Royalty rights investing offers a unique income stream by entitling investors to a percentage of revenues from intellectual property, such as music or patents, contrasting with hedge funds that pool capital to engage in diversified, high-risk strategies across various asset classes. This form of investment can provide steady, inflation-resistant cash flow with lower correlation to traditional markets, while hedge funds aim for higher returns through active management and leverage. Explore the distinct advantages and risks of these investment vehicles to determine which aligns best with your financial goals.

Why it is important

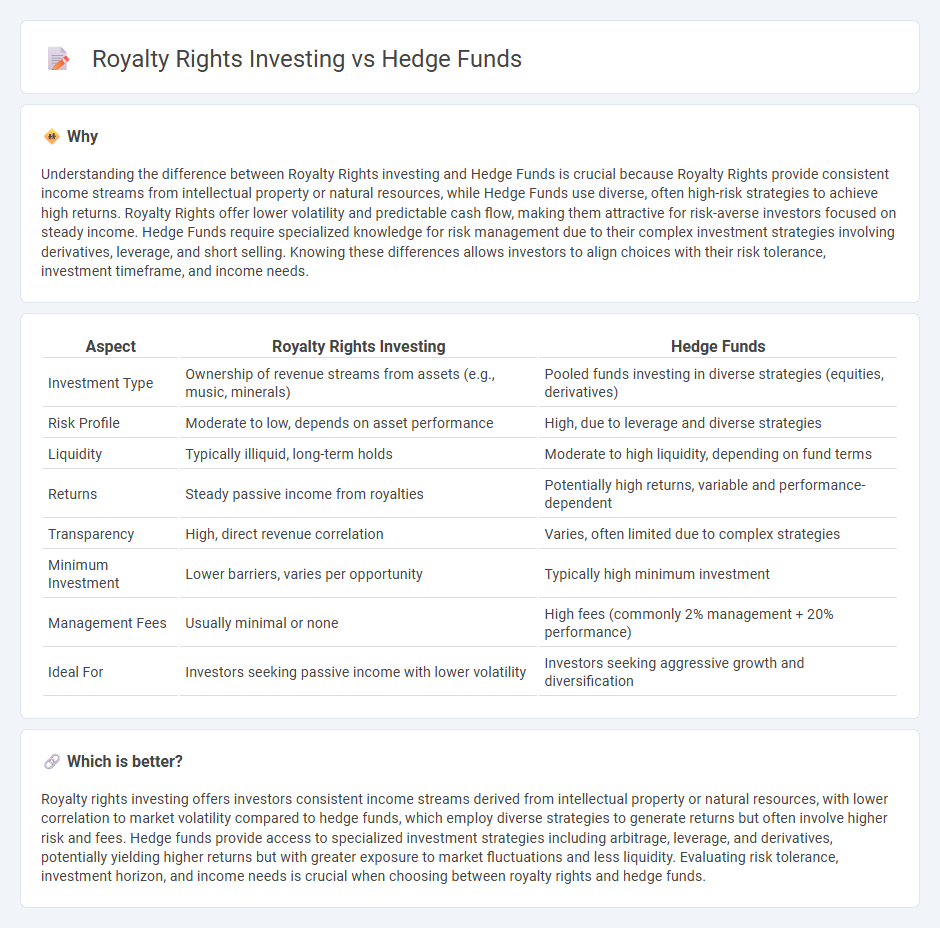

Understanding the difference between Royalty Rights investing and Hedge Funds is crucial because Royalty Rights provide consistent income streams from intellectual property or natural resources, while Hedge Funds use diverse, often high-risk strategies to achieve high returns. Royalty Rights offer lower volatility and predictable cash flow, making them attractive for risk-averse investors focused on steady income. Hedge Funds require specialized knowledge for risk management due to their complex investment strategies involving derivatives, leverage, and short selling. Knowing these differences allows investors to align choices with their risk tolerance, investment timeframe, and income needs.

Comparison Table

| Aspect | Royalty Rights Investing | Hedge Funds |

|---|---|---|

| Investment Type | Ownership of revenue streams from assets (e.g., music, minerals) | Pooled funds investing in diverse strategies (equities, derivatives) |

| Risk Profile | Moderate to low, depends on asset performance | High, due to leverage and diverse strategies |

| Liquidity | Typically illiquid, long-term holds | Moderate to high liquidity, depending on fund terms |

| Returns | Steady passive income from royalties | Potentially high returns, variable and performance-dependent |

| Transparency | High, direct revenue correlation | Varies, often limited due to complex strategies |

| Minimum Investment | Lower barriers, varies per opportunity | Typically high minimum investment |

| Management Fees | Usually minimal or none | High fees (commonly 2% management + 20% performance) |

| Ideal For | Investors seeking passive income with lower volatility | Investors seeking aggressive growth and diversification |

Which is better?

Royalty rights investing offers investors consistent income streams derived from intellectual property or natural resources, with lower correlation to market volatility compared to hedge funds, which employ diverse strategies to generate returns but often involve higher risk and fees. Hedge funds provide access to specialized investment strategies including arbitrage, leverage, and derivatives, potentially yielding higher returns but with greater exposure to market fluctuations and less liquidity. Evaluating risk tolerance, investment horizon, and income needs is crucial when choosing between royalty rights and hedge funds.

Connection

Royalty rights investing and hedge funds are connected through their shared goal of diversifying investment portfolios by acquiring alternative assets that generate steady cash flows. Hedge funds often allocate capital to royalty rights in industries such as music, pharmaceuticals, and natural resources, leveraging these income streams for risk-adjusted returns. This strategy allows hedge funds to capitalize on predictable royalties, enhancing portfolio stability amid market volatility.

Key Terms

Leverage

Hedge funds typically employ significant leverage to amplify returns, using borrowed capital and complex financial instruments to increase exposure and manage risk. Royalty rights investing leverages future income streams from intellectual properties or natural resources without the need for debt, providing a more stable and predictable cash flow. Explore the advantages and risks of each to understand which leverage strategy aligns with your investment goals.

Passive Income

Hedge funds typically require active management and higher minimum investments, while royalty rights investing provides a passive income stream through ownership of revenue-generating intellectual property. Royalty rights offer consistent cash flow with lower risk and volatility compared to hedge fund portfolios that depend on market performance. Explore how royalty rights can diversify your investment strategy for steady passive income.

Liquidity

Hedge funds typically offer higher liquidity with frequent redemption opportunities, enabling investors to access funds relatively quickly compared to royalty rights investing, which often involves longer lock-in periods due to the nature of revenue streams from intellectual property or natural resources. Royalty rights provide steady income through royalties but lack the market flexibility of hedge funds, making them less liquid and more suitable for long-term, income-focused investors. Explore detailed comparisons of liquidity profiles and investment strategies to determine which aligns best with your financial goals.

Source and External Links

Hedge Funds: Overview, Recruitment, Careers & Salaries - Hedge funds are investment firms pooling capital from accredited investors to pursue alternative strategies aiming for absolute returns, often involving short-selling, derivatives, and event-driven tactics to outperform traditional asset managers.

Hedge Funds - Hedge funds are private, unregistered investment vehicles available only to sophisticated individuals and institutions, employing flexible and sometimes high-risk strategies not accessible in mutual funds or ETFs, with fewer regulatory constraints.

Hedge fund - Hedge funds employ complex trading and risk management strategies, charging typical fees of 2% management and 20% performance, and have grown into a sizable $3.8 trillion industry, but their use of leverage and collective behaviours can create systemic risks in financial crises.

dowidth.com

dowidth.com