NFT domain names offer decentralized ownership secured by blockchain technology, enabling unique digital assets with potential for rapid value appreciation. Private equity involves investing in established companies through equity stakes, focusing on long-term growth and operational improvements in traditional markets. Explore the distinct advantages and risks of NFT domain names versus private equity investments to enhance your portfolio strategy.

Why it is important

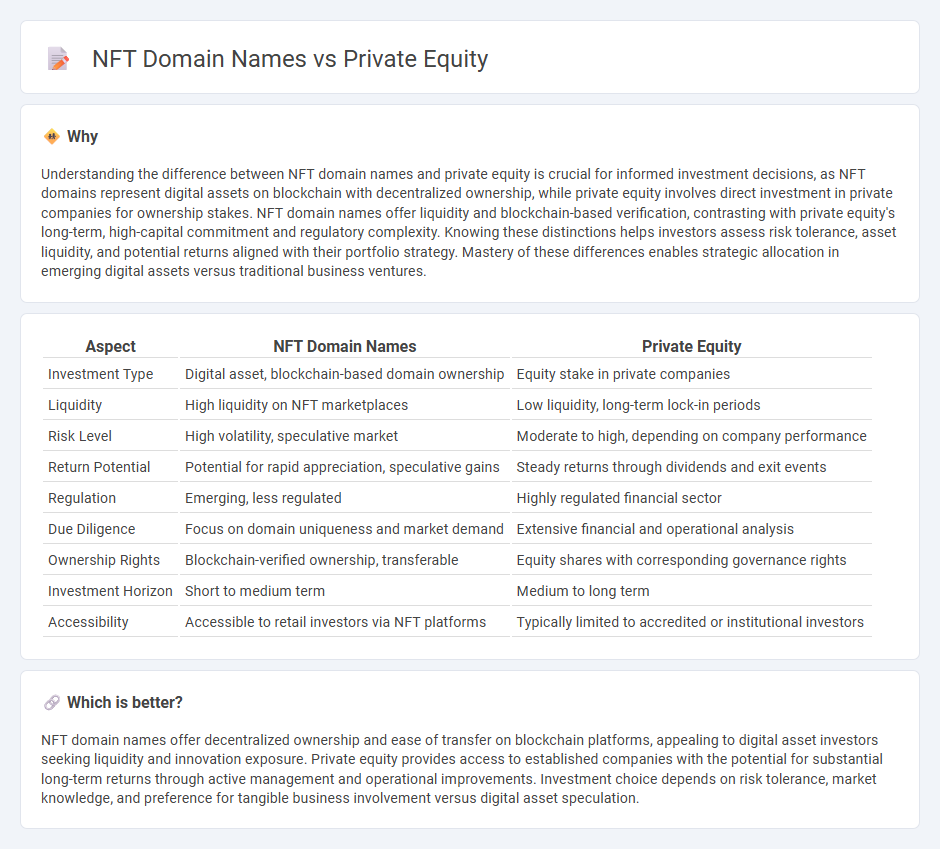

Understanding the difference between NFT domain names and private equity is crucial for informed investment decisions, as NFT domains represent digital assets on blockchain with decentralized ownership, while private equity involves direct investment in private companies for ownership stakes. NFT domain names offer liquidity and blockchain-based verification, contrasting with private equity's long-term, high-capital commitment and regulatory complexity. Knowing these distinctions helps investors assess risk tolerance, asset liquidity, and potential returns aligned with their portfolio strategy. Mastery of these differences enables strategic allocation in emerging digital assets versus traditional business ventures.

Comparison Table

| Aspect | NFT Domain Names | Private Equity |

|---|---|---|

| Investment Type | Digital asset, blockchain-based domain ownership | Equity stake in private companies |

| Liquidity | High liquidity on NFT marketplaces | Low liquidity, long-term lock-in periods |

| Risk Level | High volatility, speculative market | Moderate to high, depending on company performance |

| Return Potential | Potential for rapid appreciation, speculative gains | Steady returns through dividends and exit events |

| Regulation | Emerging, less regulated | Highly regulated financial sector |

| Due Diligence | Focus on domain uniqueness and market demand | Extensive financial and operational analysis |

| Ownership Rights | Blockchain-verified ownership, transferable | Equity shares with corresponding governance rights |

| Investment Horizon | Short to medium term | Medium to long term |

| Accessibility | Accessible to retail investors via NFT platforms | Typically limited to accredited or institutional investors |

Which is better?

NFT domain names offer decentralized ownership and ease of transfer on blockchain platforms, appealing to digital asset investors seeking liquidity and innovation exposure. Private equity provides access to established companies with the potential for substantial long-term returns through active management and operational improvements. Investment choice depends on risk tolerance, market knowledge, and preference for tangible business involvement versus digital asset speculation.

Connection

NFT domain names represent unique digital assets secured on blockchain technology, offering verifiable ownership and scarcity that appeal to private equity investors seeking innovative high-growth opportunities. Private equity firms increasingly allocate capital to blockchain-based domains, leveraging their potential for value appreciation and integration into digital business infrastructures. This intersection signifies a transformative investment landscape where traditional equity strategies converge with emerging digital asset markets.

Key Terms

Ownership structure

Private equity investments involve pooled capital managed by firms acquiring substantial ownership stakes in established companies, typically with a clear governance framework and fiduciary responsibilities. NFT domain names represent decentralized digital property recorded on blockchain, providing exclusive ownership rights secured by cryptographic proof without centralized control. Explore the nuanced differences in ownership structure and implications by learning more about these transformative assets.

Asset liquidity

Private equity investments typically offer lower liquidity due to longer lock-up periods and regulatory constraints, whereas NFT domain names provide enhanced liquidity through blockchain-enabled instant transfer and fractional ownership options. The digital nature of NFT domains allows for quicker market transactions, potentially increasing asset accessibility and trading volume compared to traditional private equity stakes. Explore deeper insights on how asset liquidity shapes investment decisions in private equity and NFT domains.

Valuation methodology

Private equity valuation relies on financial metrics such as discounted cash flow (DCF), comparable company analysis, and precedent transactions to assess intrinsic value and future earnings potential. NFT domain names, however, are often valued based on rarity, market demand, digital ownership history, and speculative trends within blockchain ecosystems. Explore deeper insights into these distinct valuation methodologies to enhance strategic investment decisions.

Source and External Links

Private Equity - Private equity involves investing in non-publicly traded companies, often using a combination of equity and debt financing to generate returns over a medium to long-term period.

What is Private Equity? - Private equity provides medium to long-term finance in exchange for an equity stake in potentially high-growth unquoted companies, often supporting management buyouts and buy-ins.

Private Equity: What You Need to Know - Private equity strategies typically involve investing in non-publicly traded companies to enhance their performance by strengthening management, acquiring new businesses, and optimizing operations.

dowidth.com

dowidth.com