Wine investing offers a unique blend of historical value and potential appreciation due to limited vintages and global demand, while jewelry investing leverages craftsmanship, precious metals, and gemstone rarity to retain and grow wealth. Both markets provide diversification opportunities but differ in liquidity, market trends, and risk profiles. Discover more about how wine and jewelry investments can fit your portfolio strategy.

Why it is important

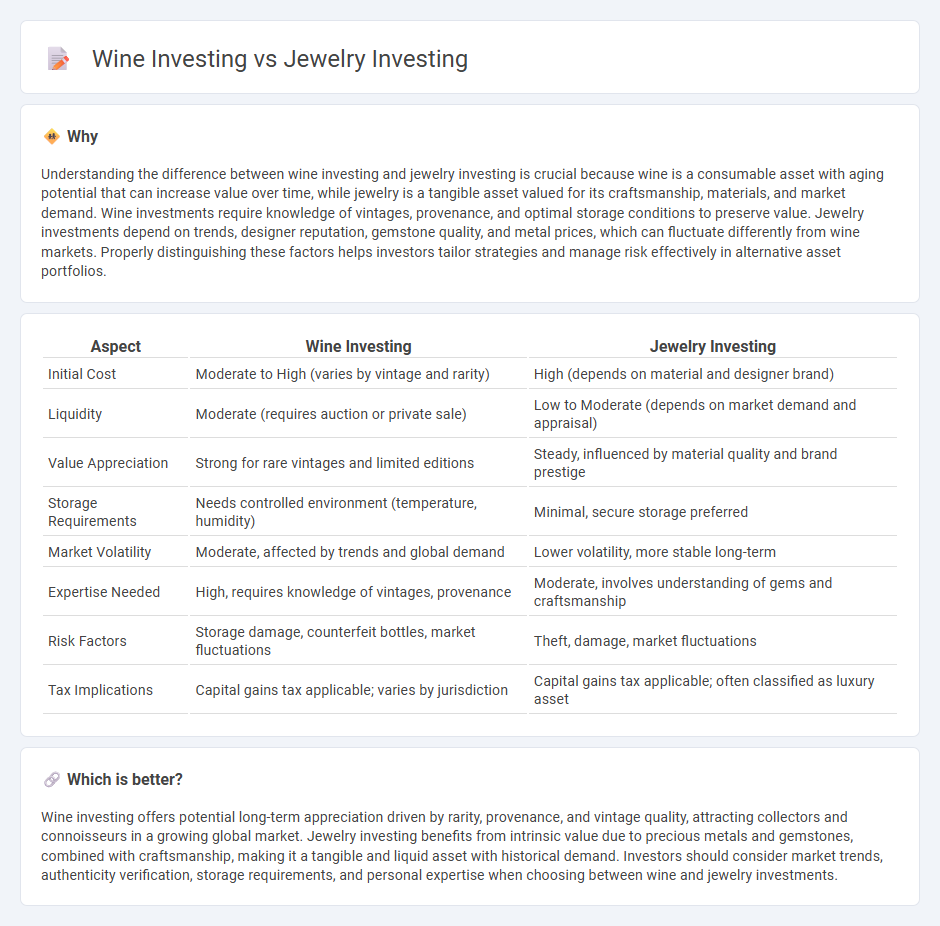

Understanding the difference between wine investing and jewelry investing is crucial because wine is a consumable asset with aging potential that can increase value over time, while jewelry is a tangible asset valued for its craftsmanship, materials, and market demand. Wine investments require knowledge of vintages, provenance, and optimal storage conditions to preserve value. Jewelry investments depend on trends, designer reputation, gemstone quality, and metal prices, which can fluctuate differently from wine markets. Properly distinguishing these factors helps investors tailor strategies and manage risk effectively in alternative asset portfolios.

Comparison Table

| Aspect | Wine Investing | Jewelry Investing |

|---|---|---|

| Initial Cost | Moderate to High (varies by vintage and rarity) | High (depends on material and designer brand) |

| Liquidity | Moderate (requires auction or private sale) | Low to Moderate (depends on market demand and appraisal) |

| Value Appreciation | Strong for rare vintages and limited editions | Steady, influenced by material quality and brand prestige |

| Storage Requirements | Needs controlled environment (temperature, humidity) | Minimal, secure storage preferred |

| Market Volatility | Moderate, affected by trends and global demand | Lower volatility, more stable long-term |

| Expertise Needed | High, requires knowledge of vintages, provenance | Moderate, involves understanding of gems and craftsmanship |

| Risk Factors | Storage damage, counterfeit bottles, market fluctuations | Theft, damage, market fluctuations |

| Tax Implications | Capital gains tax applicable; varies by jurisdiction | Capital gains tax applicable; often classified as luxury asset |

Which is better?

Wine investing offers potential long-term appreciation driven by rarity, provenance, and vintage quality, attracting collectors and connoisseurs in a growing global market. Jewelry investing benefits from intrinsic value due to precious metals and gemstones, combined with craftsmanship, making it a tangible and liquid asset with historical demand. Investors should consider market trends, authenticity verification, storage requirements, and personal expertise when choosing between wine and jewelry investments.

Connection

Wine investing and jewelry investing are connected through their status as alternative tangible assets that offer portfolio diversification and potential inflation hedges. Both markets rely heavily on rarity, provenance, and quality, with wine valuation influenced by vintage and storage conditions, while jewelry value depends on gemstone quality, craftsmanship, and brand heritage. Investors benefit from the appreciating value driven by limited supply and growing global demand for luxury collectibles in these sectors.

Key Terms

**Jewelry investing:**

Jewelry investing offers tangible assets with intrinsic value driven by precious metals, rare gemstones, and craftsmanship, making it a resilient option amid market volatility. Unlike wine investing, jewelry provides easier liquidity and less dependency on storage conditions, while historical appreciation rates for high-quality diamonds and vintage pieces have outperformed many alternative assets. Explore our comprehensive insights to understand how strategic jewelry investing can diversify and strengthen your portfolio.

Gemstone Quality

Gemstone quality in jewelry investing is assessed through the Four Cs: cut, color, clarity, and carat weight, making diamonds and colored gemstones valuable assets due to their rarity and durability. In contrast, wine investing depends on vintage, origin, and storage conditions, with quality influencing taste and potential market appreciation more than physical attributes. Explore the nuances of gemstone grading and how it impacts investment potential to make informed decisions.

Hallmark Authentication

Hallmark authentication in jewelry investing ensures the genuineness and quality of precious metals, directly impacting market value and investor confidence. In wine investing, authentication involves verifying vintage, provenance, and storage conditions to guarantee authenticity and preserve worth. Explore more to understand how hallmark authentication shapes investment strategies across these luxury asset classes.

Source and External Links

Top Tips for Investing in Jewelry: A Comprehensive Guide - Emphasizes investing in well-crafted jewelry made from precious metals like gold, platinum, or silver, focusing on quality, trusted dealers, and diversification across vintage and designer pieces for long-term value.

The Best Jewelry Investment Pieces: What to Buy for Long-Term Value - Highlights diamond engagement rings as prime investment jewelry due to their timeless appeal, durability, scarcity, and potential to appreciate over time.

Jewelry as an Investment: 10 Key Factors to Consider | Blog - Advises investing in high-quality gold, platinum, and rare gemstones such as sapphires, rubies, and emeralds, noting that rarity and quality of stones substantially influence jewelry's investment value.

dowidth.com

dowidth.com