Art tokenization offers a unique way to invest by dividing ownership of valuable artworks into digital tokens, making high-value art accessible to a broader audience. Index funds provide diversified exposure to a market segment by pooling investments across a range of assets, minimizing risk through broad representation. Explore these investment options to discover which aligns best with your financial goals and risk tolerance.

Why it is important

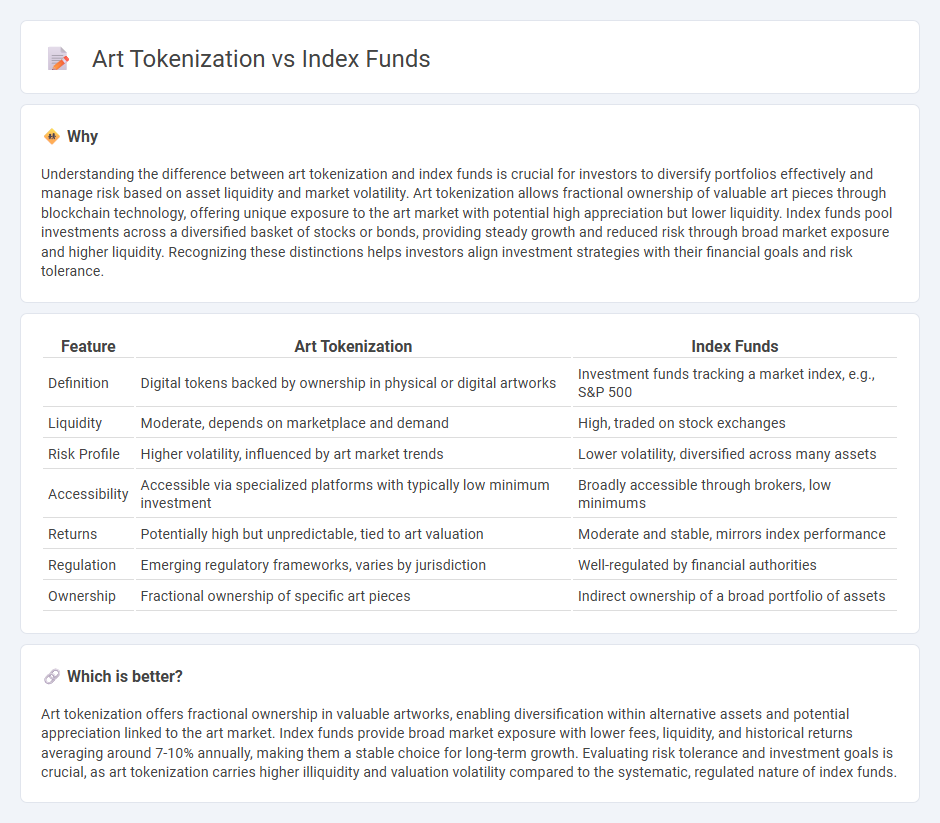

Understanding the difference between art tokenization and index funds is crucial for investors to diversify portfolios effectively and manage risk based on asset liquidity and market volatility. Art tokenization allows fractional ownership of valuable art pieces through blockchain technology, offering unique exposure to the art market with potential high appreciation but lower liquidity. Index funds pool investments across a diversified basket of stocks or bonds, providing steady growth and reduced risk through broad market exposure and higher liquidity. Recognizing these distinctions helps investors align investment strategies with their financial goals and risk tolerance.

Comparison Table

| Feature | Art Tokenization | Index Funds |

|---|---|---|

| Definition | Digital tokens backed by ownership in physical or digital artworks | Investment funds tracking a market index, e.g., S&P 500 |

| Liquidity | Moderate, depends on marketplace and demand | High, traded on stock exchanges |

| Risk Profile | Higher volatility, influenced by art market trends | Lower volatility, diversified across many assets |

| Accessibility | Accessible via specialized platforms with typically low minimum investment | Broadly accessible through brokers, low minimums |

| Returns | Potentially high but unpredictable, tied to art valuation | Moderate and stable, mirrors index performance |

| Regulation | Emerging regulatory frameworks, varies by jurisdiction | Well-regulated by financial authorities |

| Ownership | Fractional ownership of specific art pieces | Indirect ownership of a broad portfolio of assets |

Which is better?

Art tokenization offers fractional ownership in valuable artworks, enabling diversification within alternative assets and potential appreciation linked to the art market. Index funds provide broad market exposure with lower fees, liquidity, and historical returns averaging around 7-10% annually, making them a stable choice for long-term growth. Evaluating risk tolerance and investment goals is crucial, as art tokenization carries higher illiquidity and valuation volatility compared to the systematic, regulated nature of index funds.

Connection

Art tokenization transforms valuable artworks into digital tokens, enabling fractional ownership and enhanced liquidity in the investment market. Index funds, by pooling assets and tracking specific market segments, can integrate art tokens to diversify portfolios and provide exposure to the art market without direct acquisition. This connection democratizes access to high-value art investments while leveraging the stability and flexibility of index fund structures.

Key Terms

Diversification

Index funds offer broad market exposure by representing a diversified basket of stocks or bonds, minimizing individual asset risk. Art tokenization divides ownership of valuable artworks into digital tokens, enabling fractional investment but often with limited diversification compared to traditional portfolios. Explore deeper insights on how each method impacts diversification and portfolio strategy.

Liquidity

Index funds offer high liquidity by allowing investors to buy or sell shares on major stock exchanges throughout the trading day. Art tokenization provides liquidity by fractionalizing ownership of valuable artworks into digital tokens, enabling easier buying, selling, and trading on blockchain platforms. Explore the benefits and challenges of liquidity in both investment methods to make informed financial decisions.

Valuation

Index funds offer a diversified portfolio with valuation based on market capitalization and financial metrics of underlying assets, providing transparent and systematic pricing. Art tokenization assigns value through fractional ownership of unique artworks, with valuation influenced by art market trends, rarity, and expert appraisals, often resulting in less price transparency. Explore how each investment's valuation methods impact portfolio diversification and risk management in detail.

Source and External Links

Index Funds - Investor.gov - Index funds are mutual funds or ETFs designed to replicate the performance of a market index, such as the S&P 500 or Russell 2000, offering investors easy diversification and indirect access to entire market segments.

What is an index fund? - Vanguard - An index fund passively tracks a specific benchmark by holding all or a representative sample of the securities in that index, providing broad market exposure and reducing single-stock risk.

The Best Index Funds - Morningstar - Index funds are favored for their low costs and consistent performance, often outperforming actively managed funds over time by closely mirroring their benchmark indexes with minimal expenses.

dowidth.com

dowidth.com