Collectibles investment involves acquiring rare items such as art, coins, or vintage cars that appreciate over time due to scarcity and demand, offering potential portfolio diversification and aesthetic enjoyment. Business ownership requires active management, strategic decision-making, and often higher financial risk but can generate steady income and capital growth through operational success. Explore deeper insights into which investment strategy aligns best with your financial goals and risk tolerance.

Why it is important

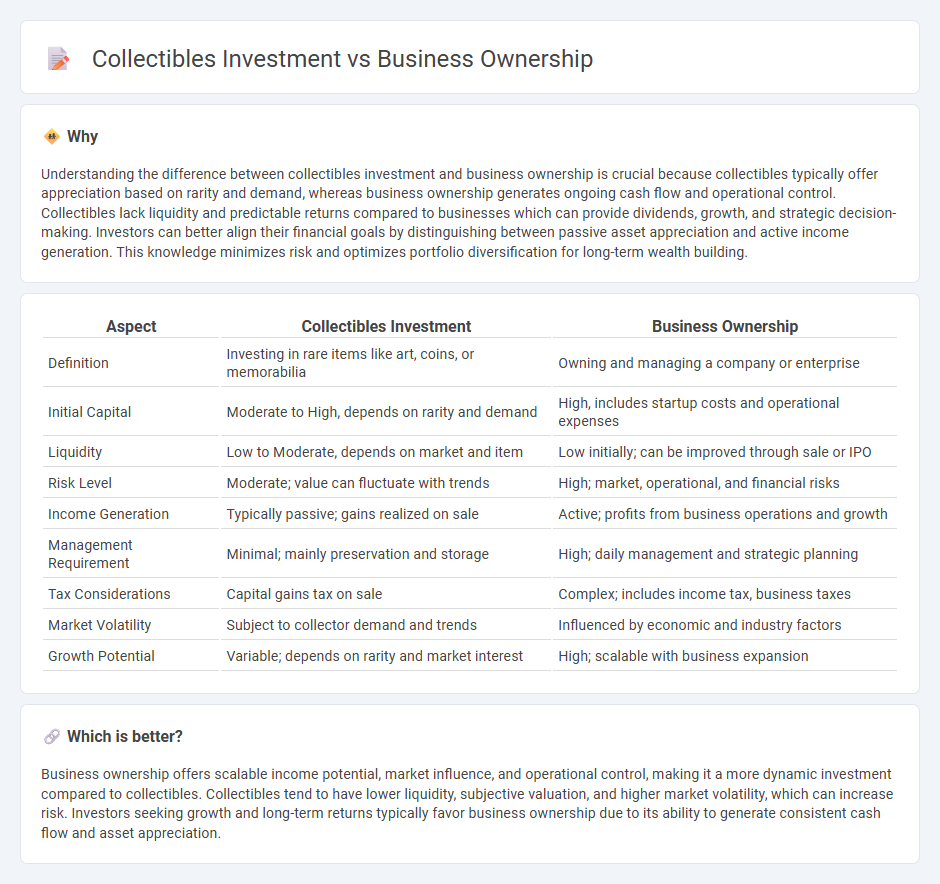

Understanding the difference between collectibles investment and business ownership is crucial because collectibles typically offer appreciation based on rarity and demand, whereas business ownership generates ongoing cash flow and operational control. Collectibles lack liquidity and predictable returns compared to businesses which can provide dividends, growth, and strategic decision-making. Investors can better align their financial goals by distinguishing between passive asset appreciation and active income generation. This knowledge minimizes risk and optimizes portfolio diversification for long-term wealth building.

Comparison Table

| Aspect | Collectibles Investment | Business Ownership |

|---|---|---|

| Definition | Investing in rare items like art, coins, or memorabilia | Owning and managing a company or enterprise |

| Initial Capital | Moderate to High, depends on rarity and demand | High, includes startup costs and operational expenses |

| Liquidity | Low to Moderate, depends on market and item | Low initially; can be improved through sale or IPO |

| Risk Level | Moderate; value can fluctuate with trends | High; market, operational, and financial risks |

| Income Generation | Typically passive; gains realized on sale | Active; profits from business operations and growth |

| Management Requirement | Minimal; mainly preservation and storage | High; daily management and strategic planning |

| Tax Considerations | Capital gains tax on sale | Complex; includes income tax, business taxes |

| Market Volatility | Subject to collector demand and trends | Influenced by economic and industry factors |

| Growth Potential | Variable; depends on rarity and market interest | High; scalable with business expansion |

Which is better?

Business ownership offers scalable income potential, market influence, and operational control, making it a more dynamic investment compared to collectibles. Collectibles tend to have lower liquidity, subjective valuation, and higher market volatility, which can increase risk. Investors seeking growth and long-term returns typically favor business ownership due to its ability to generate consistent cash flow and asset appreciation.

Connection

Collectibles investment and business ownership share a tangible asset approach that can diversify portfolios and hedge against market volatility. Both involve careful valuation, market knowledge, and timing to maximize returns, with collectibles offering unique liquidity challenges similar to private business stakes. Successful investors often leverage expertise in niche markets to identify undervalued assets, enhancing wealth through strategic acquisition and management.

Key Terms

Equity

Business ownership offers equity stakes that can appreciate through company growth and profit reinvestment, providing potential long-term wealth creation. Collectibles investment relies on market demand and rarity, with equity value often less liquid and more volatile compared to traditional business equity. Explore deeper insights on how equity dynamics differ between these investment types.

Liquidity

Business ownership often involves lower liquidity due to the time and effort required to sell or exit the enterprise, whereas collectibles investment benefits from potentially higher liquidity through various resale channels like auctions, online marketplaces, and private sales. While businesses may take months or years to liquidate assets and realize returns, collectibles can often be sold more quickly depending on market demand and rarity. Explore more about the liquidity dynamics between business ownership and collectibles investment to make informed financial decisions.

Appreciation

Business ownership offers potential for long-term appreciation through revenue growth, brand equity, and market expansion, often outperforming inflation and generating passive income streams. Collectibles investment appreciates based on rarity, condition, market demand, and cultural trends, though it carries higher liquidity risk and valuation volatility. Explore detailed insights into appreciation dynamics and risk factors to make informed investment decisions.

Source and External Links

What is Business Ownership - Business ownership refers to the legal and financial control over a business entity, including the rights and responsibilities of individuals or entities to make decisions, manage resources, assume risks, and enjoy profits or bear losses.

Business Ownership: Essential Guide to Structuring Your ... - Business ownership involves choosing a structure (such as sole proprietorship, partnership, or LLC) that determines your level of control, liability, and tax obligations, with each structure offering different benefits and risks.

The 8 Small Business Owner Structures - There are eight main types of business ownership structures, including sole proprietorship, partnership, various corporations (C, S, B, close, nonprofit), and LLC, each with distinct legal, financial, and operational implications.

dowidth.com

dowidth.com