Carbon credits trading offers investors a way to profit from reducing greenhouse gas emissions by buying and selling emission allowances in regulated markets, providing direct impact on environmental goals. Renewable energy stocks represent ownership in companies developing solar, wind, or other clean energy technologies, potentially delivering long-term growth through the global transition to sustainable power sources. Explore how these two investment options align with your financial goals and environmental values.

Why it is important

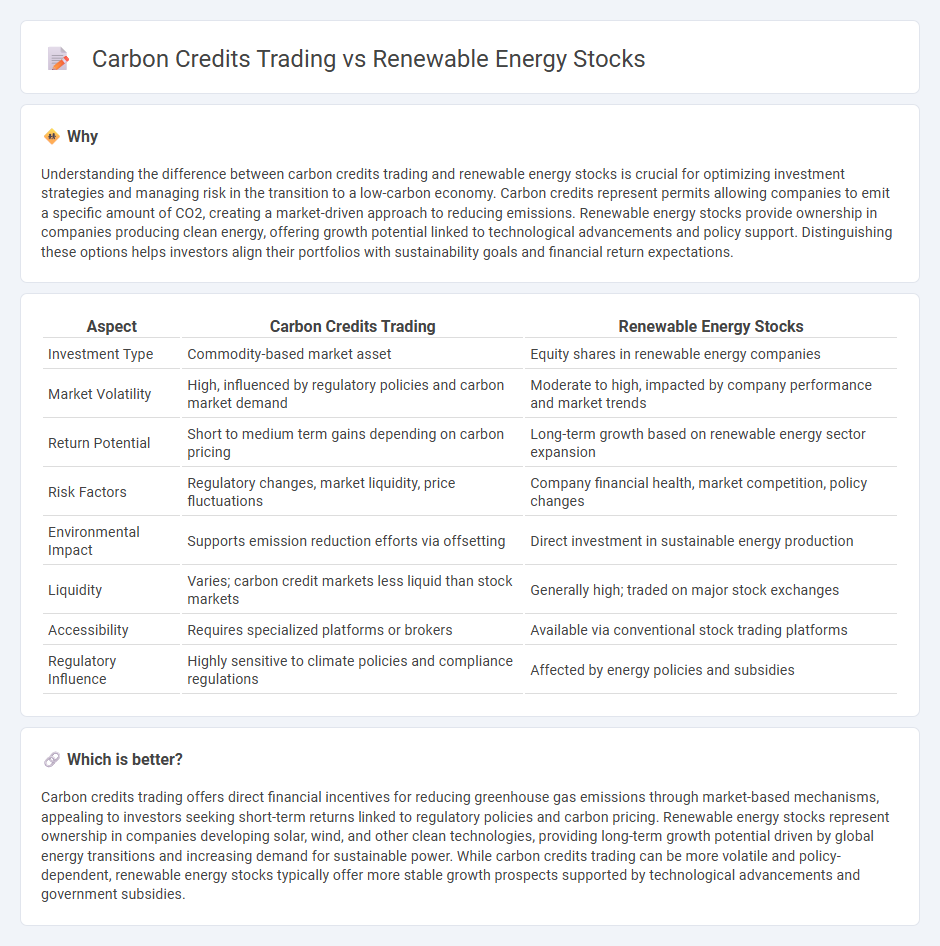

Understanding the difference between carbon credits trading and renewable energy stocks is crucial for optimizing investment strategies and managing risk in the transition to a low-carbon economy. Carbon credits represent permits allowing companies to emit a specific amount of CO2, creating a market-driven approach to reducing emissions. Renewable energy stocks provide ownership in companies producing clean energy, offering growth potential linked to technological advancements and policy support. Distinguishing these options helps investors align their portfolios with sustainability goals and financial return expectations.

Comparison Table

| Aspect | Carbon Credits Trading | Renewable Energy Stocks |

|---|---|---|

| Investment Type | Commodity-based market asset | Equity shares in renewable energy companies |

| Market Volatility | High, influenced by regulatory policies and carbon market demand | Moderate to high, impacted by company performance and market trends |

| Return Potential | Short to medium term gains depending on carbon pricing | Long-term growth based on renewable energy sector expansion |

| Risk Factors | Regulatory changes, market liquidity, price fluctuations | Company financial health, market competition, policy changes |

| Environmental Impact | Supports emission reduction efforts via offsetting | Direct investment in sustainable energy production |

| Liquidity | Varies; carbon credit markets less liquid than stock markets | Generally high; traded on major stock exchanges |

| Accessibility | Requires specialized platforms or brokers | Available via conventional stock trading platforms |

| Regulatory Influence | Highly sensitive to climate policies and compliance regulations | Affected by energy policies and subsidies |

Which is better?

Carbon credits trading offers direct financial incentives for reducing greenhouse gas emissions through market-based mechanisms, appealing to investors seeking short-term returns linked to regulatory policies and carbon pricing. Renewable energy stocks represent ownership in companies developing solar, wind, and other clean technologies, providing long-term growth potential driven by global energy transitions and increasing demand for sustainable power. While carbon credits trading can be more volatile and policy-dependent, renewable energy stocks typically offer more stable growth prospects supported by technological advancements and government subsidies.

Connection

Carbon credits trading and renewable energy stocks are interconnected as both focus on reducing carbon emissions and promoting sustainable practices. Investing in renewable energy stocks supports companies developing clean technologies, directly impacting carbon footprints, which influences the supply and demand dynamics of carbon credits. Market trends in carbon credits often reflect the growth and performance of renewable energy sectors, highlighting their intertwined financial and environmental objectives.

Key Terms

Equity (Renewable energy stocks)

Renewable energy stocks represent investments in companies developing solar, wind, hydro, and other clean energy technologies, offering potential growth driven by global decarbonization efforts and increasing government incentives. Equity in renewables often provides exposure to technological advancements and long-term sustainability trends, with companies like NextEra Energy, Enphase Energy, and Vestas leading market performance. Explore detailed insights on top renewable energy equities and their market dynamics to make informed investment decisions.

Carbon offsets (Carbon credits trading)

Carbon credits trading offers a market-driven approach to reducing greenhouse gas emissions by allowing companies to buy and sell carbon offsets, promoting investment in sustainable projects like reforestation and renewable energy. Unlike renewable energy stocks, which represent ownership in companies producing clean energy, carbon credits directly incentivize emission reductions across various industries globally. Explore how carbon offsets can complement your sustainable investment strategy and contribute to climate goals.

ESG (Environmental, Social, Governance)

Renewable energy stocks represent investments in companies advancing clean energy solutions such as solar, wind, and hydroelectric power, aligning closely with ESG principles by reducing carbon footprints and promoting social responsibility. Carbon credits trading enables organizations to offset emissions by purchasing credits that fund sustainable projects, fostering market-driven carbon reduction and governance transparency. Explore how integrating renewable energy stocks and carbon credits trading can enhance your ESG investment strategy for a sustainable future.

Source and External Links

Best renewable energy stocks to watch in 2025 - IG - Key renewable energy stocks for 2025 include NextEra Energy (NYSE: NEE), GE Vernova, First Solar (NASDAQ: FSLR), Adani Green Energy, and Brookfield Renewable Partners (NYSE: BEP), among others, representing leaders in solar, wind, and battery storage technologies.

Our Top Picks for Investing in US Renewable Energy - First Solar (FSLR) and Brookfield Renewable Partners (BEP) are highlighted as attractively valued US renewable energy stocks with strong growth potential, focusing on solar panel technology and diversified clean energy portfolios respectively.

Top 5 Renewable Energy Stocks to Watch for July 2025 - Notable renewable energy stocks in mid-2025 according to performance include Eco Wave Power Global (WAVE), Constellation Energy Corporation (CEG), and Clearway Energy Inc. (CWEN and CWEN-A), which are involved in production, storage, or distribution of renewable power.

dowidth.com

dowidth.com