Play-to-earn gaming merges interactive entertainment with blockchain technology, allowing players to earn cryptocurrency by participating in virtual economies and in-game assets trading. DeFi staking offers an alternative investment model where users lock assets in decentralized finance protocols to earn passive income through interest or rewards. Explore the unique benefits and risks of these innovative investment opportunities to make informed financial decisions.

Why it is important

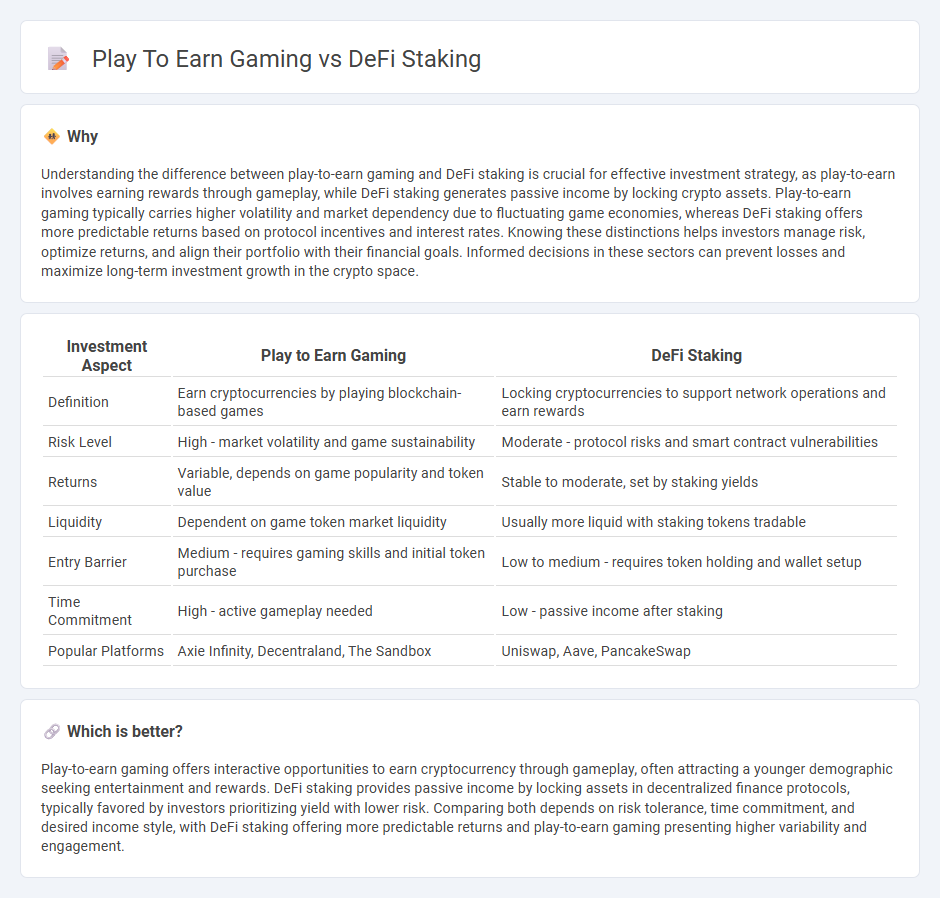

Understanding the difference between play-to-earn gaming and DeFi staking is crucial for effective investment strategy, as play-to-earn involves earning rewards through gameplay, while DeFi staking generates passive income by locking crypto assets. Play-to-earn gaming typically carries higher volatility and market dependency due to fluctuating game economies, whereas DeFi staking offers more predictable returns based on protocol incentives and interest rates. Knowing these distinctions helps investors manage risk, optimize returns, and align their portfolio with their financial goals. Informed decisions in these sectors can prevent losses and maximize long-term investment growth in the crypto space.

Comparison Table

| Investment Aspect | Play to Earn Gaming | DeFi Staking |

|---|---|---|

| Definition | Earn cryptocurrencies by playing blockchain-based games | Locking cryptocurrencies to support network operations and earn rewards |

| Risk Level | High - market volatility and game sustainability | Moderate - protocol risks and smart contract vulnerabilities |

| Returns | Variable, depends on game popularity and token value | Stable to moderate, set by staking yields |

| Liquidity | Dependent on game token market liquidity | Usually more liquid with staking tokens tradable |

| Entry Barrier | Medium - requires gaming skills and initial token purchase | Low to medium - requires token holding and wallet setup |

| Time Commitment | High - active gameplay needed | Low - passive income after staking |

| Popular Platforms | Axie Infinity, Decentraland, The Sandbox | Uniswap, Aave, PancakeSwap |

Which is better?

Play-to-earn gaming offers interactive opportunities to earn cryptocurrency through gameplay, often attracting a younger demographic seeking entertainment and rewards. DeFi staking provides passive income by locking assets in decentralized finance protocols, typically favored by investors prioritizing yield with lower risk. Comparing both depends on risk tolerance, time commitment, and desired income style, with DeFi staking offering more predictable returns and play-to-earn gaming presenting higher variability and engagement.

Connection

Play-to-earn gaming and DeFi staking intersect through blockchain technology, enabling users to earn digital assets that can be staked for passive income. Players acquire in-game tokens or NFTs, which hold real-world value and can be deposited in DeFi protocols to generate additional yields. This integration creates a dynamic investment ecosystem where gaming rewards directly contribute to decentralized finance portfolios.

Key Terms

Yield (DeFi Staking)

DeFi staking offers a consistent yield by locking cryptocurrency assets in smart contracts, generating rewards based on network participation and transaction validation. Unlike play-to-earn gaming, which relies heavily on in-game achievements and token appreciation, DeFi staking provides predictable income leveraged through decentralized finance protocols such as Ethereum 2.0, Aave, or Compound. Explore how DeFi staking strategies compare in yield potential and risk to maximize your digital asset growth.

Tokenomics (Play to Earn Gaming)

Play to earn gaming leverages tokenomics by integrating in-game tokens that have real-world value, creating economic incentives for players to engage and contribute to the game's ecosystem. These tokens often have utility beyond gameplay, such as staking, governance, or trading on decentralized exchanges, enhancing player investment and retention. Discover how tokenomics transforms player engagement and rewards in the evolving landscape of play to earn gaming.

Liquidity (DeFi Staking)

DeFi staking enhances liquidity by allowing users to lock tokens in smart contracts, earning rewards while maintaining decentralized asset control and reducing market volatility. Play-to-earn gaming generates liquidity through in-game asset transactions and token economies, but often faces liquidity challenges due to market fragmentation and game-specific tokens. Explore deeper insights into how liquidity dynamics differ between DeFi staking and play-to-earn ecosystems.

Source and External Links

DeFi Staking Explained: From Concept To Risks And Security - DeFi staking means locking up cryptocurrency to support network operations under Proof of Stake (PoS), where stakers validate transactions and earn rewards proportional to their stake, often via staking pools with potential lock-up periods and automatic reward distributions.

DeFi Staking Platforms 2025: How It Works & Risks - Webisoft - DeFi staking involves locking crypto assets to validate blockchain transactions and earn rewards, with common types including PoS staking for moderate risk and yield farming for higher returns but more frequent asset movement.

DeFi staking: A beginner's guide to proof-of-stake (PoS) coins - DeFi staking lets investors lock PoS coins in smart contracts to earn passive income and rewards, gaining popularity especially after Ethereum's shift to PoS in 2022, though it carries risks like market volatility and network security challenges.

dowidth.com

dowidth.com