Collectible sneakers and stocks represent two distinct investment avenues, each with unique risk and return profiles. Sneaker investments rely on limited edition releases and cultural demand, often generating high returns through resale in niche markets. Explore how these unconventional assets compare to traditional stock investments to diversify your portfolio effectively.

Why it is important

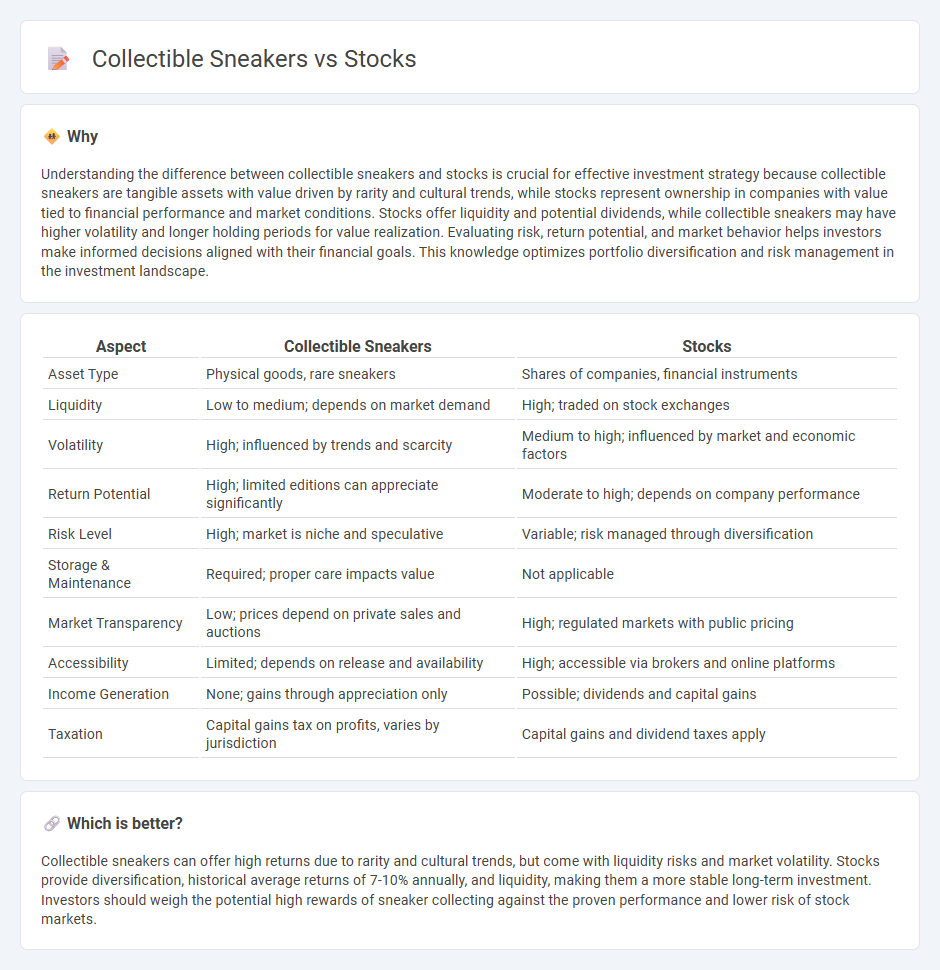

Understanding the difference between collectible sneakers and stocks is crucial for effective investment strategy because collectible sneakers are tangible assets with value driven by rarity and cultural trends, while stocks represent ownership in companies with value tied to financial performance and market conditions. Stocks offer liquidity and potential dividends, while collectible sneakers may have higher volatility and longer holding periods for value realization. Evaluating risk, return potential, and market behavior helps investors make informed decisions aligned with their financial goals. This knowledge optimizes portfolio diversification and risk management in the investment landscape.

Comparison Table

| Aspect | Collectible Sneakers | Stocks |

|---|---|---|

| Asset Type | Physical goods, rare sneakers | Shares of companies, financial instruments |

| Liquidity | Low to medium; depends on market demand | High; traded on stock exchanges |

| Volatility | High; influenced by trends and scarcity | Medium to high; influenced by market and economic factors |

| Return Potential | High; limited editions can appreciate significantly | Moderate to high; depends on company performance |

| Risk Level | High; market is niche and speculative | Variable; risk managed through diversification |

| Storage & Maintenance | Required; proper care impacts value | Not applicable |

| Market Transparency | Low; prices depend on private sales and auctions | High; regulated markets with public pricing |

| Accessibility | Limited; depends on release and availability | High; accessible via brokers and online platforms |

| Income Generation | None; gains through appreciation only | Possible; dividends and capital gains |

| Taxation | Capital gains tax on profits, varies by jurisdiction | Capital gains and dividend taxes apply |

Which is better?

Collectible sneakers can offer high returns due to rarity and cultural trends, but come with liquidity risks and market volatility. Stocks provide diversification, historical average returns of 7-10% annually, and liquidity, making them a more stable long-term investment. Investors should weigh the potential high rewards of sneaker collecting against the proven performance and lower risk of stock markets.

Connection

Collectible sneakers and stocks share a unique investment dynamic where both markets rely heavily on rarity, brand value, and consumer demand to drive appreciation. The sneaker market, like stocks, experiences fluctuations influenced by trends, hype cycles, and limited supply, creating opportunities for capital gains. Platforms that facilitate sneaker trading mirror stock exchanges by providing liquidity and price discovery, thus connecting these asset classes through their market-driven valuation mechanisms.

Key Terms

Liquidity

Stocks offer high liquidity, allowing investors to buy or sell shares quickly through established exchanges with minimal transaction costs. Collectible sneakers, on the other hand, have lower liquidity due to the niche market, reliance on platforms like StockX or physical marketplaces, and longer times to find buyers at desired prices. Explore deeper insights on asset liquidity differences to enhance your investment strategy.

Volatility

Stock markets exhibit significant volatility influenced by economic indicators, geopolitical events, and corporate earnings, often resulting in rapid price fluctuations. Collectible sneakers experience volatility driven by limited releases, cultural trends, and resale market demand, with price swings that can be less predictable but sometimes more dramatic in niche markets. Explore further to understand how volatility impacts investment strategies in stocks and collectible sneakers.

Valuation

Stock valuation relies on financial metrics such as price-to-earnings ratio, earnings growth, and market trends, providing a quantifiable and transparent basis for investment decisions. Collectible sneakers are valued based on rarity, brand collaborations, condition, and cultural significance, often leading to subjective and highly fluctuating prices. Explore deeper insights into how valuation methods impact investment strategies in both domains.

Source and External Links

Stocks | Investor.gov - Stocks represent ownership in a company and come mainly in two types: common stock, which offers voting rights and dividends, and preferred stock, which offers priority dividends and bankruptcy claims but typically no voting rights; they are further categorized by growth, income, value, blue-chip, and company size like large-cap or penny stocks.

Stocks | FINRA.org - Common stocks fluctuate in price and may pay dividends, while preferred stocks pay fixed dividends with less price volatility and have priority over common stocks in bankruptcy, with buying on margin as a riskier method of investing in stocks.

Google Finance - Stock Market Prices, Real-time Quotes & Business - Google Finance offers real-time stock market data, financial news, analytics, and tools like watchlists to help investors monitor and make informed decisions on stocks and market trends.

dowidth.com

dowidth.com