Royalty streams generate ongoing revenue from intellectual property rights such as patents, trademarks, or copyrights, providing investors with a share of the income without the principal repayment obligations typical in traditional lending. Interest income arises from lending capital through bonds, loans, or savings accounts, delivering predictable periodic payments based on the loan's interest rate. Discover more about how these income types can diversify your investment portfolio.

Why it is important

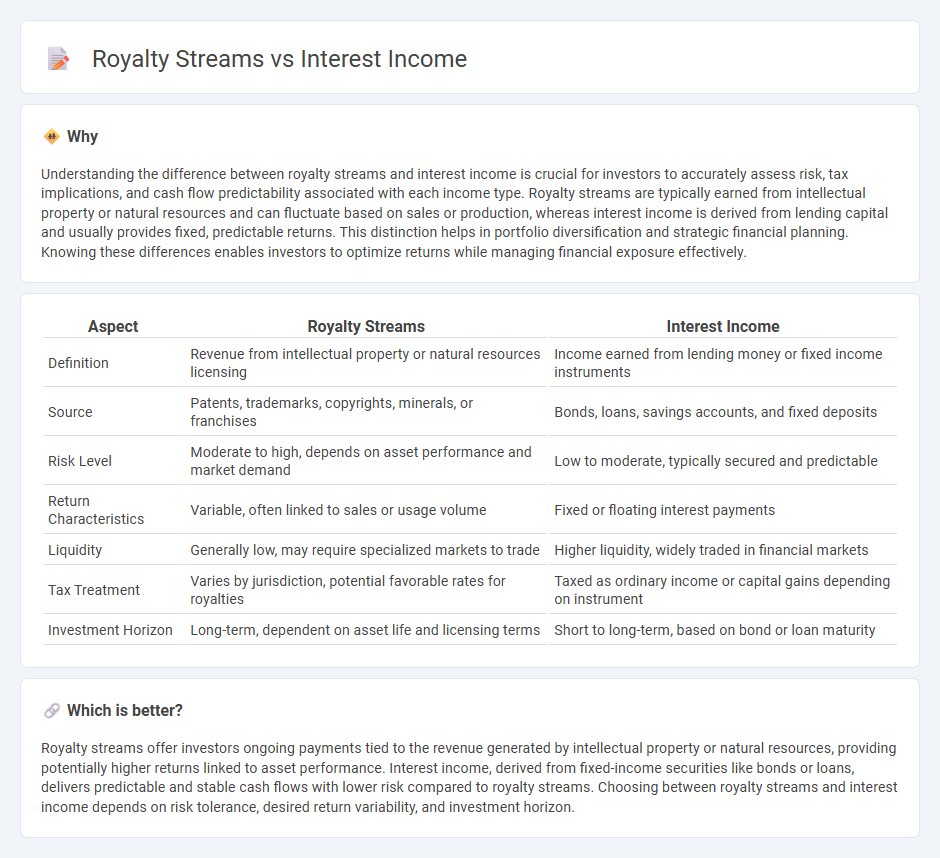

Understanding the difference between royalty streams and interest income is crucial for investors to accurately assess risk, tax implications, and cash flow predictability associated with each income type. Royalty streams are typically earned from intellectual property or natural resources and can fluctuate based on sales or production, whereas interest income is derived from lending capital and usually provides fixed, predictable returns. This distinction helps in portfolio diversification and strategic financial planning. Knowing these differences enables investors to optimize returns while managing financial exposure effectively.

Comparison Table

| Aspect | Royalty Streams | Interest Income |

|---|---|---|

| Definition | Revenue from intellectual property or natural resources licensing | Income earned from lending money or fixed income instruments |

| Source | Patents, trademarks, copyrights, minerals, or franchises | Bonds, loans, savings accounts, and fixed deposits |

| Risk Level | Moderate to high, depends on asset performance and market demand | Low to moderate, typically secured and predictable |

| Return Characteristics | Variable, often linked to sales or usage volume | Fixed or floating interest payments |

| Liquidity | Generally low, may require specialized markets to trade | Higher liquidity, widely traded in financial markets |

| Tax Treatment | Varies by jurisdiction, potential favorable rates for royalties | Taxed as ordinary income or capital gains depending on instrument |

| Investment Horizon | Long-term, dependent on asset life and licensing terms | Short to long-term, based on bond or loan maturity |

Which is better?

Royalty streams offer investors ongoing payments tied to the revenue generated by intellectual property or natural resources, providing potentially higher returns linked to asset performance. Interest income, derived from fixed-income securities like bonds or loans, delivers predictable and stable cash flows with lower risk compared to royalty streams. Choosing between royalty streams and interest income depends on risk tolerance, desired return variability, and investment horizon.

Connection

Royalty streams generate consistent cash flow from intellectual property rights, which can be reinvested to earn interest income, creating a diversified income portfolio. Investors leverage royalty payments as predictable revenue sources while placing surplus funds in interest-bearing accounts or bonds to optimize overall returns. This connection enhances financial stability by balancing variable royalties with steady interest earnings, maximizing investment growth.

Key Terms

Passive Income

Interest income and royalty streams both generate passive income but differ in origin and risk profile. Interest income arises from lending capital, such as bonds or savings accounts, providing predictable returns with relatively low risk. Royalty streams stem from intellectual property rights or natural resource extraction, offering potentially higher returns linked to market demand and usage; explore how these streams can diversify your passive income portfolio.

Tax Treatment

Interest income is generally taxed as ordinary income at the recipient's marginal tax rate, often subject to withholding tax if received from foreign sources. Royalty streams are typically classified as passive income, with tax treatment varying based on the jurisdiction, including potential withholding taxes and eligibility for tax treaties or reductions under intellectual property agreements. Explore detailed tax regulations to optimize income structuring and compliance strategies.

Revenue Source

Interest income arises from lending capital or deposits, generating predictable cash flow based on fixed or variable interest rates. Royalty streams derive from intellectual property rights, such as patents, trademarks, or copyrights, producing ongoing revenue tied to the commercial use or sales volume of the licensed asset. Explore further to understand how these distinct revenue sources impact financial strategies and tax implications.

Source and External Links

Interest Income - Definition, Example, and How to Compute - Interest income is the amount paid to an entity for lending its money or allowing another entity to use its funds, calculated typically by multiplying the principal by the interest rate over time, and usually presented as taxable income in the income statement either under operations or other income depending on the primary business nature.

Interest income definition - AccountingTools - Interest income is the interest earned from investments or loans over a specific period, recorded either as cash received or accrued receivables, generally taxable and presented separately from interest expense in financial statements.

Interest | Department of Revenue | Commonwealth of Pennsylvania - Under Pennsylvania law, interest income from various investments is considered taxable gross income and classified separately unless earned in the ordinary course of business or related to specific types of property transactions.

dowidth.com

dowidth.com