculture funds prioritize investments in eco-friendly farming practices that enhance soil health, water conservation, and biodiversity while supporting socially responsible policies aligned with ESG criteria. Carbon credits trading enables companies to offset their greenhouse gas emissions by purchasing credits from verified projects, fostering a market-driven approach to reducing environmental impact and promoting transparency in governance. Explore the nuances between these ESG-focused strategies to optimize your sustainable investment portfolio.

Impact Investing

Sustainable agriculture funds channel capital into farming practices that improve soil health, conserve water, and reduce greenhouse gas emissions, promoting long-term environmental and economic benefits. Carbon credits trading permits businesses to offset emissions by purchasing credits generated from verified projects like reforestation or methane capture, enabling measurable climate impact through market mechanisms. Explore how these impact investing strategies drive green innovation and deliver measurable returns in the fight against climate change.

Source and External Links

Washington State Organic & Sustainable Farming Fund - This grant supports organic and regenerative agriculture focused on soil health, biodiversity, carbon sequestration, and environmental sustainability, favoring projects with shared benefits and marginalized community participation.

Farm Grants - SARE - SARE offers competitive grants for research and education projects that advance sustainable agricultural practices across the U.S., available to farmers, researchers, educators, and students but not for starting farms or large equipment purchases.

Sustainable Food and Agriculture Fund - Boulder County provides grants between $10,000 and $25,000 for projects supporting sustainable and regenerative agriculture, farmer education, market infrastructure, local food processing, and support for frontline farm workers.

dowidth.com

dowidth.com