Royalty streaming offers an alternative investment model where investors receive a percentage of revenue from a project or company, unlike traditional loans that require fixed interest payments and principal repayment. This approach aligns investor returns with the performance of the underlying asset, reducing default risk associated with loan structures. Explore how royalty streaming can diversify your investment portfolio and potentially enhance cash flow stability.

Why it is important

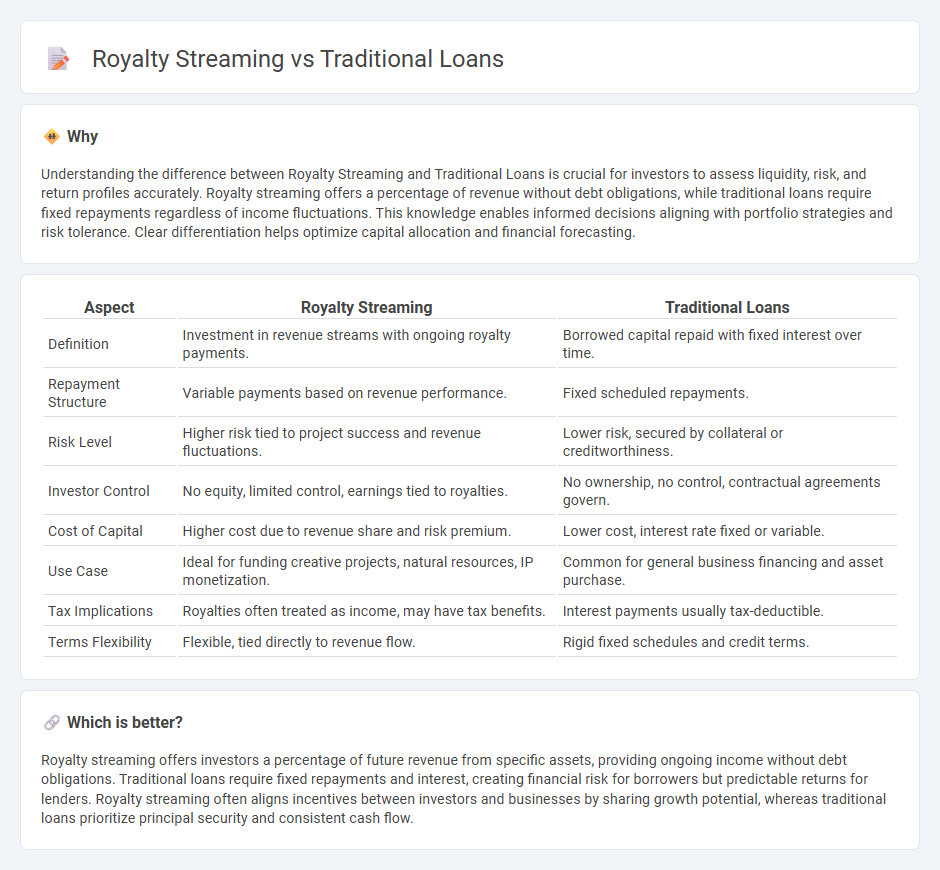

Understanding the difference between Royalty Streaming and Traditional Loans is crucial for investors to assess liquidity, risk, and return profiles accurately. Royalty streaming offers a percentage of revenue without debt obligations, while traditional loans require fixed repayments regardless of income fluctuations. This knowledge enables informed decisions aligning with portfolio strategies and risk tolerance. Clear differentiation helps optimize capital allocation and financial forecasting.

Comparison Table

| Aspect | Royalty Streaming | Traditional Loans |

|---|---|---|

| Definition | Investment in revenue streams with ongoing royalty payments. | Borrowed capital repaid with fixed interest over time. |

| Repayment Structure | Variable payments based on revenue performance. | Fixed scheduled repayments. |

| Risk Level | Higher risk tied to project success and revenue fluctuations. | Lower risk, secured by collateral or creditworthiness. |

| Investor Control | No equity, limited control, earnings tied to royalties. | No ownership, no control, contractual agreements govern. |

| Cost of Capital | Higher cost due to revenue share and risk premium. | Lower cost, interest rate fixed or variable. |

| Use Case | Ideal for funding creative projects, natural resources, IP monetization. | Common for general business financing and asset purchase. |

| Tax Implications | Royalties often treated as income, may have tax benefits. | Interest payments usually tax-deductible. |

| Terms Flexibility | Flexible, tied directly to revenue flow. | Rigid fixed schedules and credit terms. |

Which is better?

Royalty streaming offers investors a percentage of future revenue from specific assets, providing ongoing income without debt obligations. Traditional loans require fixed repayments and interest, creating financial risk for borrowers but predictable returns for lenders. Royalty streaming often aligns incentives between investors and businesses by sharing growth potential, whereas traditional loans prioritize principal security and consistent cash flow.

Connection

Royalty streaming and traditional loans are connected through their roles in providing alternative financing options for businesses. Both methods enable companies to access capital without immediately diluting equity, with royalty streams tied to future revenue and traditional loans requiring fixed repayments. Investors and lenders assess cash flow stability and risk to determine terms, blending aspects of debt and revenue-based financing.

Key Terms

Principal

Traditional loans require fixed principal repayments over a defined term, impacting cash flow predictability and credit risk management. Royalty streaming offers a flexible alternative by generating principal returns linked to revenue streams, aligning repayments with business performance and reducing default risk. Discover more about how principal-focused financing options can optimize your capital strategy.

Interest Rate

Traditional loans typically have fixed or variable interest rates based on credit scores and market conditions, often resulting in predictable repayment schedules. Royalty streaming agreements replace interest with a percentage of future revenues, aligning investor returns with project success and reducing fixed financial burden. Explore more about how interest rate dynamics influence financing choices between these options.

Revenue Share

Traditional loans require fixed repayments and interest regardless of business performance, often impacting cash flow stability, while royalty streaming involves revenue share agreements where repayments fluctuate with actual sales, aligning lender returns with company success. Revenue share models reduce financial risk during downturns and preserve equity, making them attractive for companies with volatile or growing revenue streams. Discover how revenue share financing can optimize capital structures and support sustainable growth strategies.

Source and External Links

What Is a Conventional Loan? - A traditional (or conventional) loan is a mortgage not backed by the government, typically requiring a credit score of 620 or higher, down payments as low as 3%, and may require private mortgage insurance if less than 20% is put down, with loan limits up to $806,500 (or higher in some areas).

Conventional Loans: Everything You Need To Know - Conventional loans offer lower down payment options (as low as 3%), cancellable mortgage insurance, and financing for primary, investment, or secondary homes, but require a minimum credit score around 620 and may have higher interest rates compared to government-backed loans.

Conventional loans | Consumer Financial Protection Bureau - Conventional loans are those not backed by government programs and come in two main categories: conforming loans with limits (e.g., $766,550 in most counties) and conforming jumbo loans for higher loan amounts in select areas, often requiring mortgage insurance if the down payment is under 20%.

dowidth.com

dowidth.com