Sports card fractionalization platforms enable investors to buy shares in high-value sports cards, offering liquidity and access to rare collectibles without full ownership. Comic book investment platforms similarly allow fractional ownership but focus on graded, limited-edition comics with potential appreciation driven by market trends and pop culture influence. Explore the differences in risk, market dynamics, and return potential to determine which asset class aligns best with your investment goals.

Why it is important

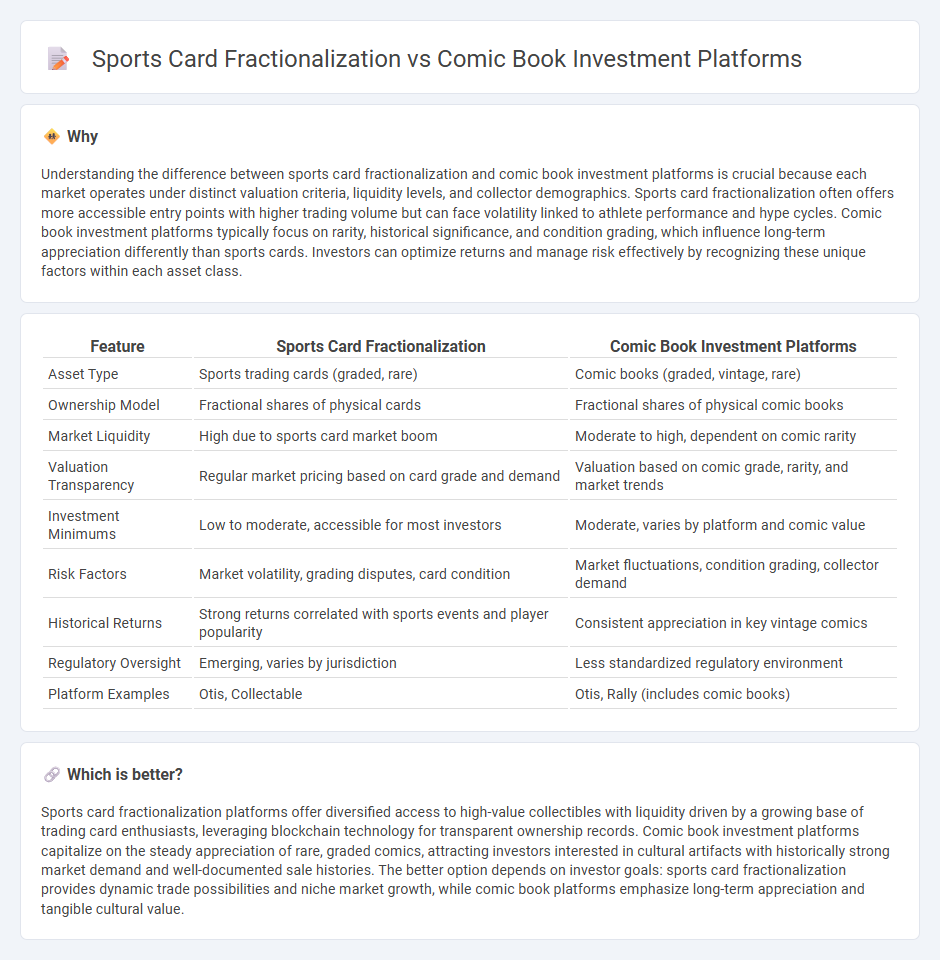

Understanding the difference between sports card fractionalization and comic book investment platforms is crucial because each market operates under distinct valuation criteria, liquidity levels, and collector demographics. Sports card fractionalization often offers more accessible entry points with higher trading volume but can face volatility linked to athlete performance and hype cycles. Comic book investment platforms typically focus on rarity, historical significance, and condition grading, which influence long-term appreciation differently than sports cards. Investors can optimize returns and manage risk effectively by recognizing these unique factors within each asset class.

Comparison Table

| Feature | Sports Card Fractionalization | Comic Book Investment Platforms |

|---|---|---|

| Asset Type | Sports trading cards (graded, rare) | Comic books (graded, vintage, rare) |

| Ownership Model | Fractional shares of physical cards | Fractional shares of physical comic books |

| Market Liquidity | High due to sports card market boom | Moderate to high, dependent on comic rarity |

| Valuation Transparency | Regular market pricing based on card grade and demand | Valuation based on comic grade, rarity, and market trends |

| Investment Minimums | Low to moderate, accessible for most investors | Moderate, varies by platform and comic value |

| Risk Factors | Market volatility, grading disputes, card condition | Market fluctuations, condition grading, collector demand |

| Historical Returns | Strong returns correlated with sports events and player popularity | Consistent appreciation in key vintage comics |

| Regulatory Oversight | Emerging, varies by jurisdiction | Less standardized regulatory environment |

| Platform Examples | Otis, Collectable | Otis, Rally (includes comic books) |

Which is better?

Sports card fractionalization platforms offer diversified access to high-value collectibles with liquidity driven by a growing base of trading card enthusiasts, leveraging blockchain technology for transparent ownership records. Comic book investment platforms capitalize on the steady appreciation of rare, graded comics, attracting investors interested in cultural artifacts with historically strong market demand and well-documented sale histories. The better option depends on investor goals: sports card fractionalization provides dynamic trade possibilities and niche market growth, while comic book platforms emphasize long-term appreciation and tangible cultural value.

Connection

Sports card fractionalization and comic book investment platforms both leverage blockchain technology to enable fractional ownership, making rare collectibles more accessible to a broader range of investors. By tokenizing high-value sports cards and comic books, these platforms facilitate liquidity and diversify portfolios with alternative assets. This innovative investment model reduces entry barriers while offering potential appreciation through the collectible market's growth.

Key Terms

Grading

Comic book investment platforms leverage established grading systems like CGC to authenticate and evaluate the condition, significantly impacting market value by providing clear standards for rarity and quality. Sports card fractionalization often relies on PSA grades to subdivide ownership while maintaining transparency and trust among investors, enhancing liquidity in a traditionally opaque market. Explore in-depth comparisons to understand how grading influences asset valuation and investor confidence across these collectible domains.

Provenance

Comic book investment platforms leverage blockchain technology to ensure transparent provenance and secure ownership tracking, enhancing investor confidence. Sports card fractionalization similarly uses digital ledgers but often lacks the same level of detailed historical data validation found in comic book marketplaces. Explore the nuances of provenance and its impact on asset value in these emerging collectibles markets.

Fractional Ownership

Fractional ownership allows investors to buy shares in high-value assets like comic books and sports cards without full purchase commitments, democratizing access and increasing liquidity in niche markets. Platforms specializing in comic book investment offer robust authentication and grading services, ensuring asset quality and market transparency, while sports card fractionalization benefits from a rapidly growing collector base and high aftermarket demand. Discover how fractional ownership transforms collectible investments and explore which asset class suits your investment strategy best.

dowidth.com

dowidth.com