Livestock investment platforms offer direct participation in agricultural assets, enabling investors to benefit from the growth and productivity of livestock with tangible backing. Private equity platforms focus on acquiring equity stakes in private companies, targeting higher returns through operational improvements and strategic growth. Explore the distinct advantages and risks of each platform to determine the best fit for your investment portfolio.

Why it is important

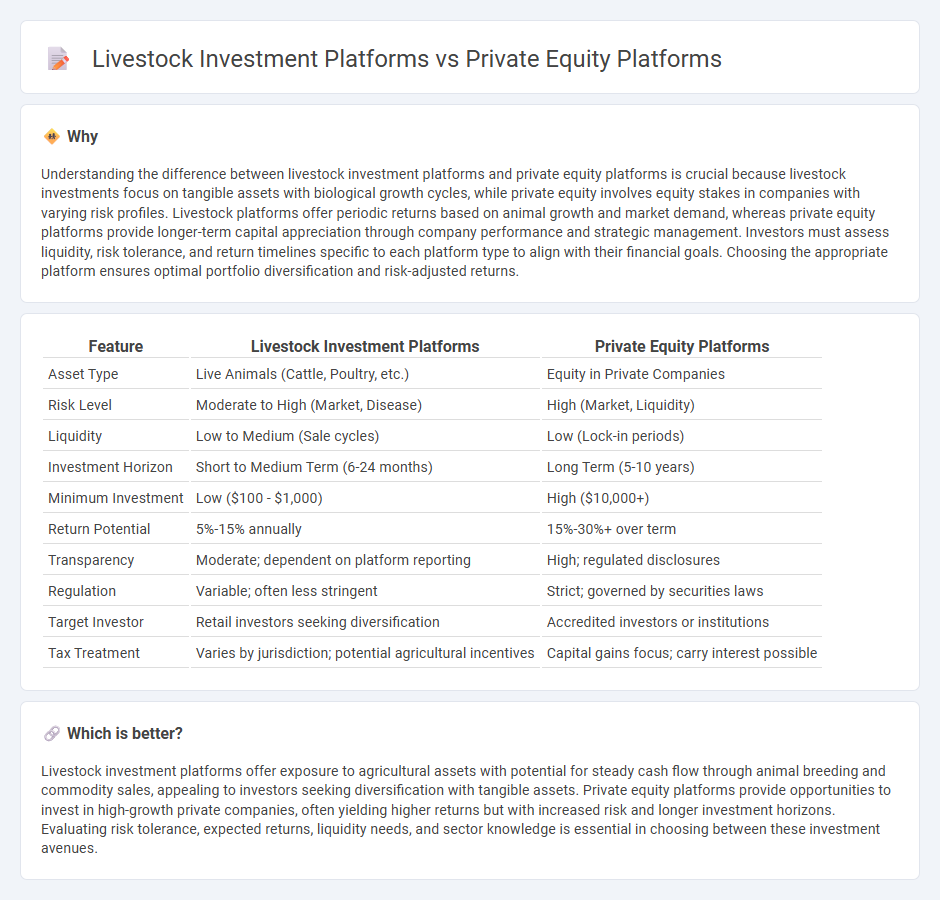

Understanding the difference between livestock investment platforms and private equity platforms is crucial because livestock investments focus on tangible assets with biological growth cycles, while private equity involves equity stakes in companies with varying risk profiles. Livestock platforms offer periodic returns based on animal growth and market demand, whereas private equity platforms provide longer-term capital appreciation through company performance and strategic management. Investors must assess liquidity, risk tolerance, and return timelines specific to each platform type to align with their financial goals. Choosing the appropriate platform ensures optimal portfolio diversification and risk-adjusted returns.

Comparison Table

| Feature | Livestock Investment Platforms | Private Equity Platforms |

|---|---|---|

| Asset Type | Live Animals (Cattle, Poultry, etc.) | Equity in Private Companies |

| Risk Level | Moderate to High (Market, Disease) | High (Market, Liquidity) |

| Liquidity | Low to Medium (Sale cycles) | Low (Lock-in periods) |

| Investment Horizon | Short to Medium Term (6-24 months) | Long Term (5-10 years) |

| Minimum Investment | Low ($100 - $1,000) | High ($10,000+) |

| Return Potential | 5%-15% annually | 15%-30%+ over term |

| Transparency | Moderate; dependent on platform reporting | High; regulated disclosures |

| Regulation | Variable; often less stringent | Strict; governed by securities laws |

| Target Investor | Retail investors seeking diversification | Accredited investors or institutions |

| Tax Treatment | Varies by jurisdiction; potential agricultural incentives | Capital gains focus; carry interest possible |

Which is better?

Livestock investment platforms offer exposure to agricultural assets with potential for steady cash flow through animal breeding and commodity sales, appealing to investors seeking diversification with tangible assets. Private equity platforms provide opportunities to invest in high-growth private companies, often yielding higher returns but with increased risk and longer investment horizons. Evaluating risk tolerance, expected returns, liquidity needs, and sector knowledge is essential in choosing between these investment avenues.

Connection

Livestock investment platforms often attract private equity firms seeking diversified agricultural assets with stable cash flow potential. Private equity platforms provide capital and strategic management to scale livestock operations efficiently, enhancing productivity and profitability. This synergy drives growth in agribusiness by leveraging private equity's funding expertise and livestock platforms' operational knowledge.

Key Terms

Portfolio Diversification

Private equity platforms enable investors to diversify portfolios by providing access to a wide range of industries, including technology, healthcare, and manufacturing, thus reducing sector-specific risks. Livestock investment platforms offer diversification through agricultural assets like cattle and poultry, often appealing to those seeking exposure to tangible, real-world commodities. Explore detailed comparisons and strategies to enhance your portfolio diversification by learning more about both investment types.

Asset Valuation

Private equity platforms emphasize comprehensive asset valuation by analyzing company financials, market position, and growth potential to determine investment worth. Livestock investment platforms focus on animal health, breed quality, and market trends affecting livestock prices for accurate asset valuation. Explore more to understand the nuances between these investment approaches.

Exit Strategy

Private equity platforms typically emphasize clear exit strategies such as initial public offerings (IPOs), mergers, or strategic sales to maximize investor returns within a defined timeframe. Livestock investment platforms often rely on natural biological cycles and market demand fluctuations to determine exit points, which can be less predictable but offer unique diversification benefits. Discover how tailored exit strategies impact investment outcomes in these distinct platforms.

Source and External Links

Moonfare - Offers retail and institutional investors access to curated, top-tier private equity funds and co-investments with lower minimums, including diversified portfolios and semi-liquid products.

What Is a Platform Company in Private Equity? - Defines a platform company as one acquired by a private equity group to serve as a base for further industry acquisitions, ultimately increasing value before resale.

19 Best Private Equity Data Providers in 2025 - Highlights leading market intelligence platforms like PE Hub, CB Insights, and Bloomberg Terminal that provide news, data, and analytics for private equity investors and professionals.

dowidth.com

dowidth.com