Designer sneaker portfolios offer high liquidity and strong resale value driven by limited editions and brand collaborations, appealing to younger collectors and investors. Music memorabilia investments provide unique historical value and rarity, often appreciating steadily due to cultural significance and artist legacy. Explore the distinct benefits and challenges of these alternative asset classes to diversify your investment strategy.

Why it is important

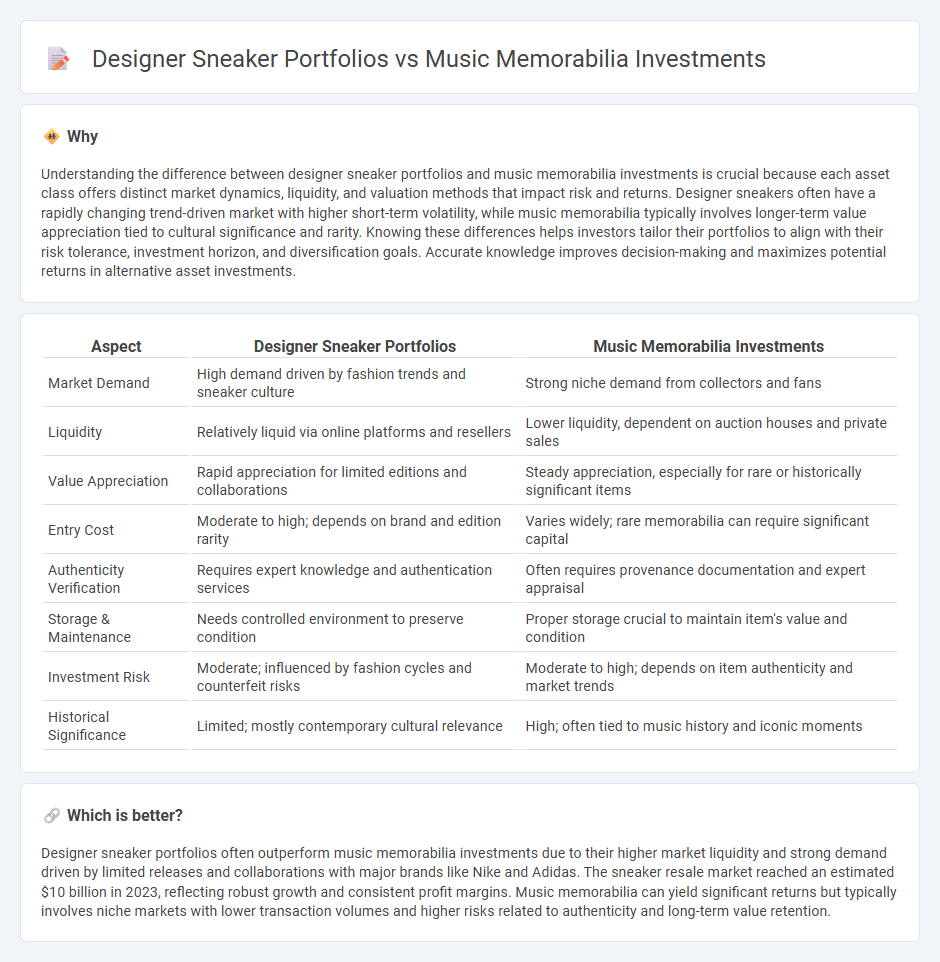

Understanding the difference between designer sneaker portfolios and music memorabilia investments is crucial because each asset class offers distinct market dynamics, liquidity, and valuation methods that impact risk and returns. Designer sneakers often have a rapidly changing trend-driven market with higher short-term volatility, while music memorabilia typically involves longer-term value appreciation tied to cultural significance and rarity. Knowing these differences helps investors tailor their portfolios to align with their risk tolerance, investment horizon, and diversification goals. Accurate knowledge improves decision-making and maximizes potential returns in alternative asset investments.

Comparison Table

| Aspect | Designer Sneaker Portfolios | Music Memorabilia Investments |

|---|---|---|

| Market Demand | High demand driven by fashion trends and sneaker culture | Strong niche demand from collectors and fans |

| Liquidity | Relatively liquid via online platforms and resellers | Lower liquidity, dependent on auction houses and private sales |

| Value Appreciation | Rapid appreciation for limited editions and collaborations | Steady appreciation, especially for rare or historically significant items |

| Entry Cost | Moderate to high; depends on brand and edition rarity | Varies widely; rare memorabilia can require significant capital |

| Authenticity Verification | Requires expert knowledge and authentication services | Often requires provenance documentation and expert appraisal |

| Storage & Maintenance | Needs controlled environment to preserve condition | Proper storage crucial to maintain item's value and condition |

| Investment Risk | Moderate; influenced by fashion cycles and counterfeit risks | Moderate to high; depends on item authenticity and market trends |

| Historical Significance | Limited; mostly contemporary cultural relevance | High; often tied to music history and iconic moments |

Which is better?

Designer sneaker portfolios often outperform music memorabilia investments due to their higher market liquidity and strong demand driven by limited releases and collaborations with major brands like Nike and Adidas. The sneaker resale market reached an estimated $10 billion in 2023, reflecting robust growth and consistent profit margins. Music memorabilia can yield significant returns but typically involves niche markets with lower transaction volumes and higher risks related to authenticity and long-term value retention.

Connection

Designer sneaker portfolios and music memorabilia investments both capitalize on niche markets driven by cultural trends and limited availability, creating high-demand assets with potential for substantial ROI. These alternative investments appeal to collectors seeking tangible, appreciating goods tied to pop culture, fostering liquidity through specialized auctions and resale platforms. The intersection of hype, rarity, and historical significance underpins value growth in both sectors, making them attractive diversifiers in modern investment strategies.

Key Terms

**Music memorabilia investments:**

Music memorabilia investments offer unique opportunities to own rare artifacts such as vintage instruments, autographed albums, and iconic concert posters, which appreciate in value due to their historical significance and cultural relevance. High-profile sales of items linked to legendary musicians like The Beatles or Michael Jackson demonstrate robust market demand and potential for substantial financial returns. Explore the latest trends and strategies to navigate the thriving music memorabilia market and enhance your investment portfolio.

Provenance

Music memorabilia investments rely heavily on provenance to authenticate items such as autographed guitars and concert posters, enhancing their market value and collectibility. Designer sneaker portfolios also emphasize provenance through limited edition releases, authenticated serial numbers, and celebrity endorsements to ensure rarity and desirability. Explore how provenance shapes trust and valuation in these distinctive investment markets.

Rarity

Rarity drives value in both music memorabilia and designer sneaker investments, with limited editions, autographed items, and iconic releases commanding premium prices. Music memorabilia often gains worth through historical significance and unique artist associations, while designer sneakers rely on limited production runs, collaborations, and cultural relevance. Explore which market offers greater potential by understanding the nuances behind rarity in these collectible assets.

Source and External Links

Why music memorabilia might be a solid investment - RTE - Music memorabilia can be a worthwhile alternative investment due to insatiable demand and rising values for items connected to iconic music stars, but it carries higher risk than conventional stocks.

Investing in Memorabilia - Paul Fraser Collectibles - Memorabilia offers exciting investment potential thanks to growing demand in celebrity culture, with music collectibles considered blue-chip investments if tied to enduring stars and events.

Music Memorabilia--Can It Be Considered an Investment? - The value of music memorabilia depends on artist popularity, rarity, and condition; investing requires research and caution due to risks like fake items and market volatility.

dowidth.com

dowidth.com