Fractional farmland ownership offers individual investors the opportunity to buy a specific portion of a farm, providing direct exposure to agricultural assets and potential rental income. Farm syndications pool capital from multiple investors to collectively purchase and manage larger farmland properties, spreading risk and operational responsibilities among participants. Explore the detailed differences and benefits of each investment approach to determine which aligns best with your financial goals.

Why it is important

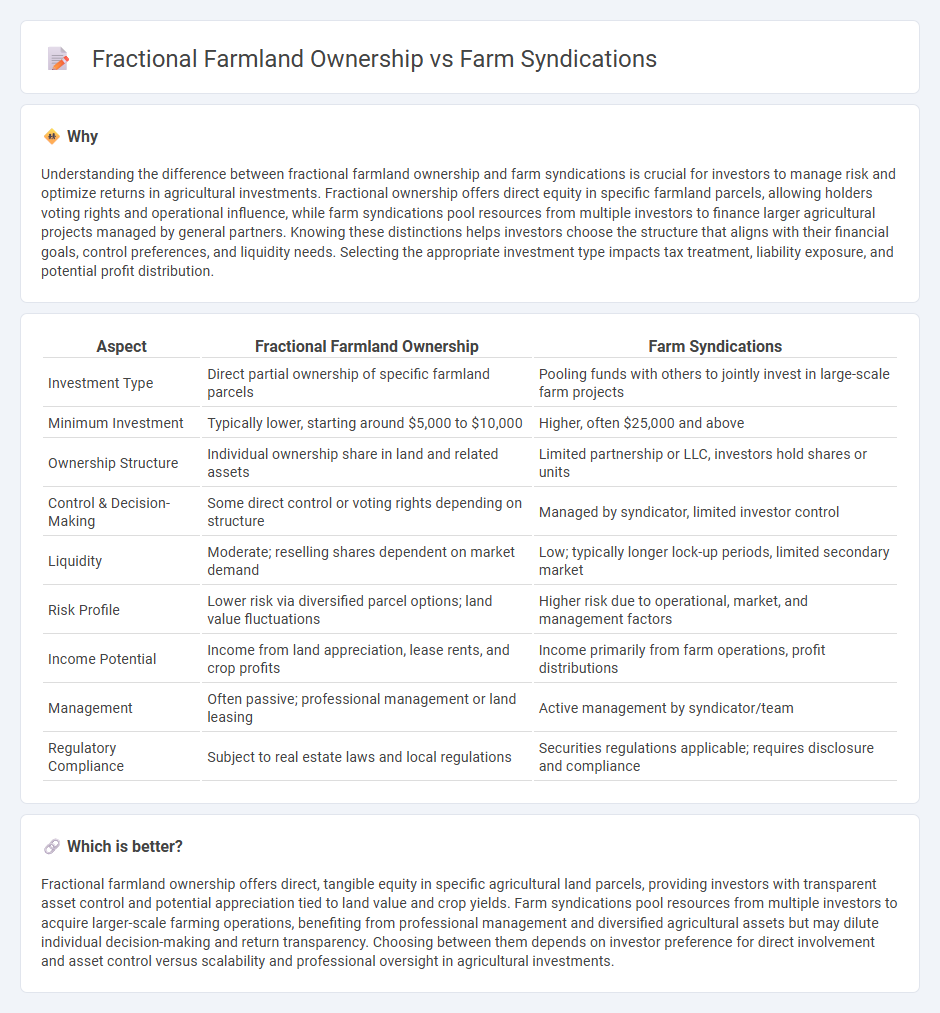

Understanding the difference between fractional farmland ownership and farm syndications is crucial for investors to manage risk and optimize returns in agricultural investments. Fractional ownership offers direct equity in specific farmland parcels, allowing holders voting rights and operational influence, while farm syndications pool resources from multiple investors to finance larger agricultural projects managed by general partners. Knowing these distinctions helps investors choose the structure that aligns with their financial goals, control preferences, and liquidity needs. Selecting the appropriate investment type impacts tax treatment, liability exposure, and potential profit distribution.

Comparison Table

| Aspect | Fractional Farmland Ownership | Farm Syndications |

|---|---|---|

| Investment Type | Direct partial ownership of specific farmland parcels | Pooling funds with others to jointly invest in large-scale farm projects |

| Minimum Investment | Typically lower, starting around $5,000 to $10,000 | Higher, often $25,000 and above |

| Ownership Structure | Individual ownership share in land and related assets | Limited partnership or LLC, investors hold shares or units |

| Control & Decision-Making | Some direct control or voting rights depending on structure | Managed by syndicator, limited investor control |

| Liquidity | Moderate; reselling shares dependent on market demand | Low; typically longer lock-up periods, limited secondary market |

| Risk Profile | Lower risk via diversified parcel options; land value fluctuations | Higher risk due to operational, market, and management factors |

| Income Potential | Income from land appreciation, lease rents, and crop profits | Income primarily from farm operations, profit distributions |

| Management | Often passive; professional management or land leasing | Active management by syndicator/team |

| Regulatory Compliance | Subject to real estate laws and local regulations | Securities regulations applicable; requires disclosure and compliance |

Which is better?

Fractional farmland ownership offers direct, tangible equity in specific agricultural land parcels, providing investors with transparent asset control and potential appreciation tied to land value and crop yields. Farm syndications pool resources from multiple investors to acquire larger-scale farming operations, benefiting from professional management and diversified agricultural assets but may dilute individual decision-making and return transparency. Choosing between them depends on investor preference for direct involvement and asset control versus scalability and professional oversight in agricultural investments.

Connection

Fractional farmland ownership enables multiple investors to purchase shares of agricultural land, reducing individual capital requirements while diversifying risk. Farm syndications aggregate funds from various investors to acquire large-scale farmland, leveraging fractional ownership principles to facilitate collective investment. Both strategies optimize access to farmland assets, enhance portfolio diversification, and democratize agricultural investment opportunities.

Key Terms

Ownership Structure

Farm syndications involve multiple investors pooling capital to collectively own and operate a farming enterprise, distributing profits and risks based on investment shares. Fractional farmland ownership grants individual investors a direct percentage of a specific parcel of land, providing distinct ownership rights and often more control over decisions related to that property. Explore the differences in ownership structures to determine which investment aligns best with your agricultural portfolio goals.

Liquidity

Farm syndications offer higher liquidity by allowing investors to pool resources and easily transfer shares, while fractional farmland ownership typically involves longer holding periods with less flexible exit options. Syndications often provide structured timelines for buyouts or secondary markets, enhancing investor access to capital. Discover how these investment methods impact your access to cash and portfolio flexibility.

Governance

Farm syndications typically centralize governance with a general partner who makes operational decisions, while fractional farmland ownership often allows investors more direct influence through collective decision-making or voting rights. Syndications streamline management but limit investor control, whereas fractional ownership promotes transparency and stakeholder participation in governance. Explore deeper insights on how governance structures impact investment returns and risk in agricultural ventures.

Source and External Links

What are farm syndicates and how do they operate? - Farm syndicates offer investors a way to buy shares in rural productive initiatives, managed by professional companies, allowing participation without direct involvement in farming activities.

Farm Syndication - A Continuing Trend - Farm syndication is a growing trend in New Zealand's rural economy, providing a platform for diversification and growth for farmers and new investors.

What Is Farm Syndication? - Farm syndication brings together various stakeholders, including farmers, investors, and market participants, to create sustainable and profitable agricultural partnerships.

dowidth.com

dowidth.com