Rare whisky bottles trading offers a unique investment opportunity driven by scarcity, aging potential, and increasing global demand, often delivering higher returns compared to traditional assets. Designer handbags, renowned for their brand prestige and limited editions, retain value through brand recognition and fashion trends but may face volatility in market preferences. Explore the distinct advantages and risks of investing in rare whisky versus designer handbags to enhance your portfolio strategy.

Why it is important

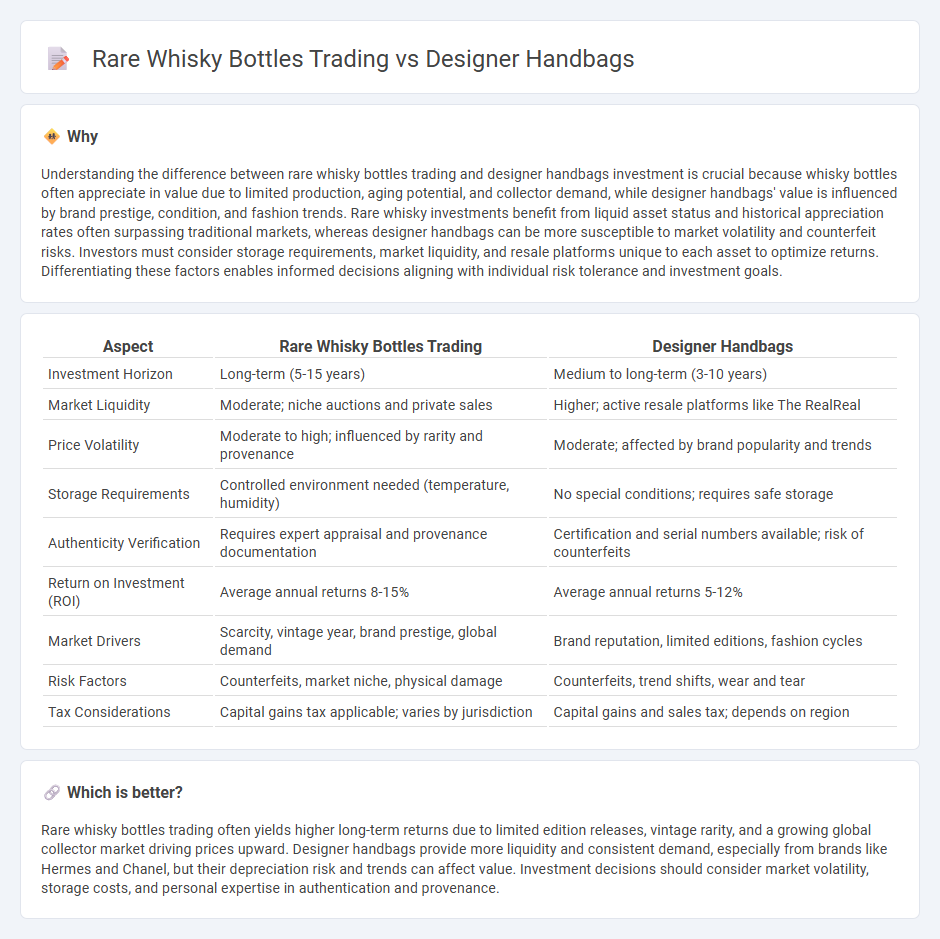

Understanding the difference between rare whisky bottles trading and designer handbags investment is crucial because whisky bottles often appreciate in value due to limited production, aging potential, and collector demand, while designer handbags' value is influenced by brand prestige, condition, and fashion trends. Rare whisky investments benefit from liquid asset status and historical appreciation rates often surpassing traditional markets, whereas designer handbags can be more susceptible to market volatility and counterfeit risks. Investors must consider storage requirements, market liquidity, and resale platforms unique to each asset to optimize returns. Differentiating these factors enables informed decisions aligning with individual risk tolerance and investment goals.

Comparison Table

| Aspect | Rare Whisky Bottles Trading | Designer Handbags |

|---|---|---|

| Investment Horizon | Long-term (5-15 years) | Medium to long-term (3-10 years) |

| Market Liquidity | Moderate; niche auctions and private sales | Higher; active resale platforms like The RealReal |

| Price Volatility | Moderate to high; influenced by rarity and provenance | Moderate; affected by brand popularity and trends |

| Storage Requirements | Controlled environment needed (temperature, humidity) | No special conditions; requires safe storage |

| Authenticity Verification | Requires expert appraisal and provenance documentation | Certification and serial numbers available; risk of counterfeits |

| Return on Investment (ROI) | Average annual returns 8-15% | Average annual returns 5-12% |

| Market Drivers | Scarcity, vintage year, brand prestige, global demand | Brand reputation, limited editions, fashion cycles |

| Risk Factors | Counterfeits, market niche, physical damage | Counterfeits, trend shifts, wear and tear |

| Tax Considerations | Capital gains tax applicable; varies by jurisdiction | Capital gains and sales tax; depends on region |

Which is better?

Rare whisky bottles trading often yields higher long-term returns due to limited edition releases, vintage rarity, and a growing global collector market driving prices upward. Designer handbags provide more liquidity and consistent demand, especially from brands like Hermes and Chanel, but their depreciation risk and trends can affect value. Investment decisions should consider market volatility, storage costs, and personal expertise in authentication and provenance.

Connection

Rare whisky bottles and designer handbags both serve as alternative investment assets, leveraging scarcity and brand prestige to appreciate in value over time. Collectors and investors capitalize on limited editions and high demand within niche markets, driving secondary market prices upwards. Tracking market trends and authentication ensures portfolio diversification and potential high returns beyond traditional financial instruments.

Key Terms

Authenticity

Authenticity is paramount in designer handbags and rare whisky bottles trading, ensuring provenance through certificates and expert verification minimizes the risk of counterfeits. Transparent supply chains and detailed documentation authenticate the value of luxury handbags by brands such as Hermes and Chanel, while rare whisky relies on serial numbers and distillery seals for validation. Explore further to understand how authenticity safeguards investment in these coveted assets.

Provenance

Provenance plays a crucial role in both designer handbags and rare whisky bottles trading, as authentic origin and ownership history significantly enhance their value and desirability. Detailed documentation and certificates of authenticity are essential to verify provenance, ensuring trust and transparency in high-value transactions. Explore the intricate provenance factors that define worth in these luxury markets to make informed trading decisions.

Market Liquidity

Designer handbags exhibit robust market liquidity due to consistent demand, brand prestige, and ease of resale through established platforms like luxury consignment stores and online marketplaces. Rare whisky bottles, though possessing a niche market, often face lower liquidity, driven by collector interest and auction dynamics, making transactions less frequent but potentially higher in value. Explore detailed analyses on how market liquidity impacts investment strategies in both luxury goods categories.

Source and External Links

Designer Handbags Sale | kate spade new york - Offers a wide selection of designer handbags including satchels, crossbody bags, and totes at discounted prices with free U.S. shipping and returns.

Shop Women's Designer Bags & Wallets | elysewalker - Features designer handbags from luxury brands like Saint Laurent, Bottega Veneta, and Gucci, ranging from leather shoulder bags to evening bags for formal events.

Shop Pre-Owned Luxury Designer Handbags - Specializes in 100% authentic pre-owned luxury handbags from brands such as Louis Vuitton, Chanel, and Hermes, often available at up to 70% below retail prices.

dowidth.com

dowidth.com