Music royalties investing offers a steady income stream backed by intellectual property rights and historical royalty payments, providing portfolio diversification with relatively low volatility. Cryptocurrency investing involves high-risk, high-reward potential driven by market speculation, blockchain technology, and decentralized finance trends. Explore the advantages and risks of each to determine the best fit for your investment strategy.

Why it is important

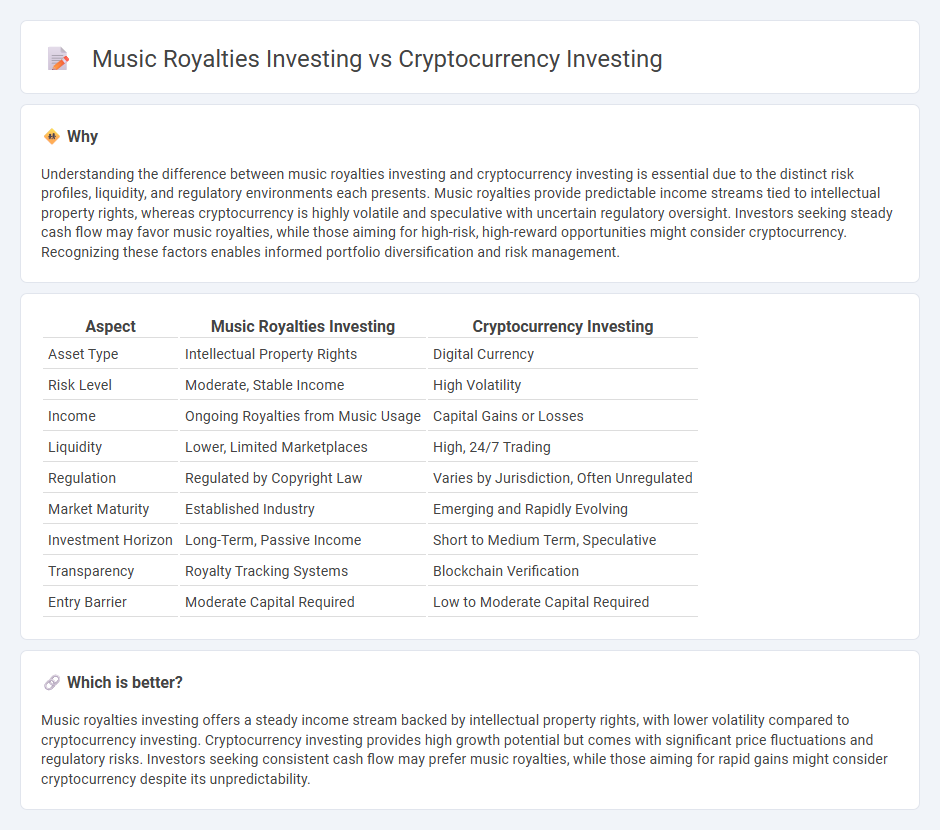

Understanding the difference between music royalties investing and cryptocurrency investing is essential due to the distinct risk profiles, liquidity, and regulatory environments each presents. Music royalties provide predictable income streams tied to intellectual property rights, whereas cryptocurrency is highly volatile and speculative with uncertain regulatory oversight. Investors seeking steady cash flow may favor music royalties, while those aiming for high-risk, high-reward opportunities might consider cryptocurrency. Recognizing these factors enables informed portfolio diversification and risk management.

Comparison Table

| Aspect | Music Royalties Investing | Cryptocurrency Investing |

|---|---|---|

| Asset Type | Intellectual Property Rights | Digital Currency |

| Risk Level | Moderate, Stable Income | High Volatility |

| Income | Ongoing Royalties from Music Usage | Capital Gains or Losses |

| Liquidity | Lower, Limited Marketplaces | High, 24/7 Trading |

| Regulation | Regulated by Copyright Law | Varies by Jurisdiction, Often Unregulated |

| Market Maturity | Established Industry | Emerging and Rapidly Evolving |

| Investment Horizon | Long-Term, Passive Income | Short to Medium Term, Speculative |

| Transparency | Royalty Tracking Systems | Blockchain Verification |

| Entry Barrier | Moderate Capital Required | Low to Moderate Capital Required |

Which is better?

Music royalties investing offers a steady income stream backed by intellectual property rights, with lower volatility compared to cryptocurrency investing. Cryptocurrency investing provides high growth potential but comes with significant price fluctuations and regulatory risks. Investors seeking consistent cash flow may prefer music royalties, while those aiming for rapid gains might consider cryptocurrency despite its unpredictability.

Connection

Music royalties investing and cryptocurrency investing intersect through blockchain technology, which enables transparent and secure tracking of royalty payments and ownership rights. This synergy allows investors to trade fractionalized music assets as digital tokens, enhancing liquidity and accessibility within the investment market. The fusion of these sectors leverages smart contracts to automate royalty distribution, optimizing income streams for stakeholders.

Key Terms

**Cryptocurrency investing:**

Cryptocurrency investing involves buying digital assets like Bitcoin and Ethereum, which offer high volatility and potential for significant returns due to blockchain technology and market demand. Unlike traditional investments, cryptocurrencies operate on decentralized networks, providing increased transparency but also exposing investors to regulatory risks and security challenges. Explore deeper insights into cryptocurrency investing strategies and market trends to maximize your portfolio.

Blockchain

Blockchain technology underpins both cryptocurrency investing and music royalties investing, providing secure, transparent, and decentralized platforms. Cryptocurrency investments leverage blockchain for digital currency transactions and asset management, while music royalties use blockchain to track ownership rights and automate royalty payments. Explore how blockchain transforms these sectors and discover opportunities in these innovative investment models.

Volatility

Cryptocurrency investing is characterized by extreme volatility, with prices often experiencing rapid and unpredictable fluctuations driven by market sentiment, regulatory news, and technological developments. In contrast, music royalties investing offers more stable and consistent income streams, as royalties are tied to long-term asset performance and consumption patterns which tend to be less volatile. Explore the benefits and risks of each investment type to determine which aligns best with your financial goals and risk tolerance.

Source and External Links

Cryptocurrency Investments: ETFs, Stocks & Futures | E*TRADE - Investors can access cryptocurrencies indirectly through ETFs, stocks, coin trusts, and futures without holding crypto wallets by trading on platforms like E*TRADE and Power E*TRADE.

What is Cryptocurrency and How Does It Work? - Charles Schwab - Schwab offers multiple ways to invest in crypto, including spot bitcoin or ether ETPs, crypto-related ETFs, stocks, futures, and options, but highlights crypto as highly speculative and suitable mostly for trading outside traditional long-term portfolios.

Before You Invest in Crypto, Know the Risks | disb - Cryptocurrency investing carries substantial risks including volatility, lack of regulation, and susceptibility to scams, especially impacting minority investors who may underestimate these risks.

dowidth.com

dowidth.com