Wine investing offers tangible assets with potential for appreciation tied to vintage, provenance, and storage conditions, while rare coin investing relies on historical significance, rarity, and condition grading to determine value. Both markets require expertise and careful authentication to minimize risks and maximize returns. Explore detailed comparisons to discover which investment aligns best with your portfolio goals.

Why it is important

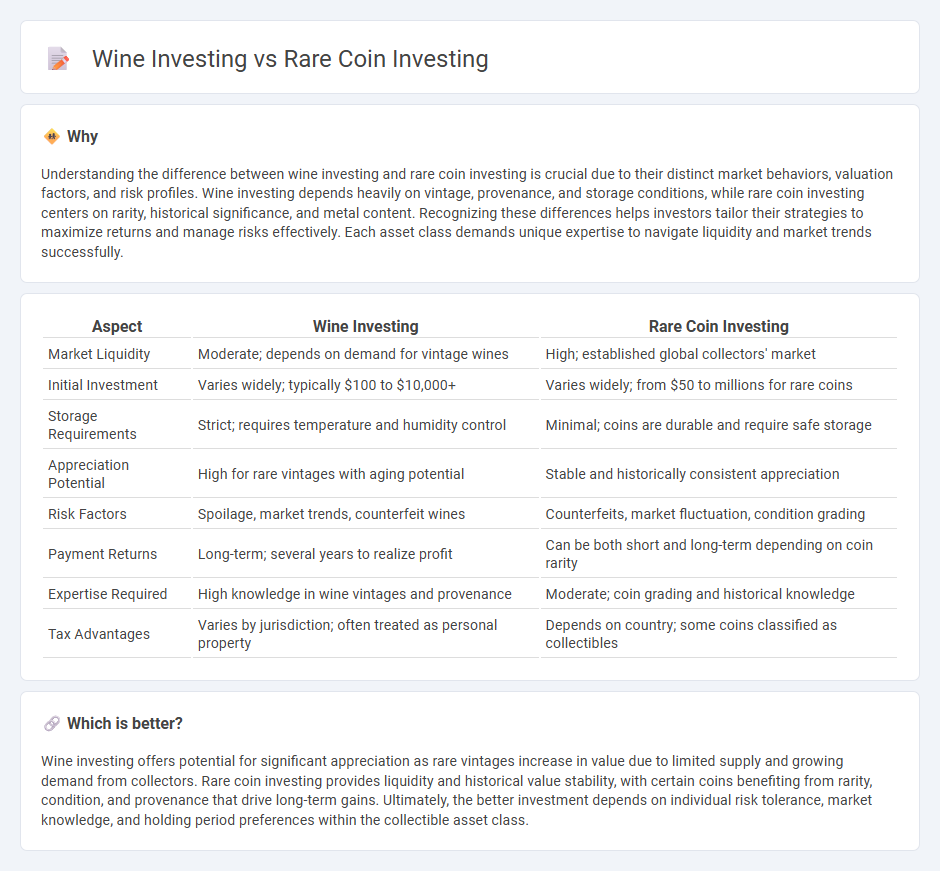

Understanding the difference between wine investing and rare coin investing is crucial due to their distinct market behaviors, valuation factors, and risk profiles. Wine investing depends heavily on vintage, provenance, and storage conditions, while rare coin investing centers on rarity, historical significance, and metal content. Recognizing these differences helps investors tailor their strategies to maximize returns and manage risks effectively. Each asset class demands unique expertise to navigate liquidity and market trends successfully.

Comparison Table

| Aspect | Wine Investing | Rare Coin Investing |

|---|---|---|

| Market Liquidity | Moderate; depends on demand for vintage wines | High; established global collectors' market |

| Initial Investment | Varies widely; typically $100 to $10,000+ | Varies widely; from $50 to millions for rare coins |

| Storage Requirements | Strict; requires temperature and humidity control | Minimal; coins are durable and require safe storage |

| Appreciation Potential | High for rare vintages with aging potential | Stable and historically consistent appreciation |

| Risk Factors | Spoilage, market trends, counterfeit wines | Counterfeits, market fluctuation, condition grading |

| Payment Returns | Long-term; several years to realize profit | Can be both short and long-term depending on coin rarity |

| Expertise Required | High knowledge in wine vintages and provenance | Moderate; coin grading and historical knowledge |

| Tax Advantages | Varies by jurisdiction; often treated as personal property | Depends on country; some coins classified as collectibles |

Which is better?

Wine investing offers potential for significant appreciation as rare vintages increase in value due to limited supply and growing demand from collectors. Rare coin investing provides liquidity and historical value stability, with certain coins benefiting from rarity, condition, and provenance that drive long-term gains. Ultimately, the better investment depends on individual risk tolerance, market knowledge, and holding period preferences within the collectible asset class.

Connection

Wine investing and rare coin investing both offer alternative asset classes that appeal to collectors seeking tangible, appreciating assets outside traditional financial markets. These investments share characteristics such as rarity, historical significance, and market-driven value fluctuations influenced by provenance and condition. Investors benefit from portfolio diversification and potential inflation hedging by allocating capital to physical goods with intrinsic and collectible value.

Key Terms

**Rare coin investing:**

Rare coin investing offers a tangible asset with historical significance and intrinsic value, often appreciating due to rarity, condition, and demand within collector communities. Unlike wine, coins are durable, easier to store, and less susceptible to spoilage, making them a more stable long-term investment option. Explore expert insights and market trends to maximize returns in rare coin investing.

Numismatics

Numismatics, the study and collection of rare coins, offers a tangible and historically rich investment avenue often characterized by high liquidity and a global collector base. Unlike wine investing, rare coins benefit from their durability, standardized grading systems, and easier storage, making them a more accessible asset for both novice and experienced investors. Explore the intricacies of numismatic investing to understand how market demand and rarity factors influence coin values.

Grading (coin condition)

Rare coin investing relies heavily on professional grading systems such as the Sheldon Scale, which grades coins from 1 to 70 based on condition, luster, and strike quality, directly affecting market value and liquidity. Wine investing focuses on vintage authenticity, provenance, and storage conditions, with grading typically centered on expert tasting notes and ratings from critics like Robert Parker, which influence the wine's market demand and price appreciation. Explore detailed comparisons of grading methodologies to optimize your investment strategy in rare coins and fine wines.

Source and External Links

Investing in Rare Coins | SoFi - Rare coins are an alternative investment that can diversify a portfolio and may appreciate over time, but they carry risks such as market volatility, potential fraud, and require diligent research to authenticate and value properly.

Rare Coin Investments | Olevian Numismatic Rarities - Long-term, informed investors have sometimes achieved superior returns with rare coins compared to traditional assets, especially when focusing on authenticated, high-quality numismatic items with historical significance.

Investing in Rare Coins - Fraud and false appreciation claims are common in the rare coin market, and success typically favors knowledgeable collectors who research rarity, grading, and dealer reputations--investors without expertise risk significant losses.

dowidth.com

dowidth.com