Blue economy funds focus on sustainable investments in marine and ocean resources, promoting economic growth while preserving aquatic ecosystems. Green bonds finance environmentally friendly projects, targeting climate change mitigation and renewable energy development. Explore how these financial instruments drive impact investing and contribute to a sustainable future.

Why it is important

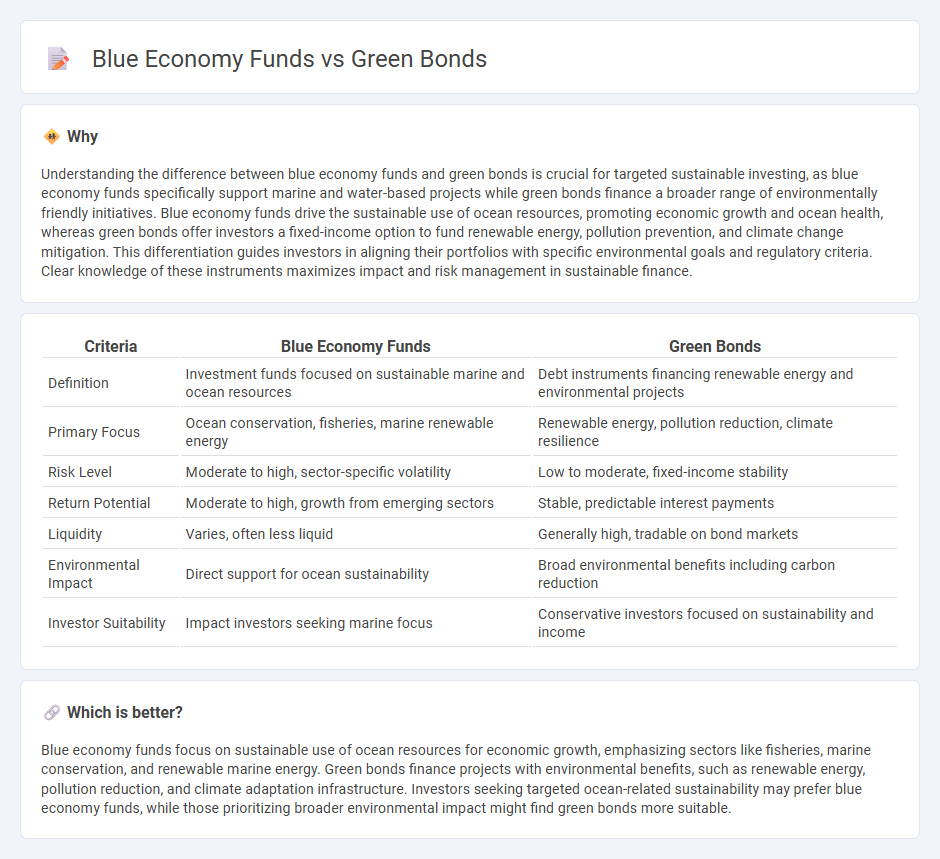

Understanding the difference between blue economy funds and green bonds is crucial for targeted sustainable investing, as blue economy funds specifically support marine and water-based projects while green bonds finance a broader range of environmentally friendly initiatives. Blue economy funds drive the sustainable use of ocean resources, promoting economic growth and ocean health, whereas green bonds offer investors a fixed-income option to fund renewable energy, pollution prevention, and climate change mitigation. This differentiation guides investors in aligning their portfolios with specific environmental goals and regulatory criteria. Clear knowledge of these instruments maximizes impact and risk management in sustainable finance.

Comparison Table

| Criteria | Blue Economy Funds | Green Bonds |

|---|---|---|

| Definition | Investment funds focused on sustainable marine and ocean resources | Debt instruments financing renewable energy and environmental projects |

| Primary Focus | Ocean conservation, fisheries, marine renewable energy | Renewable energy, pollution reduction, climate resilience |

| Risk Level | Moderate to high, sector-specific volatility | Low to moderate, fixed-income stability |

| Return Potential | Moderate to high, growth from emerging sectors | Stable, predictable interest payments |

| Liquidity | Varies, often less liquid | Generally high, tradable on bond markets |

| Environmental Impact | Direct support for ocean sustainability | Broad environmental benefits including carbon reduction |

| Investor Suitability | Impact investors seeking marine focus | Conservative investors focused on sustainability and income |

Which is better?

Blue economy funds focus on sustainable use of ocean resources for economic growth, emphasizing sectors like fisheries, marine conservation, and renewable marine energy. Green bonds finance projects with environmental benefits, such as renewable energy, pollution reduction, and climate adaptation infrastructure. Investors seeking targeted ocean-related sustainability may prefer blue economy funds, while those prioritizing broader environmental impact might find green bonds more suitable.

Connection

Blue economy funds and green bonds both focus on financing sustainable projects that promote environmental conservation and climate resilience. Blue economy funds specifically target marine and coastal ecosystem preservation, while green bonds raise capital for a broader range of environmentally friendly initiatives, including renewable energy and pollution reduction. Together, they channel investments into sustainable development that supports ocean health and mitigates climate change impacts.

Key Terms

Environmental Impact

Green bonds primarily fund renewable energy, sustainable agriculture, and pollution reduction projects that significantly lower carbon emissions and promote environmental sustainability. Blue economy funds specifically target marine and coastal ecosystems, supporting sustainable fisheries, ocean health, and marine biodiversity conservation to address climate change impacts on water resources. Explore the differences between these investment vehicles to understand their unique contributions to environmental impact and sustainable finance.

Use of Proceeds

Green bonds primarily finance projects that promote environmental sustainability, such as renewable energy, energy efficiency, and pollution prevention. Blue economy funds target investments related to sustainable use and conservation of ocean resources, including fisheries, marine biodiversity, and clean maritime technologies. Explore how these financial instruments differ in supporting climate and marine conservation initiatives.

Sustainability Standards

Green bonds finance environmentally friendly projects adhering to rigorous sustainability standards like the Climate Bonds Initiative, ensuring measurable climate impact and transparency. Blue economy funds invest in marine and coastal resources with strict criteria for ecological preservation, supporting sustainable fisheries, ocean health, and climate resilience. Explore more about how these financial tools drive sustainable development in environmental sectors.

Source and External Links

Green bond - Wikipedia - A green bond is a fixed-income financial instrument used to fund projects with positive environmental benefits, such as renewable energy, energy efficiency, pollution prevention, and climate change adaptation, allowing investors to meet ESG goals while being issued by governments or corporations.

What are Green Bonds and what projects do they finance? - Iberdrola - Green bonds are debt instruments issued by public or private institutions committed to financing environmentally sustainable and socially responsible projects like renewable energy, clean transportation, and waste management, supporting Sustainable Development Goals.

Green Bond Principles (GBP) - ICMA - The Green Bond Principles provide voluntary guidelines to issuers for transparency, disclosure, and integrity in raising capital for projects that promote a net-zero emissions economy and protect the environment, ensuring funds are tracked and reported clearly.

dowidth.com

dowidth.com