Sports memorabilia investment offers tangible assets with historical and emotional value, often appreciating over time due to rarity and fan demand. Cryptocurrency investment involves digital assets with high volatility and potential for rapid gains driven by market trends and blockchain technology. Explore the benefits and risks of each to determine the best fit for your investment strategy.

Why it is important

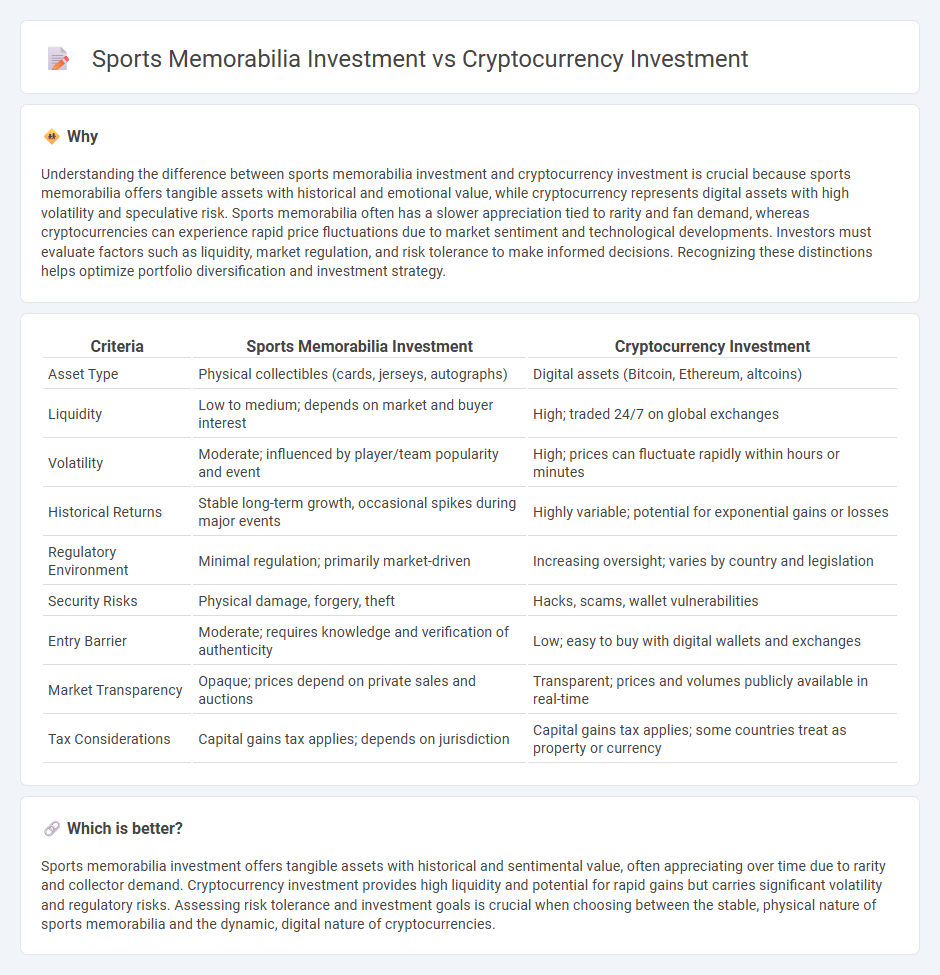

Understanding the difference between sports memorabilia investment and cryptocurrency investment is crucial because sports memorabilia offers tangible assets with historical and emotional value, while cryptocurrency represents digital assets with high volatility and speculative risk. Sports memorabilia often has a slower appreciation tied to rarity and fan demand, whereas cryptocurrencies can experience rapid price fluctuations due to market sentiment and technological developments. Investors must evaluate factors such as liquidity, market regulation, and risk tolerance to make informed decisions. Recognizing these distinctions helps optimize portfolio diversification and investment strategy.

Comparison Table

| Criteria | Sports Memorabilia Investment | Cryptocurrency Investment |

|---|---|---|

| Asset Type | Physical collectibles (cards, jerseys, autographs) | Digital assets (Bitcoin, Ethereum, altcoins) |

| Liquidity | Low to medium; depends on market and buyer interest | High; traded 24/7 on global exchanges |

| Volatility | Moderate; influenced by player/team popularity and event | High; prices can fluctuate rapidly within hours or minutes |

| Historical Returns | Stable long-term growth, occasional spikes during major events | Highly variable; potential for exponential gains or losses |

| Regulatory Environment | Minimal regulation; primarily market-driven | Increasing oversight; varies by country and legislation |

| Security Risks | Physical damage, forgery, theft | Hacks, scams, wallet vulnerabilities |

| Entry Barrier | Moderate; requires knowledge and verification of authenticity | Low; easy to buy with digital wallets and exchanges |

| Market Transparency | Opaque; prices depend on private sales and auctions | Transparent; prices and volumes publicly available in real-time |

| Tax Considerations | Capital gains tax applies; depends on jurisdiction | Capital gains tax applies; some countries treat as property or currency |

Which is better?

Sports memorabilia investment offers tangible assets with historical and sentimental value, often appreciating over time due to rarity and collector demand. Cryptocurrency investment provides high liquidity and potential for rapid gains but carries significant volatility and regulatory risks. Assessing risk tolerance and investment goals is crucial when choosing between the stable, physical nature of sports memorabilia and the dynamic, digital nature of cryptocurrencies.

Connection

Sports memorabilia investment and cryptocurrency investment both represent alternative asset classes appealing to investors seeking diversification and high returns. Both markets are characterized by volatility and require specialized knowledge to evaluate value fluctuations influenced by market trends and rarity or demand. Blockchain technology increasingly supports sports memorabilia authenticity, linking the digital verification methods typical in cryptocurrency with tangible collectibles.

Key Terms

**Cryptocurrency investment:**

Cryptocurrency investment offers high liquidity and the potential for significant short-term gains due to its 24/7 market operations and global accessibility. Digital assets like Bitcoin and Ethereum present opportunities for decentralized finance participation and portfolio diversification with relatively low entry barriers. Explore the dynamic world of cryptocurrency investment to understand its risks, rewards, and emerging trends.

Blockchain

Blockchain technology underpins cryptocurrency investment by ensuring secure, transparent, and decentralized transactions, which enhances trust and liquidity in digital asset markets. Sports memorabilia investment benefits from blockchain through non-fungible tokens (NFTs), providing verifiable provenance and authenticity that protect against forgery and enhance collectible value. Explore how blockchain revolutionizes asset security and market dynamics in both cryptocurrency and sports memorabilia investing.

Volatility

Cryptocurrency investment is characterized by extreme volatility, with price fluctuations driven by market sentiment, regulatory news, and technological advancements, often resulting in rapid gains or losses within short periods. Sports memorabilia investment tends to exhibit lower volatility, as its value depends on factors like rarity, player popularity, and historical significance, providing more stable but potentially slower appreciation. Explore the nuances of these investment types to better understand which aligns with your risk tolerance and financial goals.

Source and External Links

Bitcoin News Today: Thumzup Media Approves $250 Million Crypto Investment - Thumzup Media Corporation, a Nasdaq-listed company, has approved a $250 million investment to diversify its portfolio across major cryptocurrencies including Bitcoin, Ethereum, Solana, Ripple, Dogecoin, Litecoin, and USDC, reflecting a growing trend among institutional investors.

Cryptocurrency Basics: Pros, Cons and How It Works - NerdWallet - Cryptocurrency is a digital currency used as an alternative payment method or speculative investment, with pros including significant long-term value increase, removal of central banks from money supply management, potential financial inclusion, blockchain security, and opportunities like staking.

What is Cryptocurrency and How Does it Work? - Kaspersky - Cryptocurrency is a digital currency secured by cryptography, and safe investment requires researching exchanges, understanding storage options like digital wallets, and diversifying investments to manage risks effectively.

dowidth.com

dowidth.com