Wine funds offer investors a unique opportunity to diversify portfolios through tangible assets with potential for long-term appreciation linked to rare and vintage wines, while mutual funds provide diversified exposure to stocks and bonds managed by professionals for liquidity and growth. Unlike mutual funds, wine funds are less correlated with traditional markets, appealing to those seeking alternative investments with cultural and collectible value. Explore the distinct advantages and risks of wine funds versus mutual funds to determine the best fit for your investment strategy.

Why it is important

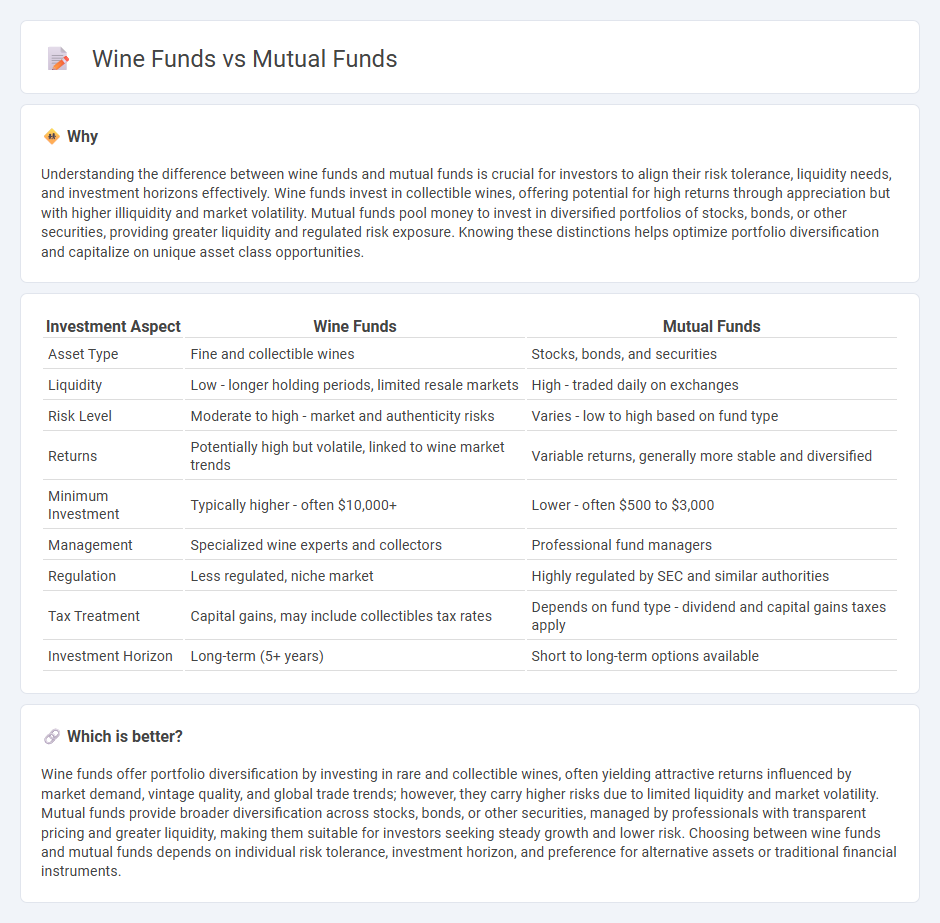

Understanding the difference between wine funds and mutual funds is crucial for investors to align their risk tolerance, liquidity needs, and investment horizons effectively. Wine funds invest in collectible wines, offering potential for high returns through appreciation but with higher illiquidity and market volatility. Mutual funds pool money to invest in diversified portfolios of stocks, bonds, or other securities, providing greater liquidity and regulated risk exposure. Knowing these distinctions helps optimize portfolio diversification and capitalize on unique asset class opportunities.

Comparison Table

| Investment Aspect | Wine Funds | Mutual Funds |

|---|---|---|

| Asset Type | Fine and collectible wines | Stocks, bonds, and securities |

| Liquidity | Low - longer holding periods, limited resale markets | High - traded daily on exchanges |

| Risk Level | Moderate to high - market and authenticity risks | Varies - low to high based on fund type |

| Returns | Potentially high but volatile, linked to wine market trends | Variable returns, generally more stable and diversified |

| Minimum Investment | Typically higher - often $10,000+ | Lower - often $500 to $3,000 |

| Management | Specialized wine experts and collectors | Professional fund managers |

| Regulation | Less regulated, niche market | Highly regulated by SEC and similar authorities |

| Tax Treatment | Capital gains, may include collectibles tax rates | Depends on fund type - dividend and capital gains taxes apply |

| Investment Horizon | Long-term (5+ years) | Short to long-term options available |

Which is better?

Wine funds offer portfolio diversification by investing in rare and collectible wines, often yielding attractive returns influenced by market demand, vintage quality, and global trade trends; however, they carry higher risks due to limited liquidity and market volatility. Mutual funds provide broader diversification across stocks, bonds, or other securities, managed by professionals with transparent pricing and greater liquidity, making them suitable for investors seeking steady growth and lower risk. Choosing between wine funds and mutual funds depends on individual risk tolerance, investment horizon, and preference for alternative assets or traditional financial instruments.

Connection

Wine funds and mutual funds are connected through their shared goal of portfolio diversification and capital growth by pooling investor resources. Both investment vehicles allow access to assets--wine funds specialize in fine wine collections, while mutual funds invest in stocks and bonds--managed by professionals to optimize returns. Their underlying connection lies in structured, collective investment strategies targeting asset appreciation over time.

Key Terms

Diversification

Mutual funds offer broad diversification by pooling investments across various asset classes and sectors, reducing risk through balanced exposure. Wine funds concentrate on rare and collectible wines, providing niche portfolio diversification with alternative asset characteristics that are less correlated to traditional markets. Explore how each fund type diversifies portfolios by understanding their strategies and risk profiles.

Liquidity

Mutual funds offer high liquidity, allowing investors to buy or sell shares on any business day at the fund's net asset value (NAV), making them suitable for quick access to cash. Wine funds, however, are less liquid because the market for fine wine is niche and transactions can take weeks or months, limiting immediate cash availability. Explore more to understand which investment aligns best with your liquidity needs.

Asset Valuation

Mutual funds primarily value assets based on market prices of stocks, bonds, and other securities, allowing for daily pricing and liquidity. Wine funds appraise assets through expert valuations of collectible wines, considering factors like provenance, vintage, and market demand, resulting in less frequent, appraisal-based pricing. Discover how asset valuation influences investment decisions in these contrasting fund types.

Source and External Links

Mutual Funds - U.S. SEC Investor.gov - A mutual fund is an SEC-registered investment company pooling money from many investors to buy stocks, bonds, or other securities, managed professionally with advantages like diversification, liquidity, and low minimum investments.

Mutual fund - Wikipedia - Mutual funds pool investor money to purchase securities and vary by type (money market, bond, stock, hybrid), management style (active vs. passive), and structure (open-end or closed-end), offering benefits of diversification, professional management, and liquidity but with fees and expenses.

Understanding mutual funds - Charles Schwab - Mutual funds offer access to diversified portfolios managed by professionals, providing benefits like low transaction costs, convenience, and investment exposure to stocks, bonds, and commodities with various investment strategies.

dowidth.com

dowidth.com