Crowdlending platforms enable individual investors to directly fund businesses through online loans, offering fixed returns and lower entry barriers compared to traditional venture capital. Venture capital involves professional investors providing equity financing to high-growth startups, often taking an active role in business strategy in exchange for ownership stakes. Explore deeper insights into the benefits and risks of crowdlending versus venture capital to make informed investment decisions.

Why it is important

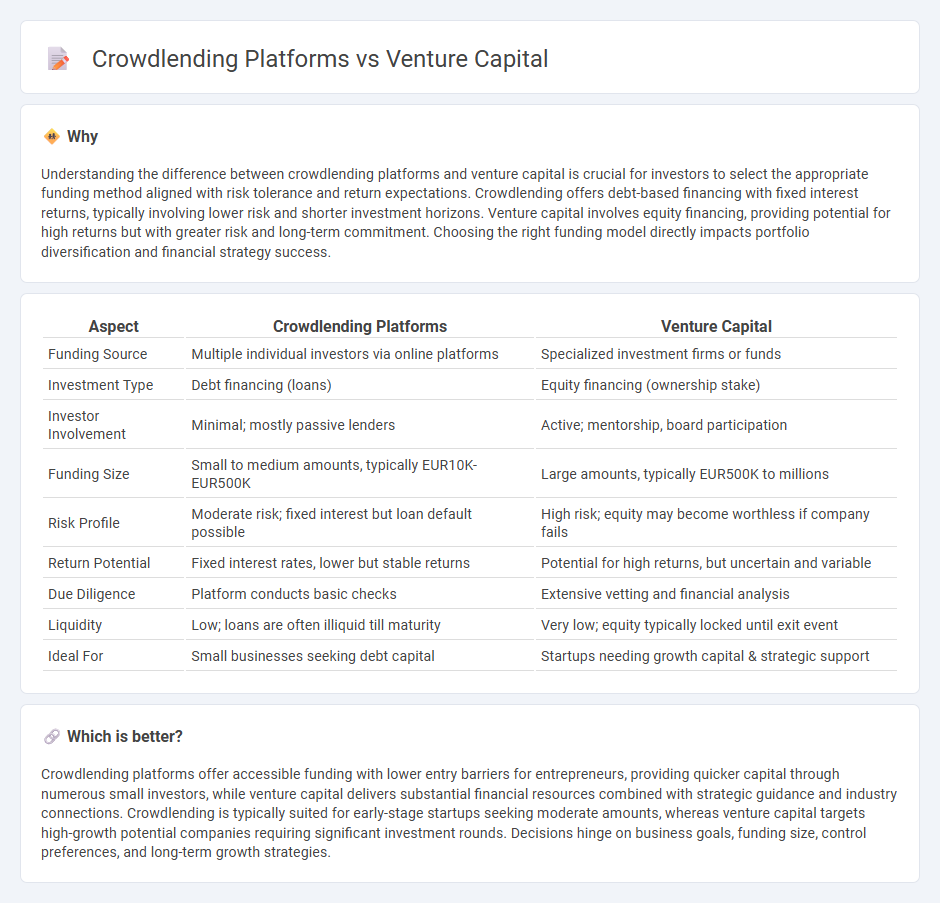

Understanding the difference between crowdlending platforms and venture capital is crucial for investors to select the appropriate funding method aligned with risk tolerance and return expectations. Crowdlending offers debt-based financing with fixed interest returns, typically involving lower risk and shorter investment horizons. Venture capital involves equity financing, providing potential for high returns but with greater risk and long-term commitment. Choosing the right funding model directly impacts portfolio diversification and financial strategy success.

Comparison Table

| Aspect | Crowdlending Platforms | Venture Capital |

|---|---|---|

| Funding Source | Multiple individual investors via online platforms | Specialized investment firms or funds |

| Investment Type | Debt financing (loans) | Equity financing (ownership stake) |

| Investor Involvement | Minimal; mostly passive lenders | Active; mentorship, board participation |

| Funding Size | Small to medium amounts, typically EUR10K-EUR500K | Large amounts, typically EUR500K to millions |

| Risk Profile | Moderate risk; fixed interest but loan default possible | High risk; equity may become worthless if company fails |

| Return Potential | Fixed interest rates, lower but stable returns | Potential for high returns, but uncertain and variable |

| Due Diligence | Platform conducts basic checks | Extensive vetting and financial analysis |

| Liquidity | Low; loans are often illiquid till maturity | Very low; equity typically locked until exit event |

| Ideal For | Small businesses seeking debt capital | Startups needing growth capital & strategic support |

Which is better?

Crowdlending platforms offer accessible funding with lower entry barriers for entrepreneurs, providing quicker capital through numerous small investors, while venture capital delivers substantial financial resources combined with strategic guidance and industry connections. Crowdlending is typically suited for early-stage startups seeking moderate amounts, whereas venture capital targets high-growth potential companies requiring significant investment rounds. Decisions hinge on business goals, funding size, control preferences, and long-term growth strategies.

Connection

Crowdlending platforms and venture capital both provide alternative financing solutions for startups and growing businesses, bridging gaps left by traditional banks. Crowdlending involves multiple investors lending smaller amounts directly to companies, while venture capital injects larger sums in exchange for equity stakes, accelerating growth opportunities. These funding methods complement each other by catering to different stages of business development, with crowdlending supporting early revenue generation and venture capital driving scale and market expansion.

Key Terms

Equity

Venture capital involves investors providing equity funding to startups in exchange for ownership shares, often influencing company decisions and future growth strategies. Crowdlending platforms allow multiple investors to lend funds to businesses with the expectation of repayment plus interest, without granting equity or ownership rights. Explore the key differences in equity involvement between venture capital and crowdlending to make informed investment choices.

Interest Rate

Venture capital typically involves equity investment with no fixed interest rates, focusing on high-growth potential and long-term returns, whereas crowdlending platforms provide debt financing with predetermined interest rates, offering predictable income streams for investors. Interest rates in crowdlending vary based on borrower creditworthiness and platform risk assessments, often ranging between 5% to 15% annually, contrasting the equity risk and reward structure of venture capital. Explore detailed comparisons of venture capital and crowdlending to decide which financing option aligns with your investment strategy.

Risk

Venture capital investments typically involve higher risks due to early-stage company uncertainty and potential for total loss, whereas crowdlending platforms offer relatively lower risk by providing more predictable returns through fixed-interest loans. Crowdlending investors benefit from diversification across multiple loans, reducing exposure to any single borrower's default risk. Discover detailed insights on managing risk in these funding methods to make informed investment decisions.

Source and External Links

What is Venture Capital? - Venture capital is private equity financing that turns innovative ideas and research into high-growth companies by investing long-term capital and providing strategic guidance, creating jobs and economic value, often in startups that can't access traditional bank financing.

Fund your business | U.S. Small Business Administration - Venture capital funding involves investors providing capital in exchange for equity ownership and an active role, focusing on high-growth companies with a longer investment horizon and higher risk tolerance than traditional loans, usually requiring entrepreneurs to share control.

What is venture capital? - Silicon Valley Bank - Venture capital supports startups and early-stage companies with strong growth potential by providing financial backing and managerial expertise in exchange for ownership stakes, playing a key role in innovation and company expansion.

dowidth.com

dowidth.com