Carbon credits trading involves buying and selling certificates that represent the reduction of one metric ton of carbon dioxide emissions, enabling companies to meet regulatory requirements or achieve sustainability goals. Impact investing targets projects or companies generating measurable social and environmental benefits alongside financial returns, focusing on long-term positive change. Explore the key differences and potential benefits of each approach to align your investment strategy with sustainability objectives.

Why it is important

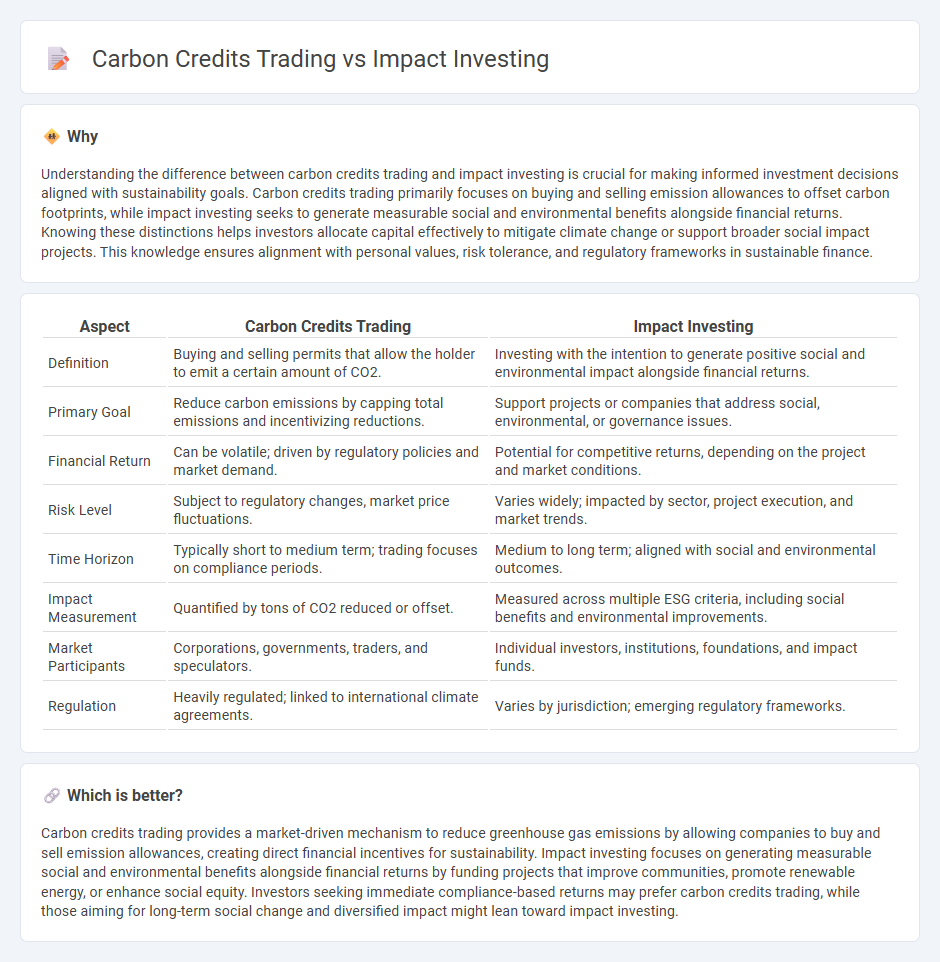

Understanding the difference between carbon credits trading and impact investing is crucial for making informed investment decisions aligned with sustainability goals. Carbon credits trading primarily focuses on buying and selling emission allowances to offset carbon footprints, while impact investing seeks to generate measurable social and environmental benefits alongside financial returns. Knowing these distinctions helps investors allocate capital effectively to mitigate climate change or support broader social impact projects. This knowledge ensures alignment with personal values, risk tolerance, and regulatory frameworks in sustainable finance.

Comparison Table

| Aspect | Carbon Credits Trading | Impact Investing |

|---|---|---|

| Definition | Buying and selling permits that allow the holder to emit a certain amount of CO2. | Investing with the intention to generate positive social and environmental impact alongside financial returns. |

| Primary Goal | Reduce carbon emissions by capping total emissions and incentivizing reductions. | Support projects or companies that address social, environmental, or governance issues. |

| Financial Return | Can be volatile; driven by regulatory policies and market demand. | Potential for competitive returns, depending on the project and market conditions. |

| Risk Level | Subject to regulatory changes, market price fluctuations. | Varies widely; impacted by sector, project execution, and market trends. |

| Time Horizon | Typically short to medium term; trading focuses on compliance periods. | Medium to long term; aligned with social and environmental outcomes. |

| Impact Measurement | Quantified by tons of CO2 reduced or offset. | Measured across multiple ESG criteria, including social benefits and environmental improvements. |

| Market Participants | Corporations, governments, traders, and speculators. | Individual investors, institutions, foundations, and impact funds. |

| Regulation | Heavily regulated; linked to international climate agreements. | Varies by jurisdiction; emerging regulatory frameworks. |

Which is better?

Carbon credits trading provides a market-driven mechanism to reduce greenhouse gas emissions by allowing companies to buy and sell emission allowances, creating direct financial incentives for sustainability. Impact investing focuses on generating measurable social and environmental benefits alongside financial returns by funding projects that improve communities, promote renewable energy, or enhance social equity. Investors seeking immediate compliance-based returns may prefer carbon credits trading, while those aiming for long-term social change and diversified impact might lean toward impact investing.

Connection

Carbon credits trading and impact investing converge by channeling capital towards environmentally sustainable projects that generate measurable social and ecological benefits. Trading carbon credits incentivizes reductions in greenhouse gas emissions, while impact investing prioritizes funding for initiatives that deliver positive environmental outcomes alongside financial returns. This synergy enhances market mechanisms that support climate action and attract investors seeking both profit and purpose.

Key Terms

**Impact Investing:**

Impact investing directs capital towards companies and projects generating measurable social and environmental benefits alongside financial returns, targeting areas like renewable energy, sustainable agriculture, and affordable housing. This strategy empowers investors to align their portfolios with values and drive systemic change in climate action and social equity. Discover more about how impact investing shapes sustainable development and responsible finance.

Social Return

Impact investing drives measurable social return by directing capital toward projects that generate positive environmental and community outcomes, prioritizing long-term sustainability and social equity. Carbon credits trading primarily facilitates emission reductions by allowing businesses to offset their carbon footprint, with social benefits often being secondary and less directly accountable. Explore the nuanced differences and strategic advantages of impact investing versus carbon credits trading for maximizing social return.

ESG (Environmental, Social, and Governance)

Impact investing directs capital towards companies and projects generating measurable environmental and social benefits aligned with ESG criteria, fostering sustainable development and positive societal impact. Carbon credits trading enables organizations to offset their greenhouse gas emissions by purchasing credits from verified emissions reduction projects, supporting carbon neutrality goals while complying with regulatory frameworks. Explore the dynamics between these approaches to optimize your ESG strategy and drive meaningful change.

Source and External Links

What you need to know about impact investing - Impact investing involves making investments intended to generate measurable social or environmental benefits alongside financial returns, addressing global challenges in areas like energy, healthcare, and housing with varied return expectations from below to above market rate.

What is Impact Investing? | Fidelity - Impact investing is a purposeful investment strategy that seeks social and environmental benefits while achieving financial returns, growing especially among Millennials and institutional investors who want to align investments with their values.

Impact Investing | UNDP Istanbul International Centre for Private Sector in Development - Defined as deploying funds to generate measurable social or environmental impact and financial returns, impact investing supports private sector contributions to sustainable development and includes initiatives like the Global Islamic Finance and Impact Investing Platform.

dowidth.com

dowidth.com