Collectible sneakers have surged in value due to limited releases and strong cultural appeal, often yielding impressive returns in short timeframes. Fine art offers long-term investment stability, driven by historical significance and rarity that attract affluent collectors globally. Explore deeper insights into how these two dynamic markets compare to optimize your investment strategy.

Why it is important

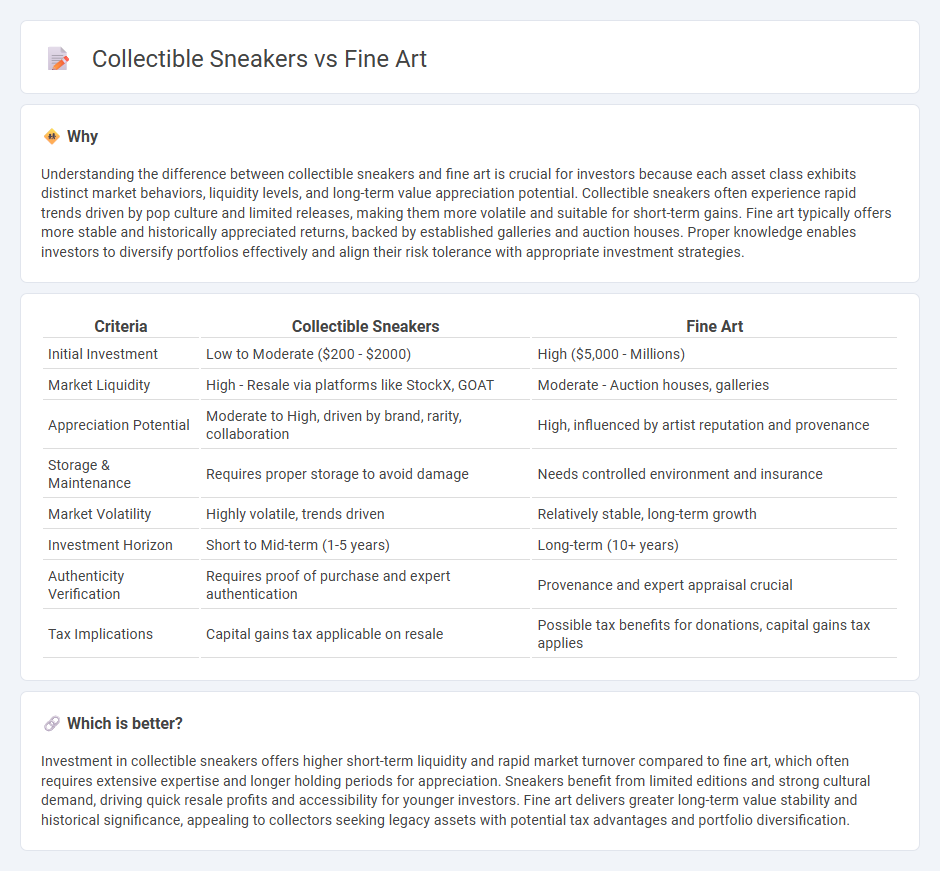

Understanding the difference between collectible sneakers and fine art is crucial for investors because each asset class exhibits distinct market behaviors, liquidity levels, and long-term value appreciation potential. Collectible sneakers often experience rapid trends driven by pop culture and limited releases, making them more volatile and suitable for short-term gains. Fine art typically offers more stable and historically appreciated returns, backed by established galleries and auction houses. Proper knowledge enables investors to diversify portfolios effectively and align their risk tolerance with appropriate investment strategies.

Comparison Table

| Criteria | Collectible Sneakers | Fine Art |

|---|---|---|

| Initial Investment | Low to Moderate ($200 - $2000) | High ($5,000 - Millions) |

| Market Liquidity | High - Resale via platforms like StockX, GOAT | Moderate - Auction houses, galleries |

| Appreciation Potential | Moderate to High, driven by brand, rarity, collaboration | High, influenced by artist reputation and provenance |

| Storage & Maintenance | Requires proper storage to avoid damage | Needs controlled environment and insurance |

| Market Volatility | Highly volatile, trends driven | Relatively stable, long-term growth |

| Investment Horizon | Short to Mid-term (1-5 years) | Long-term (10+ years) |

| Authenticity Verification | Requires proof of purchase and expert authentication | Provenance and expert appraisal crucial |

| Tax Implications | Capital gains tax applicable on resale | Possible tax benefits for donations, capital gains tax applies |

Which is better?

Investment in collectible sneakers offers higher short-term liquidity and rapid market turnover compared to fine art, which often requires extensive expertise and longer holding periods for appreciation. Sneakers benefit from limited editions and strong cultural demand, driving quick resale profits and accessibility for younger investors. Fine art delivers greater long-term value stability and historical significance, appealing to collectors seeking legacy assets with potential tax advantages and portfolio diversification.

Connection

Collectible sneakers and fine art share similarities as alternative investment assets that appreciate in value due to rarity, cultural significance, and demand within niche markets. Both markets rely on provenance, authenticity, and limited edition releases to drive their price dynamics and attract collectors worldwide. Investors diversify portfolios by leveraging the potential high returns and emotional appeal offered by these tangible assets.

Key Terms

Provenance

Provenance plays a crucial role in distinguishing fine art from collectible sneakers by authenticating origin, ownership history, and enhancing value. Fine art provenance is meticulously documented through galleries, exhibitions, and artist records, while collectible sneakers rely on limited edition releases, celebrity endorsements, and sneaker culture resales. Explore how provenance impacts investment potential and cultural significance within these two dynamic markets.

Liquidity

Fine art often faces lower liquidity due to niche markets and extended appraisal times, with transactions sometimes taking months to finalize. Collectible sneakers benefit from higher liquidity, supported by online marketplaces and rapid market cycles that facilitate quicker sales. Explore more to understand how liquidity impacts investment strategies in fine art and collectible sneakers.

Market Valuation

Fine art consistently commands higher market valuations due to its established historical significance, rarity, and enduring cultural impact, with masterpieces often fetching millions at auctions. Collectible sneakers have surged in market value driven by limited releases, brand collaborations, and a growing community of enthusiasts, sometimes reaching tens of thousands of dollars for rare editions. Explore the evolving dynamics and investment potential of these contrasting markets to understand their unique valuation drivers.

Source and External Links

Fine art - Wikipedia - Fine art is visual art created primarily for aesthetic and intellectual purposes, traditionally including painting, sculpture, drawing, watercolor, graphics, and architecture, and is distinguished from decorative or applied arts by its emphasis on beauty and meaningfulness.

Fine Art America | Curated Wall Art from Independent Artists - Fine Art America is the world's largest online marketplace for independent artists, offering millions of original artworks, prints, and custom products available for purchase direct from creators worldwide.

Fine Art Connoisseur: Home - Fine Art Connoisseur provides curated insights into the fine art world, featuring expert analysis, artist profiles, and exclusive coverage of exhibitions and auctions, with a focus on both traditional and contemporary practices.

dowidth.com

dowidth.com