Psychedelic stocks represent a high-growth sector driven by emerging research and increasing acceptance of psychedelic therapies in mental health treatment, often showing volatile price movements and speculative investment potential. Blue chip stocks refer to established companies with stable earnings, strong market presence, and consistent dividend payouts, offering lower risk and long-term value appreciation. Explore the distinct risk profiles and growth opportunities of psychedelic stocks versus blue chip stocks to make informed investment decisions.

Why it is important

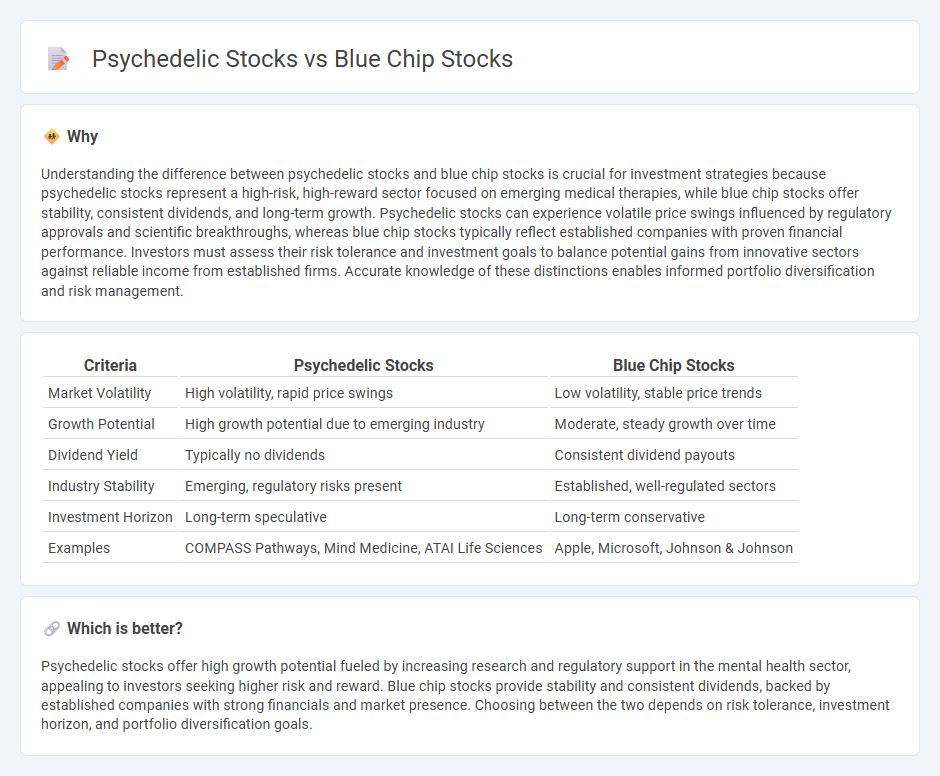

Understanding the difference between psychedelic stocks and blue chip stocks is crucial for investment strategies because psychedelic stocks represent a high-risk, high-reward sector focused on emerging medical therapies, while blue chip stocks offer stability, consistent dividends, and long-term growth. Psychedelic stocks can experience volatile price swings influenced by regulatory approvals and scientific breakthroughs, whereas blue chip stocks typically reflect established companies with proven financial performance. Investors must assess their risk tolerance and investment goals to balance potential gains from innovative sectors against reliable income from established firms. Accurate knowledge of these distinctions enables informed portfolio diversification and risk management.

Comparison Table

| Criteria | Psychedelic Stocks | Blue Chip Stocks |

|---|---|---|

| Market Volatility | High volatility, rapid price swings | Low volatility, stable price trends |

| Growth Potential | High growth potential due to emerging industry | Moderate, steady growth over time |

| Dividend Yield | Typically no dividends | Consistent dividend payouts |

| Industry Stability | Emerging, regulatory risks present | Established, well-regulated sectors |

| Investment Horizon | Long-term speculative | Long-term conservative |

| Examples | COMPASS Pathways, Mind Medicine, ATAI Life Sciences | Apple, Microsoft, Johnson & Johnson |

Which is better?

Psychedelic stocks offer high growth potential fueled by increasing research and regulatory support in the mental health sector, appealing to investors seeking higher risk and reward. Blue chip stocks provide stability and consistent dividends, backed by established companies with strong financials and market presence. Choosing between the two depends on risk tolerance, investment horizon, and portfolio diversification goals.

Connection

Psychedelic stocks and blue chip stocks intersect through their investment potential in emerging and stable sectors, respectively, offering diversification and risk balance. Psychedelic stocks represent innovative biotech ventures focused on mental health treatments, while blue chip stocks provide reliability from established companies with consistent dividends. Investors leverage both to optimize portfolio growth, combining high-growth opportunities with steady returns.

Key Terms

Market Capitalization

Blue chip stocks typically boast market capitalizations in the billions, reflecting their established stability and investor confidence within sectors like technology, finance, and consumer goods. Psychedelic stocks, often part of an emerging industry with companies specializing in mental health treatments and drug development, usually have smaller market capitalizations, indicating higher volatility and growth potential. Explore detailed market cap comparisons and investment strategies for these stocks to make informed financial decisions.

Volatility

Blue chip stocks, known for stable earnings and extensive market history, typically exhibit lower volatility, making them suitable for conservative investors. Psychedelic stocks, driven by emerging market potential and regulatory developments, experience significant price fluctuations and higher risk. Explore more to understand how volatility impacts investment strategies within these sectors.

Regulatory Environment

Blue chip stocks benefit from established regulatory frameworks, offering stability and predictable compliance costs, while psychedelic stocks face evolving and often uncertain regulatory landscapes due to shifting legalization and medical research policies. The regulatory environment for psychedelics remains fragmented across regions, impacting market entry, clinical trials, and investor risk profiles compared to blue chips. Explore more about how regulatory trends shape investment strategies in both sectors.

Source and External Links

Understanding blue-chip stocks: what they are and why you should care - Blue-chip stocks are shares in large, well-established companies known for financial stability, reliable performance, and often consistent dividend payments, such as Microsoft, Berkshire Hathaway, Procter & Gamble, and Exxon Mobil.

7 Best-Performing Blue-Chip Stocks for July 2025 - Blue-chip stocks come from major, industry-leading companies with large market capitalizations, a history of steady growth, inclusion in major market indices, and a reputation for investor reliability, though they do not guarantee immunity from market downturns.

Blue chip (stock market) - The term "blue chip" refers to stocks of corporations with a national reputation for quality, reliability, and the ability to operate profitably in both favorable and unfavorable economic conditions, originating from the high-value blue poker chips.

dowidth.com

dowidth.com