Spice trading offers historically rich investment opportunities influenced by global demand, supply chain dynamics, and commodity price fluctuations. Angel investing focuses on funding early-stage startups with high growth potential, driven by innovation and market disruption. Explore the unique benefits and risks of spice trading versus angel investing to make an informed decision.

Why it is important

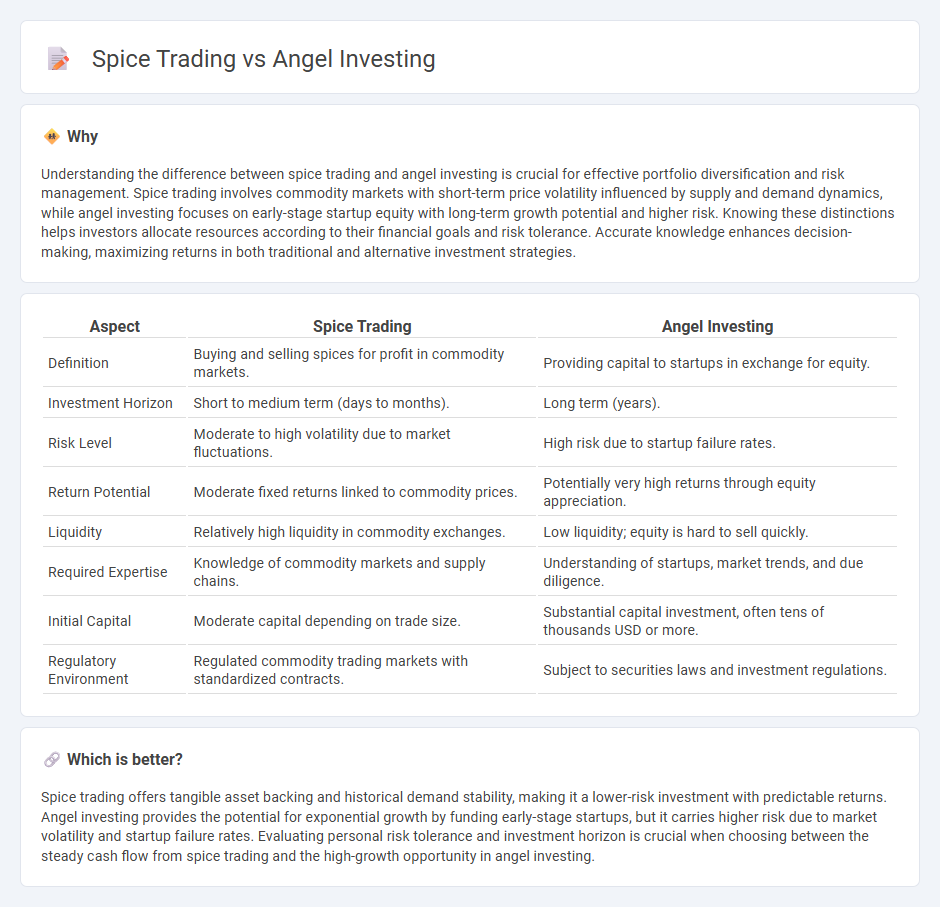

Understanding the difference between spice trading and angel investing is crucial for effective portfolio diversification and risk management. Spice trading involves commodity markets with short-term price volatility influenced by supply and demand dynamics, while angel investing focuses on early-stage startup equity with long-term growth potential and higher risk. Knowing these distinctions helps investors allocate resources according to their financial goals and risk tolerance. Accurate knowledge enhances decision-making, maximizing returns in both traditional and alternative investment strategies.

Comparison Table

| Aspect | Spice Trading | Angel Investing |

|---|---|---|

| Definition | Buying and selling spices for profit in commodity markets. | Providing capital to startups in exchange for equity. |

| Investment Horizon | Short to medium term (days to months). | Long term (years). |

| Risk Level | Moderate to high volatility due to market fluctuations. | High risk due to startup failure rates. |

| Return Potential | Moderate fixed returns linked to commodity prices. | Potentially very high returns through equity appreciation. |

| Liquidity | Relatively high liquidity in commodity exchanges. | Low liquidity; equity is hard to sell quickly. |

| Required Expertise | Knowledge of commodity markets and supply chains. | Understanding of startups, market trends, and due diligence. |

| Initial Capital | Moderate capital depending on trade size. | Substantial capital investment, often tens of thousands USD or more. |

| Regulatory Environment | Regulated commodity trading markets with standardized contracts. | Subject to securities laws and investment regulations. |

Which is better?

Spice trading offers tangible asset backing and historical demand stability, making it a lower-risk investment with predictable returns. Angel investing provides the potential for exponential growth by funding early-stage startups, but it carries higher risk due to market volatility and startup failure rates. Evaluating personal risk tolerance and investment horizon is crucial when choosing between the steady cash flow from spice trading and the high-growth opportunity in angel investing.

Connection

Spice trading and angel investing share the fundamental principle of identifying emerging opportunities with high growth potential. Both require deep market knowledge to evaluate risks and rewards, whether in exotic commodities or innovative startups. These investment strategies hinge on timing, market insight, and strategic capital allocation to maximize returns.

Key Terms

Angel Investing:

Angel investing involves providing early-stage capital to startups in exchange for equity ownership, often supporting innovative business ideas with high growth potential. This type of investment carries considerable risk but can yield substantial returns if the startup succeeds. Explore the fundamentals and strategies of angel investing to maximize your impact and financial gain.

Equity

Angel investing involves providing early-stage capital to startups in exchange for equity ownership and potential high returns, whereas spice trading is a commodity business focused on buying and selling spices without involving equity stakes. The equity component in angel investing allows investors to influence company decisions and benefit from long-term value appreciation, contrasting with the transactional nature of spice trading. Explore the nuanced differences between equity-focused investments and commodity trading to enhance your financial strategies.

Valuation

Angel investing valuation commonly relies on startups' projected growth, market potential, and competitive landscape, often using methods like discounted cash flow or comparable company analysis. Spice trading valuation centers on commodity price fluctuations, supply-demand dynamics, and geopolitical factors affecting market prices. Explore further to understand how valuation intricacies shape decision-making in both angel investing and spice trading.

Source and External Links

Understanding angel financing and investing - J.P. Morgan - Angel investors are individuals who provide early-stage capital to startups in exchange for equity or convertible debt, often bringing industry expertise, mentorship, and valuable networks to help founders reach key milestones before institutional funding.

Angel Investors - The Hartford Insurance - Angel investors are wealthy private individuals who invest their own money in small businesses for equity, typically offering more patient capital and hands-on support compared to venture capitalists, while seeking eventual profits through exits like IPOs or acquisitions.

Angel investor - Wikipedia - Angel investors, also known as business angels, are high-net-worth individuals who provide seed funding to startups, often taking an active role in the business and historically achieving average returns of about 2.2 times their investment over 3.6 years.

dowidth.com

dowidth.com