Investment communities offer personalized insights and active strategies driven by collective expertise and real-time discussions, enhancing individual decision-making. Index funds provide a passive, low-cost approach that tracks market performance, ensuring diversified exposure with minimal management. Explore the differences to determine which investment path aligns best with your financial goals.

Why it is important

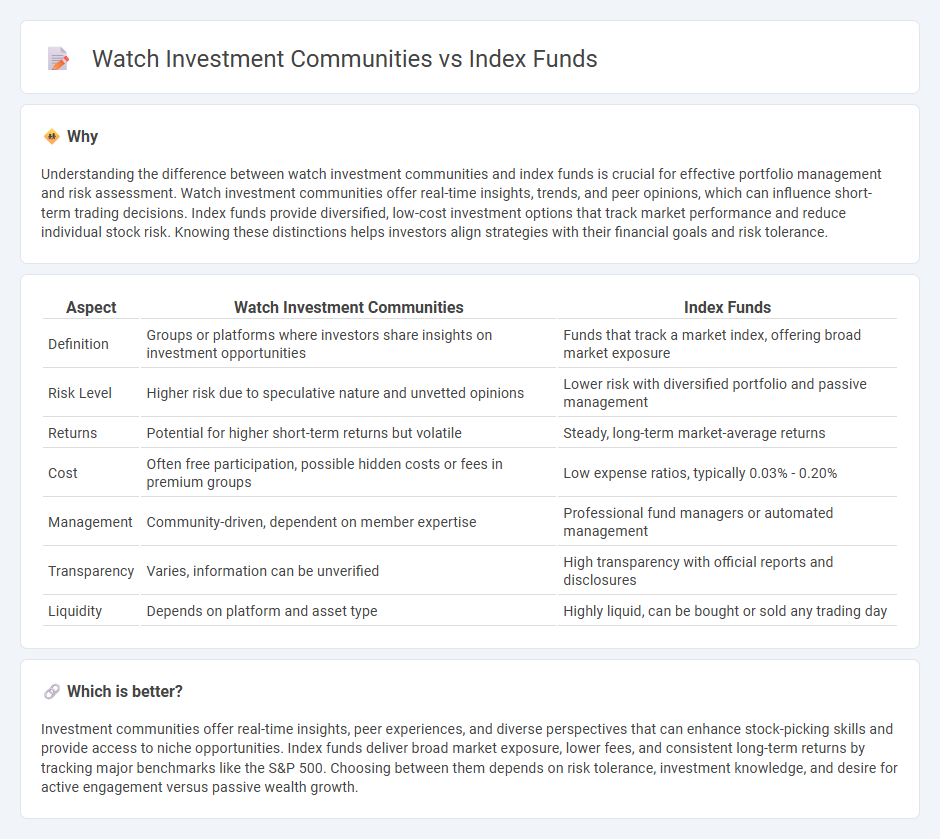

Understanding the difference between watch investment communities and index funds is crucial for effective portfolio management and risk assessment. Watch investment communities offer real-time insights, trends, and peer opinions, which can influence short-term trading decisions. Index funds provide diversified, low-cost investment options that track market performance and reduce individual stock risk. Knowing these distinctions helps investors align strategies with their financial goals and risk tolerance.

Comparison Table

| Aspect | Watch Investment Communities | Index Funds |

|---|---|---|

| Definition | Groups or platforms where investors share insights on investment opportunities | Funds that track a market index, offering broad market exposure |

| Risk Level | Higher risk due to speculative nature and unvetted opinions | Lower risk with diversified portfolio and passive management |

| Returns | Potential for higher short-term returns but volatile | Steady, long-term market-average returns |

| Cost | Often free participation, possible hidden costs or fees in premium groups | Low expense ratios, typically 0.03% - 0.20% |

| Management | Community-driven, dependent on member expertise | Professional fund managers or automated management |

| Transparency | Varies, information can be unverified | High transparency with official reports and disclosures |

| Liquidity | Depends on platform and asset type | Highly liquid, can be bought or sold any trading day |

Which is better?

Investment communities offer real-time insights, peer experiences, and diverse perspectives that can enhance stock-picking skills and provide access to niche opportunities. Index funds deliver broad market exposure, lower fees, and consistent long-term returns by tracking major benchmarks like the S&P 500. Choosing between them depends on risk tolerance, investment knowledge, and desire for active engagement versus passive wealth growth.

Connection

Investment communities foster knowledge sharing and collaborative insights, directly influencing the popularity and performance of index funds. These communities analyze market trends, discuss fund compositions, and offer strategies that guide investors toward diversified, low-cost options like index funds. Through collective wisdom, investment forums enhance awareness and trust in index fund benefits, driving increased participation and capital inflows.

Key Terms

Diversification

Index funds provide broad market diversification by tracking a wide range of securities, minimizing risk through exposure to multiple sectors. Watch investment communities often emphasize targeted diversification, sharing insights on niche markets and unique timepieces to balance portfolios. Explore how these approaches can complement your investment strategy for better risk management.

Community Insights

Index funds offer broad market exposure, low fees, and passive management, making them a popular choice for long-term investors seeking diversification and steady returns. Investment communities provide real-time market sentiment, personalized strategies, and peer insights that can enhance decision-making and identify emerging trends. Explore how combining index funds with community insights can optimize your investment approach.

Passive Strategy

Index funds offer a passive investment strategy by tracking a market index, minimizing management fees and reducing investment risk through broad market exposure. Watch investment communities provide real-time insights, peer discussions, and sentiment analysis, helping investors fine-tune strategies in passive portfolios. Discover more about how combining index funds with active community engagement can enhance passive investment outcomes.

Source and External Links

Index Funds - An index fund is a type of mutual fund or exchange-traded fund that aims to track the returns of a market index, such as the S&P 500, by investing in all or a sample of the securities in that index, often weighted by market capitalization.

What is an index fund? - Instead of selecting individual stocks, an index fund buys all or a representative portion of the stocks or bonds in a specific benchmark index, providing diversification and typically lower costs compared to actively managed funds.

The Best Index Funds - Index funds are passive investments that seek to replicate the performance of a market index, minus expenses, and have become popular because they often outperform actively managed funds over the long term while charging lower fees.

dowidth.com

dowidth.com