Carbon credits trading allows companies to buy and sell emission allowances to meet regulatory targets while promoting environmental responsibility through market mechanisms. Sustainability-linked loans offer financial incentives by tying loan conditions to a borrower's achievement of specific environmental, social, and governance (ESG) goals. Explore how these innovative financial tools drive corporate sustainability and investment strategies.

Why it is important

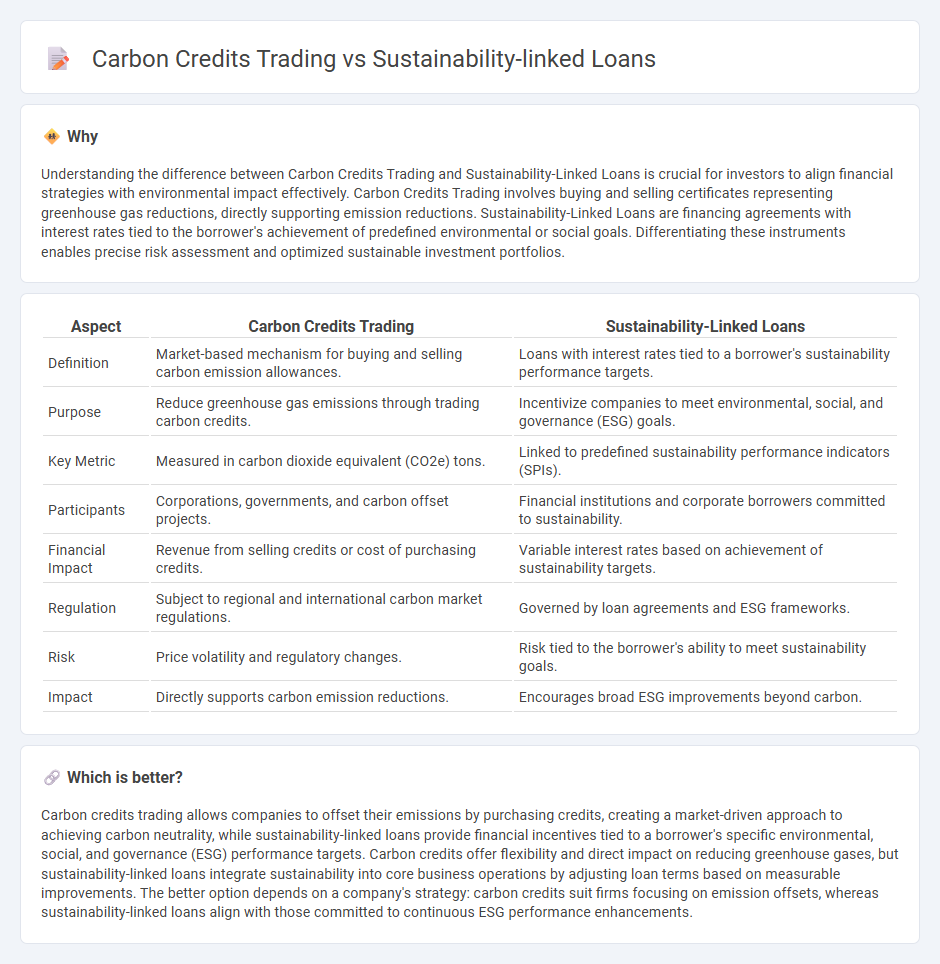

Understanding the difference between Carbon Credits Trading and Sustainability-Linked Loans is crucial for investors to align financial strategies with environmental impact effectively. Carbon Credits Trading involves buying and selling certificates representing greenhouse gas reductions, directly supporting emission reductions. Sustainability-Linked Loans are financing agreements with interest rates tied to the borrower's achievement of predefined environmental or social goals. Differentiating these instruments enables precise risk assessment and optimized sustainable investment portfolios.

Comparison Table

| Aspect | Carbon Credits Trading | Sustainability-Linked Loans |

|---|---|---|

| Definition | Market-based mechanism for buying and selling carbon emission allowances. | Loans with interest rates tied to a borrower's sustainability performance targets. |

| Purpose | Reduce greenhouse gas emissions through trading carbon credits. | Incentivize companies to meet environmental, social, and governance (ESG) goals. |

| Key Metric | Measured in carbon dioxide equivalent (CO2e) tons. | Linked to predefined sustainability performance indicators (SPIs). |

| Participants | Corporations, governments, and carbon offset projects. | Financial institutions and corporate borrowers committed to sustainability. |

| Financial Impact | Revenue from selling credits or cost of purchasing credits. | Variable interest rates based on achievement of sustainability targets. |

| Regulation | Subject to regional and international carbon market regulations. | Governed by loan agreements and ESG frameworks. |

| Risk | Price volatility and regulatory changes. | Risk tied to the borrower's ability to meet sustainability goals. |

| Impact | Directly supports carbon emission reductions. | Encourages broad ESG improvements beyond carbon. |

Which is better?

Carbon credits trading allows companies to offset their emissions by purchasing credits, creating a market-driven approach to achieving carbon neutrality, while sustainability-linked loans provide financial incentives tied to a borrower's specific environmental, social, and governance (ESG) performance targets. Carbon credits offer flexibility and direct impact on reducing greenhouse gases, but sustainability-linked loans integrate sustainability into core business operations by adjusting loan terms based on measurable improvements. The better option depends on a company's strategy: carbon credits suit firms focusing on emission offsets, whereas sustainability-linked loans align with those committed to continuous ESG performance enhancements.

Connection

Carbon credits trading incentivizes companies to reduce emissions by assigning monetary value to verified reductions, aligning financial interests with environmental goals. Sustainability-linked loans tie financing terms to a company's achievement of specific ESG targets, including emission reductions that can be supported through active participation in carbon credit markets. Both mechanisms promote corporate accountability and encourage investments that advance sustainable practices while mitigating climate risk.

Key Terms

**Sustainability-linked loans:**

Sustainability-linked loans (SLLs) incentivize borrowers to achieve specific environmental, social, and governance (ESG) performance targets, often tied to key performance indicators like carbon emissions reduction or renewable energy use. These loans offer flexible interest rates that decrease when sustainability goals are met, promoting continuous improvement in corporate sustainability practices. Explore how sustainability-linked loans are transforming green finance and driving corporate accountability.

Key Performance Indicators (KPIs)

Sustainability-linked loans (SLLs) are financial instruments tied to specific Key Performance Indicators (KPIs) such as carbon emission reduction, water usage, and energy efficiency, directly linking loan terms to a borrower's sustainability goals. Carbon credits trading involves buying and selling carbon emission allowances, with KPIs centered on measurable emission reductions achieved and verified through standardized protocols. Explore the distinctions and strategic applications of these tools to optimize your environmental and financial outcomes.

Interest Rate Adjustment

Sustainability-linked loans (SLLs) incorporate interest rate adjustments tied to predefined environmental, social, and governance (ESG) performance targets, incentivizing borrowers to improve sustainability metrics. In contrast, carbon credits trading involves buying and selling emission allowances without directly influencing loan interest but rather focusing on market-driven carbon reduction incentives. Explore the nuances of how interest rate adjustments in SLLs drive corporate sustainability efforts compared to the mechanisms of carbon credit markets.

Source and External Links

Sustainability Linked Loan Principles - These principles facilitate environmentally and socially sustainable economic activity by tying loan terms to borrowers' sustainability performance.

Sustainability Linked Loans - This type of loan allows borrowers to use funds for general business purposes, with terms tied to their ESG performance.

The Rise of Sustainability-Linked Loans - Sustainability-linked loans are gaining prominence due to their connection of economic outcomes to borrowers' sustainability performance, particularly beneficial in supporting climate-related projects.

dowidth.com

dowidth.com