Fractional ownership real estate allows multiple investors to purchase shares of a single property, sharing both risks and returns proportionally. Joint ventures involve partnerships where investors collaborate to develop or manage real estate projects, often combining resources and expertise for larger-scale investments. Discover the key differences and which option aligns best with your investment goals.

Why it is important

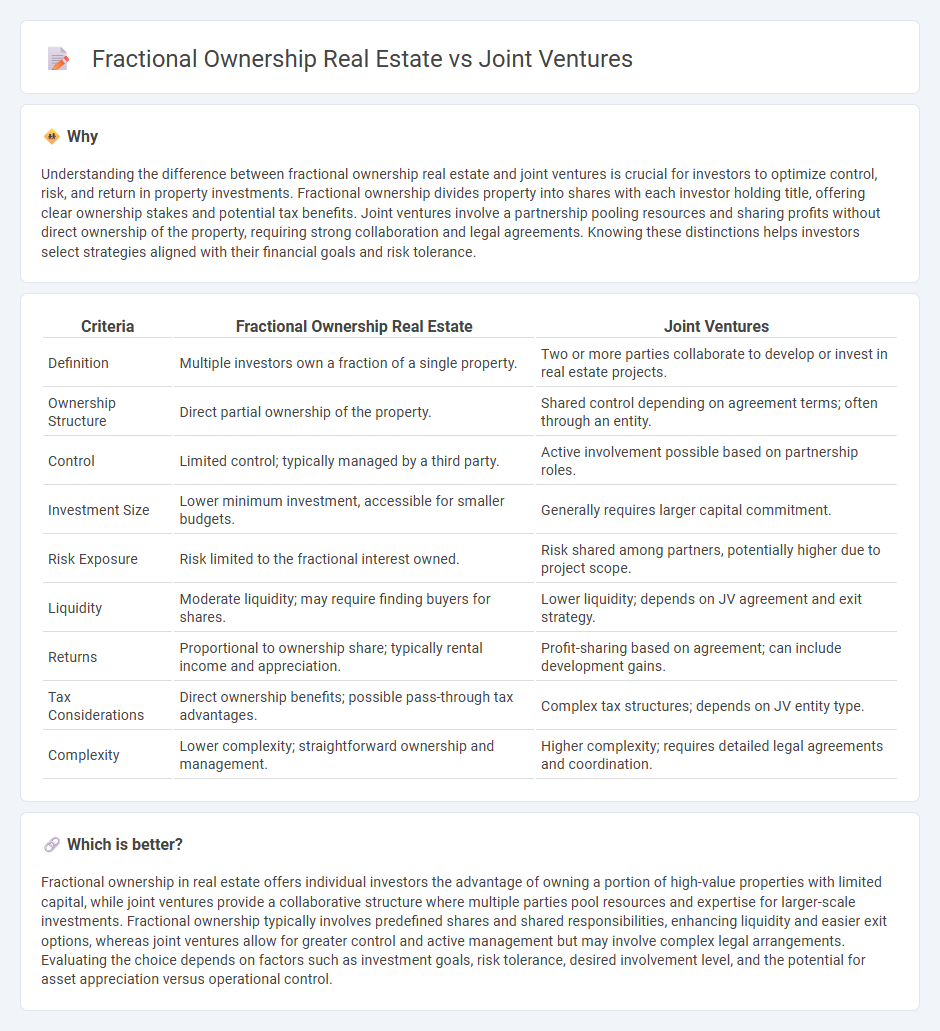

Understanding the difference between fractional ownership real estate and joint ventures is crucial for investors to optimize control, risk, and return in property investments. Fractional ownership divides property into shares with each investor holding title, offering clear ownership stakes and potential tax benefits. Joint ventures involve a partnership pooling resources and sharing profits without direct ownership of the property, requiring strong collaboration and legal agreements. Knowing these distinctions helps investors select strategies aligned with their financial goals and risk tolerance.

Comparison Table

| Criteria | Fractional Ownership Real Estate | Joint Ventures |

|---|---|---|

| Definition | Multiple investors own a fraction of a single property. | Two or more parties collaborate to develop or invest in real estate projects. |

| Ownership Structure | Direct partial ownership of the property. | Shared control depending on agreement terms; often through an entity. |

| Control | Limited control; typically managed by a third party. | Active involvement possible based on partnership roles. |

| Investment Size | Lower minimum investment, accessible for smaller budgets. | Generally requires larger capital commitment. |

| Risk Exposure | Risk limited to the fractional interest owned. | Risk shared among partners, potentially higher due to project scope. |

| Liquidity | Moderate liquidity; may require finding buyers for shares. | Lower liquidity; depends on JV agreement and exit strategy. |

| Returns | Proportional to ownership share; typically rental income and appreciation. | Profit-sharing based on agreement; can include development gains. |

| Tax Considerations | Direct ownership benefits; possible pass-through tax advantages. | Complex tax structures; depends on JV entity type. |

| Complexity | Lower complexity; straightforward ownership and management. | Higher complexity; requires detailed legal agreements and coordination. |

Which is better?

Fractional ownership in real estate offers individual investors the advantage of owning a portion of high-value properties with limited capital, while joint ventures provide a collaborative structure where multiple parties pool resources and expertise for larger-scale investments. Fractional ownership typically involves predefined shares and shared responsibilities, enhancing liquidity and easier exit options, whereas joint ventures allow for greater control and active management but may involve complex legal arrangements. Evaluating the choice depends on factors such as investment goals, risk tolerance, desired involvement level, and the potential for asset appreciation versus operational control.

Connection

Fractional ownership real estate and joint ventures are connected through their shared strategy of pooling capital from multiple investors to acquire properties, thereby reducing individual financial risk and increasing access to high-value assets. Both structures enable investors to benefit from real estate appreciation and rental income without full property ownership, leveraging collective resources and expertise. This collaborative approach maximizes investment diversification and facilitates entry into larger or more lucrative markets.

Key Terms

Equity Structure

Joint ventures in real estate typically involve two or more parties combining resources and sharing equity based on their contributions, often resulting in proportional profit and control aligned with the equity stake. Fractional ownership divides a single property into shares, allowing multiple investors to own a fraction of the asset, with equity structured as distinct ownership interests in the property but with limited control compared to a joint venture partner. Explore detailed comparisons between joint ventures and fractional ownership to optimize your real estate investment strategy.

Legal Entity

Joint ventures in real estate typically involve the creation of a legal entity, such as an LLC or partnership, to manage property ownership and operations, providing liability protection and clear governance structures. Fractional ownership often uses tenancy-in-common agreements or trusts, allowing multiple investors to share title without forming a new entity, which impacts tax treatment and transferability. Explore the legal nuances and benefits of each structure to determine the best fit for your real estate investment strategy.

Decision-Making Authority

Joint ventures in real estate grant shared decision-making authority based on ownership percentage and partnership agreements, often requiring consensus among investors for key decisions. Fractional ownership typically provides individual decision rights proportional to each owner's share, enabling more streamlined control over property use and management. Explore detailed comparisons to understand which model best suits your investment goals and control preferences.

Source and External Links

What Is a Joint Venture? [+ How It Can Grow Your Business] - A joint venture is a strategic partnership between two or more businesses to work together on a specific project or initiative, offering benefits like increased growth and resource sharing.

Joint Venture (JV) - Corporate Finance Institute - A joint venture is a commercial enterprise combining resources from multiple organizations to gain a strategic edge, often initiated through contractual agreements and shared profits and losses.

What Is a Joint Venture and How Does It Work? - A joint venture is an agreement between two or more parties to achieve a specific business goal, commonly formed to access new markets or leverage complementary resources.

dowidth.com

dowidth.com