Whiskey barrel investment offers a unique tangible asset with potential appreciation tied to aging spirits, contrasting with crowdfunding real estate, which provides diversified exposure to property markets through pooled funds. Both investment avenues carry distinct risk profiles and liquidity considerations, appealing to different investor preferences and financial goals. Explore more to determine which strategy aligns best with your portfolio objectives.

Why it is important

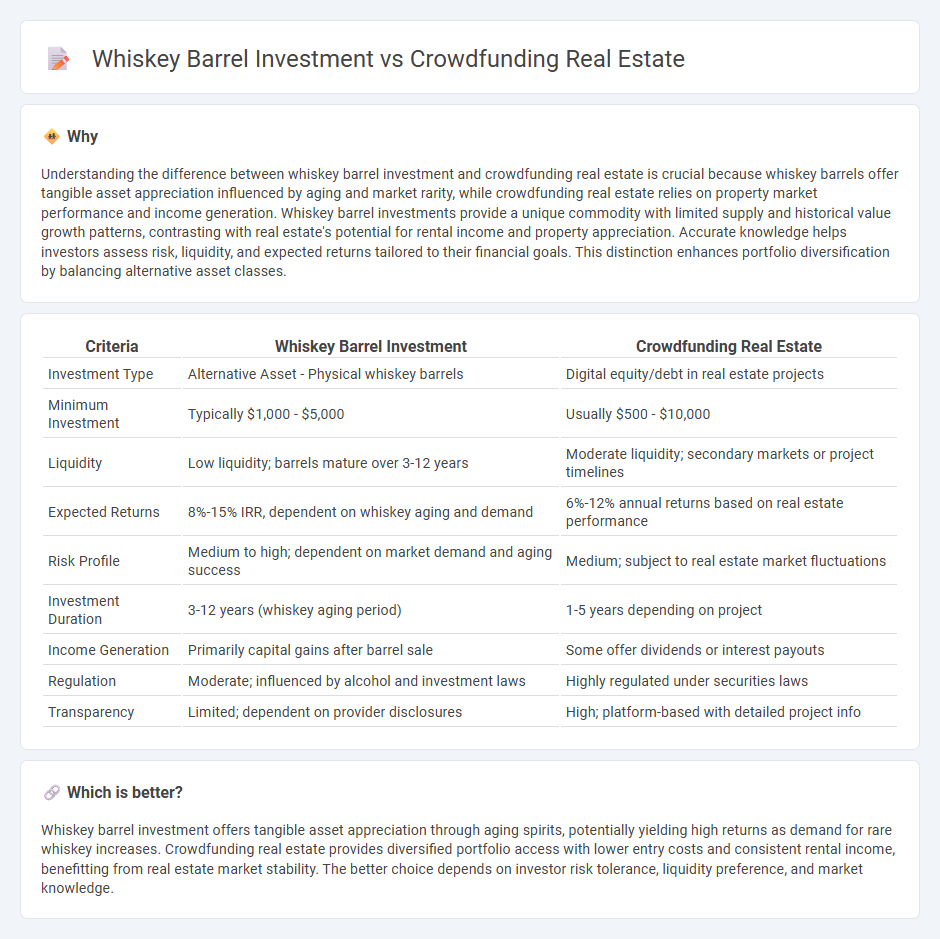

Understanding the difference between whiskey barrel investment and crowdfunding real estate is crucial because whiskey barrels offer tangible asset appreciation influenced by aging and market rarity, while crowdfunding real estate relies on property market performance and income generation. Whiskey barrel investments provide a unique commodity with limited supply and historical value growth patterns, contrasting with real estate's potential for rental income and property appreciation. Accurate knowledge helps investors assess risk, liquidity, and expected returns tailored to their financial goals. This distinction enhances portfolio diversification by balancing alternative asset classes.

Comparison Table

| Criteria | Whiskey Barrel Investment | Crowdfunding Real Estate |

|---|---|---|

| Investment Type | Alternative Asset - Physical whiskey barrels | Digital equity/debt in real estate projects |

| Minimum Investment | Typically $1,000 - $5,000 | Usually $500 - $10,000 |

| Liquidity | Low liquidity; barrels mature over 3-12 years | Moderate liquidity; secondary markets or project timelines |

| Expected Returns | 8%-15% IRR, dependent on whiskey aging and demand | 6%-12% annual returns based on real estate performance |

| Risk Profile | Medium to high; dependent on market demand and aging success | Medium; subject to real estate market fluctuations |

| Investment Duration | 3-12 years (whiskey aging period) | 1-5 years depending on project |

| Income Generation | Primarily capital gains after barrel sale | Some offer dividends or interest payouts |

| Regulation | Moderate; influenced by alcohol and investment laws | Highly regulated under securities laws |

| Transparency | Limited; dependent on provider disclosures | High; platform-based with detailed project info |

Which is better?

Whiskey barrel investment offers tangible asset appreciation through aging spirits, potentially yielding high returns as demand for rare whiskey increases. Crowdfunding real estate provides diversified portfolio access with lower entry costs and consistent rental income, benefitting from real estate market stability. The better choice depends on investor risk tolerance, liquidity preference, and market knowledge.

Connection

Whiskey barrel investment and crowdfunding real estate both offer alternative asset classes that appeal to investors seeking portfolio diversification beyond traditional stocks and bonds. Both investment strategies leverage fractional ownership models allowing multiple investors to pool resources, thus lowering entry barriers and spreading risk. This shared approach enables individual investors to access niche markets with potentially high returns and tangible, physical assets.

Key Terms

Liquidity

Crowdfunding real estate typically offers lower liquidity as funds are tied up for extended project durations, often ranging from several months to years before returns can be accessed. Whiskey barrel investments provide relatively higher liquidity, with barrels aging for 3 to 5 years and the potential for secondary market sales or early buyouts, depending on the platform. Explore detailed comparisons to determine which investment aligns better with your liquidity preferences.

Asset Appreciation

Crowdfunding real estate offers potential asset appreciation through property value increases driven by market demand, location, and development improvements. Whiskey barrel investments gain value based on factors like aging quality, brand reputation, and limited supply influencing market prices. Explore in-depth comparisons to determine which investment aligns better with your asset appreciation goals.

Regulatory Risk

Crowdfunding real estate investments are subject to stringent SEC regulations and state securities laws, requiring platforms to maintain transparency and investor protections, but potential regulatory shifts can impact market accessibility and funding structures. Whiskey barrel investments, often categorized under collectibles or commodities, face less regulatory oversight but carry uncertainties related to liquor licensing, import/export restrictions, and changing consumer protection rules. Explore regulatory risk factors in-depth to make an informed choice between these distinct asset classes.

Source and External Links

What Is Real Estate Crowdfunding & How Does It Work - BetterWorld - Real estate crowdfunding pools money from multiple investors through online platforms to fund property projects, offering both equity (ownership) and debt (loan) investment options with varying risk and return profiles.

Crowdfunding real estate: What to know - Rocket Mortgage - Investors collectively fund residential or commercial real estate deals via online platforms, enabling participation in projects that would otherwise require significant individual capital, thus diversifying portfolios with less hands-on effort.

Arrived | Easily Invest in Real Estate - Platforms like Arrived allow individuals to invest small amounts (from $100) in pre-vetted rental properties, earning passive income from dividends and potential appreciation without the responsibilities of property management.

dowidth.com

dowidth.com