Fractionalized art investment allows individuals to purchase shares in valuable artworks, offering portfolio diversification with lower capital requirements compared to traditional art ownership. Real estate crowdfunding enables investors to collectively fund property projects, providing access to real estate markets without the need for large individual investments. Explore the benefits and risks of each approach to make informed investment decisions.

Why it is important

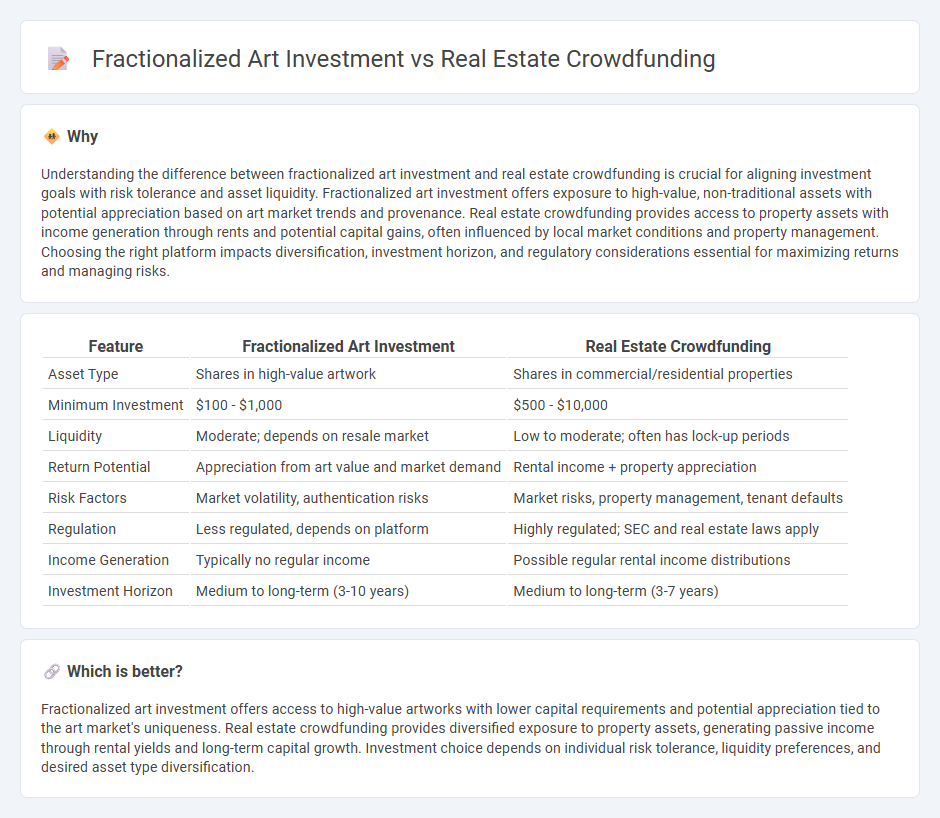

Understanding the difference between fractionalized art investment and real estate crowdfunding is crucial for aligning investment goals with risk tolerance and asset liquidity. Fractionalized art investment offers exposure to high-value, non-traditional assets with potential appreciation based on art market trends and provenance. Real estate crowdfunding provides access to property assets with income generation through rents and potential capital gains, often influenced by local market conditions and property management. Choosing the right platform impacts diversification, investment horizon, and regulatory considerations essential for maximizing returns and managing risks.

Comparison Table

| Feature | Fractionalized Art Investment | Real Estate Crowdfunding |

|---|---|---|

| Asset Type | Shares in high-value artwork | Shares in commercial/residential properties |

| Minimum Investment | $100 - $1,000 | $500 - $10,000 |

| Liquidity | Moderate; depends on resale market | Low to moderate; often has lock-up periods |

| Return Potential | Appreciation from art value and market demand | Rental income + property appreciation |

| Risk Factors | Market volatility, authentication risks | Market risks, property management, tenant defaults |

| Regulation | Less regulated, depends on platform | Highly regulated; SEC and real estate laws apply |

| Income Generation | Typically no regular income | Possible regular rental income distributions |

| Investment Horizon | Medium to long-term (3-10 years) | Medium to long-term (3-7 years) |

Which is better?

Fractionalized art investment offers access to high-value artworks with lower capital requirements and potential appreciation tied to the art market's uniqueness. Real estate crowdfunding provides diversified exposure to property assets, generating passive income through rental yields and long-term capital growth. Investment choice depends on individual risk tolerance, liquidity preferences, and desired asset type diversification.

Connection

Fractionalized art investment and real estate crowdfunding both democratize access to traditionally high-value asset classes by enabling multiple investors to pool funds and own shares of expensive properties or artworks. These platforms use blockchain technology and digital tokens to facilitate transparent, secure, and divisible ownership, increasing liquidity in markets typically characterized by illiquidity. By lowering entry barriers and allowing fractional ownership, they diversify investment portfolios and attract a broader base of investors seeking exposure to alternative assets.

Key Terms

Liquidity

Real estate crowdfunding offers moderate liquidity through periodic redemption windows, though investors often face holding periods before accessing returns. Fractionalized art investment provides enhanced liquidity via secondary markets where shares of valuable artworks can be traded more frequently, yet market depth and price volatility vary greatly. Explore the nuances of liquidity in these asset classes to make informed investment decisions.

Asset Underlying

Real estate crowdfunding involves pooling capital to invest in income-generating properties, securing ownership stakes tied to tangible real estate assets. Fractionalized art investment divides high-value artworks into digital shares, allowing investors to own portions of valuable art pieces, driven by market demand for rare cultural assets. Explore further to understand asset-backed opportunities and risk profiles in these emerging investment platforms.

Minimum Investment

Real estate crowdfunding platforms typically require a minimum investment ranging from $500 to $5,000, making them accessible for a broad range of investors seeking diversified property portfolios. Fractionalized art investments often demand higher minimum commitments, starting around $1,000 and sometimes exceeding $10,000, reflecting the unique valuation and liquidity characteristics of fine art. Explore the nuances of minimum investment thresholds in both industries to make informed financial decisions.

Source and External Links

Crowdfunding real estate: What to know - Real estate crowdfunding allows investors to pool money online to buy shares in residential or commercial properties otherwise unaffordable alone, aiming for portfolio diversification and easier access for both accredited and nonaccredited investors.

Crowdfunding - Crowdfunding in real estate is a method where investors pool funds to finance a specific project and earn passive income, facilitated by platforms like Crowdstreet, Fundrise, and YieldStreet that simplify building a real estate portfolio.

Arrived | Easily Invest in Real Estate - Arrived offers an online platform to invest in pre-vetted rental properties starting from $100, enabling investors to earn passive rental income and property appreciation while the platform manages all property operations.

dowidth.com

dowidth.com