Blue economy funds focus on sustainable investments in ocean-related sectors such as fisheries, renewable energy, and marine biotechnology, targeting long-term environmental and economic benefits. Commodity funds invest in physical goods like metals, energy resources, and agricultural products, seeking returns through market price fluctuations and demand-supply dynamics. Explore the distinct opportunities and risks in blue economy and commodity funds to diversify your investment portfolio effectively.

Why it is important

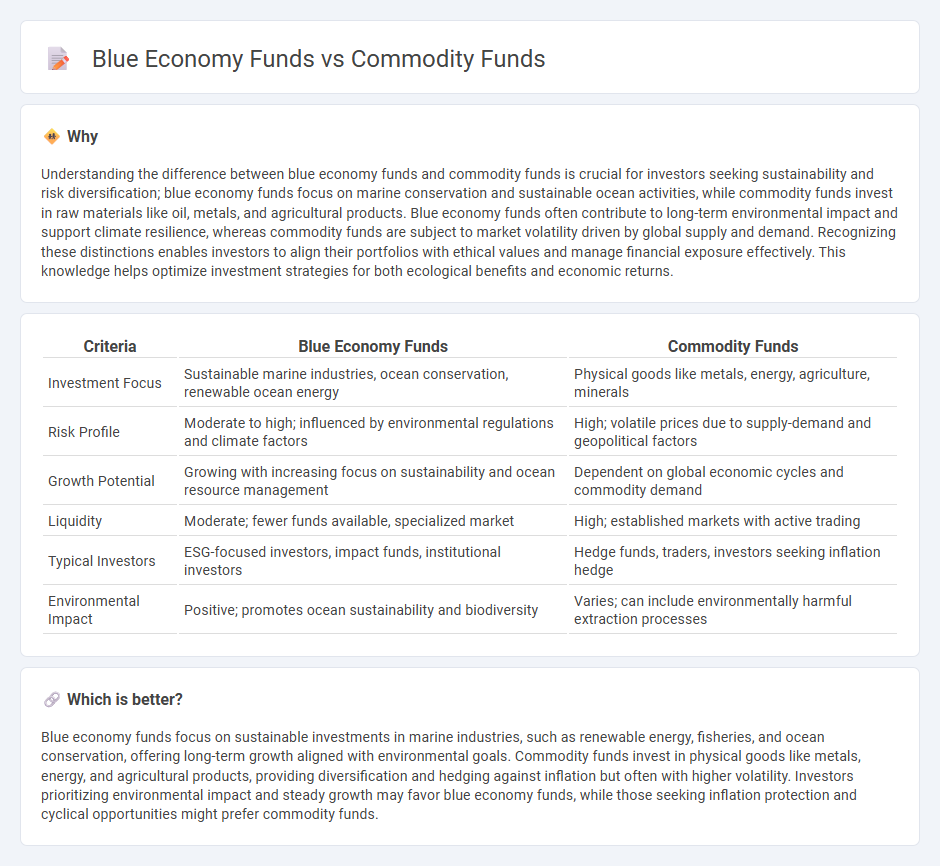

Understanding the difference between blue economy funds and commodity funds is crucial for investors seeking sustainability and risk diversification; blue economy funds focus on marine conservation and sustainable ocean activities, while commodity funds invest in raw materials like oil, metals, and agricultural products. Blue economy funds often contribute to long-term environmental impact and support climate resilience, whereas commodity funds are subject to market volatility driven by global supply and demand. Recognizing these distinctions enables investors to align their portfolios with ethical values and manage financial exposure effectively. This knowledge helps optimize investment strategies for both ecological benefits and economic returns.

Comparison Table

| Criteria | Blue Economy Funds | Commodity Funds |

|---|---|---|

| Investment Focus | Sustainable marine industries, ocean conservation, renewable ocean energy | Physical goods like metals, energy, agriculture, minerals |

| Risk Profile | Moderate to high; influenced by environmental regulations and climate factors | High; volatile prices due to supply-demand and geopolitical factors |

| Growth Potential | Growing with increasing focus on sustainability and ocean resource management | Dependent on global economic cycles and commodity demand |

| Liquidity | Moderate; fewer funds available, specialized market | High; established markets with active trading |

| Typical Investors | ESG-focused investors, impact funds, institutional investors | Hedge funds, traders, investors seeking inflation hedge |

| Environmental Impact | Positive; promotes ocean sustainability and biodiversity | Varies; can include environmentally harmful extraction processes |

Which is better?

Blue economy funds focus on sustainable investments in marine industries, such as renewable energy, fisheries, and ocean conservation, offering long-term growth aligned with environmental goals. Commodity funds invest in physical goods like metals, energy, and agricultural products, providing diversification and hedging against inflation but often with higher volatility. Investors prioritizing environmental impact and steady growth may favor blue economy funds, while those seeking inflation protection and cyclical opportunities might prefer commodity funds.

Connection

Blue economy funds and commodity funds are interconnected through their focus on natural resource investments, with blue economy funds allocating capital to sustainable ocean-based industries while commodity funds invest in raw materials such as minerals and marine resources. Both fund types capitalize on the growing global demand for renewable resources and environmentally responsible commodities, aligning investment strategies with ESG criteria. This synergy supports the transition to a sustainable economy by promoting conservation, innovation, and responsible resource management in the marine and commodity sectors.

Key Terms

Commodity Funds:

Commodity funds invest primarily in physical goods such as oil, gold, agricultural products, or metals to hedge against inflation and diversify portfolios. These funds offer exposure to global market trends and price fluctuations, making them suitable for investors seeking to benefit from commodity demand cycles. Discover more about how commodity funds can enhance your investment strategy.

Futures Contracts

Commodity funds primarily invest in futures contracts for tangible assets like oil, metals, and agricultural products, aiming to capitalize on price fluctuations in global markets. Blue economy funds, while also utilizing futures contracts, focus specifically on sustainable marine resources such as fisheries, renewable ocean energy, and maritime transportation, integrating environmental impact assessment into their investment strategy. Explore how these two fund types leverage futures contracts differently to align with their unique market goals and sustainability priorities.

Diversification

Commodity funds primarily invest in raw materials like metals, energy, and agriculture, offering diversification by exposure to physical assets that often move independently from traditional equities. Blue economy funds focus on sustainable investments related to ocean resources, including fisheries, marine biotechnology, and renewable energy, providing diversification through environmentally conscious sectors with growth potential tied to marine ecosystems. Explore detailed comparisons to understand how each fund type enhances portfolio diversification strategies.

Source and External Links

7 Best-Performing Commodity ETFs for April 2025 - Commodity ETFs are exchange-traded funds investing in physical commodities like oil, gold, and agricultural products, offering portfolio diversification and often hedging against inflation and global conflicts, with leading funds including FGDL and USG showing strong recent performance.

Commodity investing and its role in a portfolio - Vanguard - Vanguard explains commodity investing through futures contracts and highlights that including commodities in a balanced portfolio can enhance diversification and provide significant protection against unexpected inflation.

Commodities ETFs - Commodity ETFs invest in diverse commodities such as metals, livestock, and energy, with examples like the Harbor Commodity All-Weather Strategy ETF (HGER) and PIMCO Commodity Strategy Active ETF (CMDT) representing different commodity investment approaches.

dowidth.com

dowidth.com