Litigation finance involves third-party funding of legal cases, allowing plaintiffs to pursue claims without upfront costs while sharing potential settlements. Commodities investment focuses on buying and selling physical goods like oil, gold, or agricultural products to capitalize on market price fluctuations. Explore the advantages and risks of litigation finance and commodities to determine the best investment strategy for your portfolio.

Why it is important

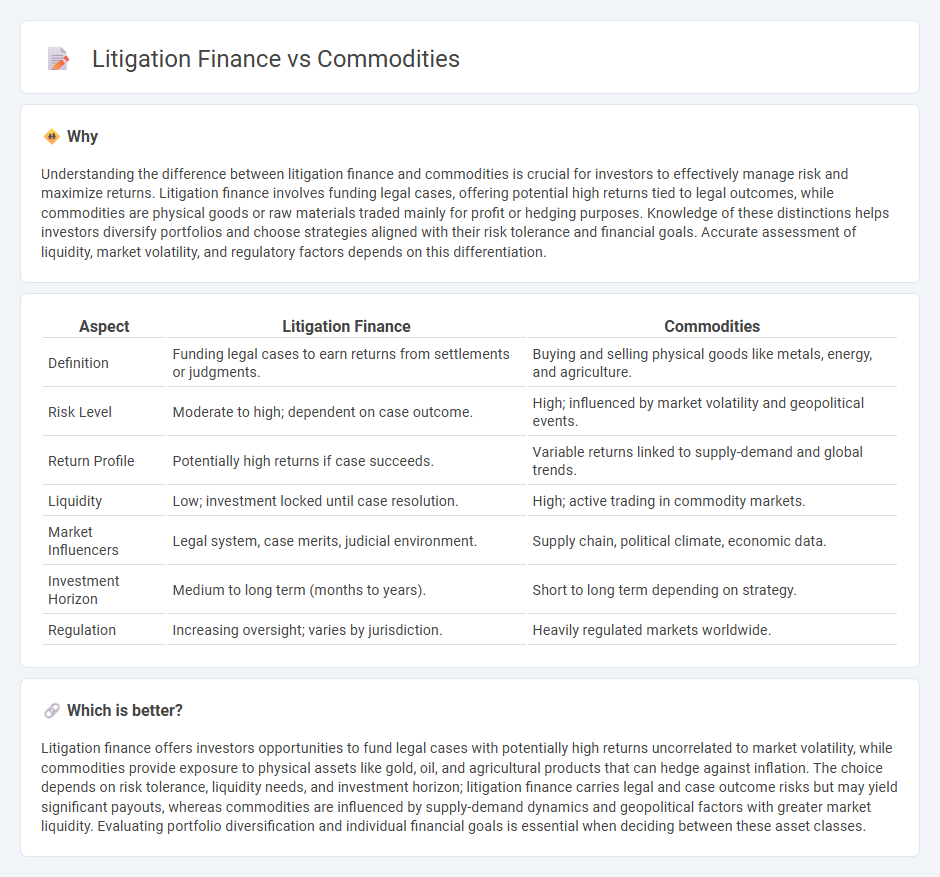

Understanding the difference between litigation finance and commodities is crucial for investors to effectively manage risk and maximize returns. Litigation finance involves funding legal cases, offering potential high returns tied to legal outcomes, while commodities are physical goods or raw materials traded mainly for profit or hedging purposes. Knowledge of these distinctions helps investors diversify portfolios and choose strategies aligned with their risk tolerance and financial goals. Accurate assessment of liquidity, market volatility, and regulatory factors depends on this differentiation.

Comparison Table

| Aspect | Litigation Finance | Commodities |

|---|---|---|

| Definition | Funding legal cases to earn returns from settlements or judgments. | Buying and selling physical goods like metals, energy, and agriculture. |

| Risk Level | Moderate to high; dependent on case outcome. | High; influenced by market volatility and geopolitical events. |

| Return Profile | Potentially high returns if case succeeds. | Variable returns linked to supply-demand and global trends. |

| Liquidity | Low; investment locked until case resolution. | High; active trading in commodity markets. |

| Market Influencers | Legal system, case merits, judicial environment. | Supply chain, political climate, economic data. |

| Investment Horizon | Medium to long term (months to years). | Short to long term depending on strategy. |

| Regulation | Increasing oversight; varies by jurisdiction. | Heavily regulated markets worldwide. |

Which is better?

Litigation finance offers investors opportunities to fund legal cases with potentially high returns uncorrelated to market volatility, while commodities provide exposure to physical assets like gold, oil, and agricultural products that can hedge against inflation. The choice depends on risk tolerance, liquidity needs, and investment horizon; litigation finance carries legal and case outcome risks but may yield significant payouts, whereas commodities are influenced by supply-demand dynamics and geopolitical factors with greater market liquidity. Evaluating portfolio diversification and individual financial goals is essential when deciding between these asset classes.

Connection

Litigation finance provides capital to plaintiffs in legal disputes, enabling them to pursue claims without financial strain, while commodities investments often involve significant risk and require substantial liquidity management. The connection lies in the strategic allocation of funds, where returns from litigation finance can support commodity trading operations by diversifying portfolios and mitigating market volatility. Both sectors leverage alternative investment strategies to optimize risk-adjusted returns and enhance capital efficiency.

Key Terms

Asset Class

Commodities are tangible assets such as oil, gold, and agricultural products that serve as essential inputs in global markets and act as a hedge against inflation. Litigation finance, an emerging alternative asset class, involves investing in legal claims to generate returns independent of market fluctuations, offering portfolio diversification and uncorrelated risk. Explore deeper insights into the unique characteristics and investment potential of these asset classes.

Risk Profile

Commodities trading involves high market volatility and exposure to price fluctuations, geopolitical events, and supply chain disruptions, resulting in a complex risk profile that demands robust hedging strategies. Litigation finance carries risks associated with case outcomes, legal complexities, and the duration of legal proceedings, with potential for significant returns or losses based on judicial decisions. Explore detailed risk assessments to understand how commodities and litigation finance compare in balancing risk and reward.

Return Correlation

Commodities often exhibit high return correlation with global economic cycles and inflation trends, making them sensitive to market volatility and geopolitical risks. Litigation finance returns tend to show low correlation with traditional asset classes, offering diversification benefits and reduced exposure to systemic market risks. Explore how understanding return correlations between these sectors can enhance your investment portfolio strategies.

Source and External Links

Understanding Commodities - PIMCO - Commodities are raw materials like agricultural products, energy, and metals that form a distinct asset class and can be traded via standardized futures contracts globally, offering investment opportunities from single commodities to broad indexes.

Commodities Versus Differentiated Products | Ag Decision Maker - Commodities are fungible raw materials, identical regardless of producer, such as corn and oil, with prices determined by the market, unlike differentiated products where producer identity matters.

Futures and Commodities | FINRA.org - Investors can access commodities by investing directly, mainly in precious metals, or by trading commodity futures contracts which obligate purchase or sale at future dates and are often used for hedging or speculation.

dowidth.com

dowidth.com