Blue economy funds focus on sustainable investments in ocean-related industries such as fisheries, shipping, and marine conservation, promoting economic growth while preserving marine ecosystems. Renewable energy funds target investments in clean energy sources like solar, wind, and hydroelectric power, aiming to reduce carbon emissions and support the transition to a low-carbon economy. Discover how these distinct fund types can align with your investment goals and contribute to environmental sustainability.

Why it is important

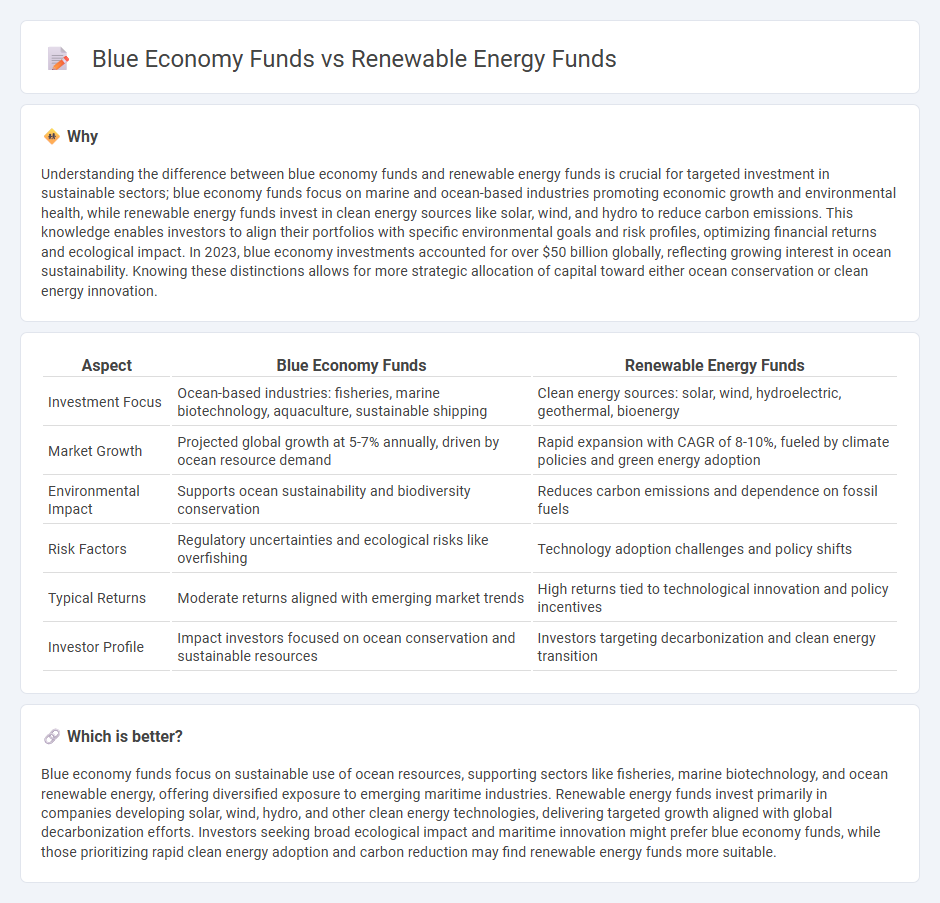

Understanding the difference between blue economy funds and renewable energy funds is crucial for targeted investment in sustainable sectors; blue economy funds focus on marine and ocean-based industries promoting economic growth and environmental health, while renewable energy funds invest in clean energy sources like solar, wind, and hydro to reduce carbon emissions. This knowledge enables investors to align their portfolios with specific environmental goals and risk profiles, optimizing financial returns and ecological impact. In 2023, blue economy investments accounted for over $50 billion globally, reflecting growing interest in ocean sustainability. Knowing these distinctions allows for more strategic allocation of capital toward either ocean conservation or clean energy innovation.

Comparison Table

| Aspect | Blue Economy Funds | Renewable Energy Funds |

|---|---|---|

| Investment Focus | Ocean-based industries: fisheries, marine biotechnology, aquaculture, sustainable shipping | Clean energy sources: solar, wind, hydroelectric, geothermal, bioenergy |

| Market Growth | Projected global growth at 5-7% annually, driven by ocean resource demand | Rapid expansion with CAGR of 8-10%, fueled by climate policies and green energy adoption |

| Environmental Impact | Supports ocean sustainability and biodiversity conservation | Reduces carbon emissions and dependence on fossil fuels |

| Risk Factors | Regulatory uncertainties and ecological risks like overfishing | Technology adoption challenges and policy shifts |

| Typical Returns | Moderate returns aligned with emerging market trends | High returns tied to technological innovation and policy incentives |

| Investor Profile | Impact investors focused on ocean conservation and sustainable resources | Investors targeting decarbonization and clean energy transition |

Which is better?

Blue economy funds focus on sustainable use of ocean resources, supporting sectors like fisheries, marine biotechnology, and ocean renewable energy, offering diversified exposure to emerging maritime industries. Renewable energy funds invest primarily in companies developing solar, wind, hydro, and other clean energy technologies, delivering targeted growth aligned with global decarbonization efforts. Investors seeking broad ecological impact and maritime innovation might prefer blue economy funds, while those prioritizing rapid clean energy adoption and carbon reduction may find renewable energy funds more suitable.

Connection

Blue economy funds and renewable energy funds are interconnected through their shared focus on sustainable resource management and eco-friendly energy solutions. Blue economy funds invest in marine and ocean-based industries that promote renewable energy sources such as offshore wind, tidal, and wave power, aligning with the objectives of renewable energy funds. Both types of funds drive capital towards reducing carbon emissions and fostering innovation in clean energy technologies to support global environmental goals.

Key Terms

Decarbonization

Renewable energy funds primarily invest in solar, wind, and other clean technologies targeting rapid decarbonization by reducing fossil fuel reliance. Blue economy funds support sustainable ocean-based activities such as fisheries, marine biotechnology, and offshore wind, contributing significantly to carbon reduction while promoting marine ecosystem health. Explore deeper insights into how these funds drive decarbonization and sustainable investment strategies.

Marine Conservation

Renewable energy funds primarily invest in sustainable energy sources like wind, solar, and tidal power to reduce carbon emissions, while blue economy funds allocate capital towards ocean-based economic activities including fisheries, aquaculture, and marine conservation. Blue economy funds emphasize preserving marine biodiversity and habitats, supporting initiatives such as coral reef restoration and sustainable fishing practices, which are critical for maintaining ecological balance. Explore further to understand how these funding strategies contribute to the future of marine conservation.

Green Bonds

Renewable energy funds primarily invest in projects like solar, wind, and bioenergy that contribute to reducing carbon emissions through sustainable power generation. Blue economy funds concentrate on ocean-based industries including sustainable fisheries, marine energy, and coastal conservation, often leveraging green bonds to finance environmentally friendly maritime initiatives. Explore how green bonds serve as a critical financing tool bridging these sectors and promoting sustainable investments.

Source and External Links

Renewable Energy Fund | REF Grants, Programs & Materials - The Rhode Island Commerce Renewable Energy Fund (REF) offers grants to support renewable energy projects that produce cleaner electricity, focusing on solar and community renewables to stimulate green job growth, funded by a system benefit charge on electric bills.

Our Top Picks for Investing in US Renewable Energy - Investment options in renewable energy include companies like First Solar and Brookfield Renewable Partners, which offer well-diversified portfolios in clean energy technologies promising moderate returns and growth through acquisitions.

6 Best-Performing Clean Energy ETFs for July 2025 - Clean energy ETFs invest broadly in alternative energy stocks such as solar, wind, hydro, and geothermal, providing diversified and cost-effective exposure to the renewable energy sector with examples of top-performing ETFs listed for 2025.

dowidth.com

dowidth.com