Sports memorabilia funds offer investors exposure to alternative assets with potential high appreciation based on rarity, athlete performance, and market demand, contrasting with hedge funds that employ diversified strategies across equities, bonds, and derivatives to maximize risk-adjusted returns. While hedge funds focus on liquidity and quantitative models, sports memorabilia funds hinge on niche collectibles whose value depends on authenticity, provenance, and cultural significance. Explore the distinct advantages and risks of sports memorabilia funds compared to hedge funds to make informed investment decisions.

Why it is important

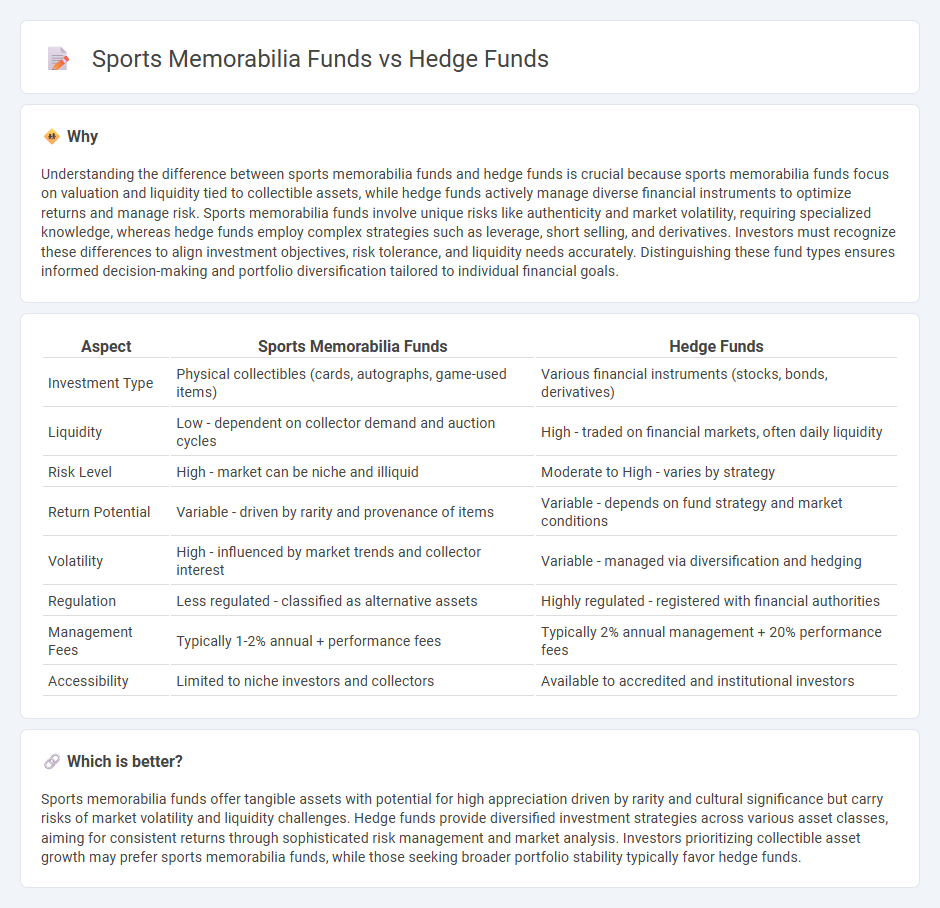

Understanding the difference between sports memorabilia funds and hedge funds is crucial because sports memorabilia funds focus on valuation and liquidity tied to collectible assets, while hedge funds actively manage diverse financial instruments to optimize returns and manage risk. Sports memorabilia funds involve unique risks like authenticity and market volatility, requiring specialized knowledge, whereas hedge funds employ complex strategies such as leverage, short selling, and derivatives. Investors must recognize these differences to align investment objectives, risk tolerance, and liquidity needs accurately. Distinguishing these fund types ensures informed decision-making and portfolio diversification tailored to individual financial goals.

Comparison Table

| Aspect | Sports Memorabilia Funds | Hedge Funds |

|---|---|---|

| Investment Type | Physical collectibles (cards, autographs, game-used items) | Various financial instruments (stocks, bonds, derivatives) |

| Liquidity | Low - dependent on collector demand and auction cycles | High - traded on financial markets, often daily liquidity |

| Risk Level | High - market can be niche and illiquid | Moderate to High - varies by strategy |

| Return Potential | Variable - driven by rarity and provenance of items | Variable - depends on fund strategy and market conditions |

| Volatility | High - influenced by market trends and collector interest | Variable - managed via diversification and hedging |

| Regulation | Less regulated - classified as alternative assets | Highly regulated - registered with financial authorities |

| Management Fees | Typically 1-2% annual + performance fees | Typically 2% annual management + 20% performance fees |

| Accessibility | Limited to niche investors and collectors | Available to accredited and institutional investors |

Which is better?

Sports memorabilia funds offer tangible assets with potential for high appreciation driven by rarity and cultural significance but carry risks of market volatility and liquidity challenges. Hedge funds provide diversified investment strategies across various asset classes, aiming for consistent returns through sophisticated risk management and market analysis. Investors prioritizing collectible asset growth may prefer sports memorabilia funds, while those seeking broader portfolio stability typically favor hedge funds.

Connection

Sports memorabilia funds and hedge funds intersect through their shared investment strategies, focusing on asset diversification and alternative investments. Sports memorabilia funds capitalize on the growing market of rare collectibles, leveraging expert valuation to generate returns, while hedge funds often allocate capital to such niche assets to enhance portfolio performance and hedge against market volatility. Both utilize rigorous market analysis and risk management techniques to optimize investment outcomes.

Key Terms

**Hedge Funds:**

Hedge funds deploy sophisticated investment strategies including long-short equity, global macro, and arbitrage to generate high returns with managed risk across diverse asset classes. They are characterized by active management, significant leverage, and stringent regulatory oversight, catering primarily to accredited investors seeking portfolio diversification and risk-adjusted returns. Discover how hedge funds compare to niche asset investments like sports memorabilia funds by exploring their structural and performance differences.

Leverage

Hedge funds typically use financial leverage to amplify returns by borrowing capital or using derivatives, enabling larger market positions with relatively low initial investment. In contrast, sports memorabilia funds leverage physical asset valuation, relying on the appreciation of rare collectibles, which are less liquid and more volatile compared to traditional financial instruments. Explore the dynamics of leverage in these distinct investment strategies to better understand their risk and return profiles.

Short Selling

Hedge funds actively engage in short selling, leveraging market volatility to profit from declining asset prices by borrowing and selling securities with the intent to repurchase them at lower prices. In contrast, sports memorabilia funds typically avoid short selling as their investments center around tangible collectibles with limited liquidity and valuation transparency. Explore the strategic differences between these fund types and how short selling impacts their overall risk and return profiles.

Source and External Links

Hedge Funds: Overview, Recruitment, Careers & Salaries - Hedge funds are investment firms that raise capital from institutional and accredited investors to pursue alternative investments aiming for absolute returns by using diverse and flexible strategies, including short-selling and derivatives, distinct from mutual funds targeting relative returns.

Hedge Funds | Investor.gov - Hedge funds are private, unregistered investment funds pooling money from accredited and institutional investors to invest flexibly in various securities, generally carrying higher risk and subject to less regulation than mutual funds.

Hedge fund - Wikipedia - Hedge funds use complex trading and risk management techniques with typical fees of 2% asset management plus 20% performance, invest in liquid assets, have grown significantly with trillions in assets, and can pose systemic risks due to leverage and correlated strategies.

dowidth.com

dowidth.com