Vintage video game investing offers unique market volatility and niche demand, often characterized by limited editions and collector enthusiasm, whereas real estate investing provides more stable, long-term asset appreciation and rental income opportunities. Both investment types require analysis of market trends, risk tolerance, and potential liquidity, with vintage games offering quicker turnaround but higher speculative risk. Discover how these asset classes compare to tailor your investment portfolio effectively.

Why it is important

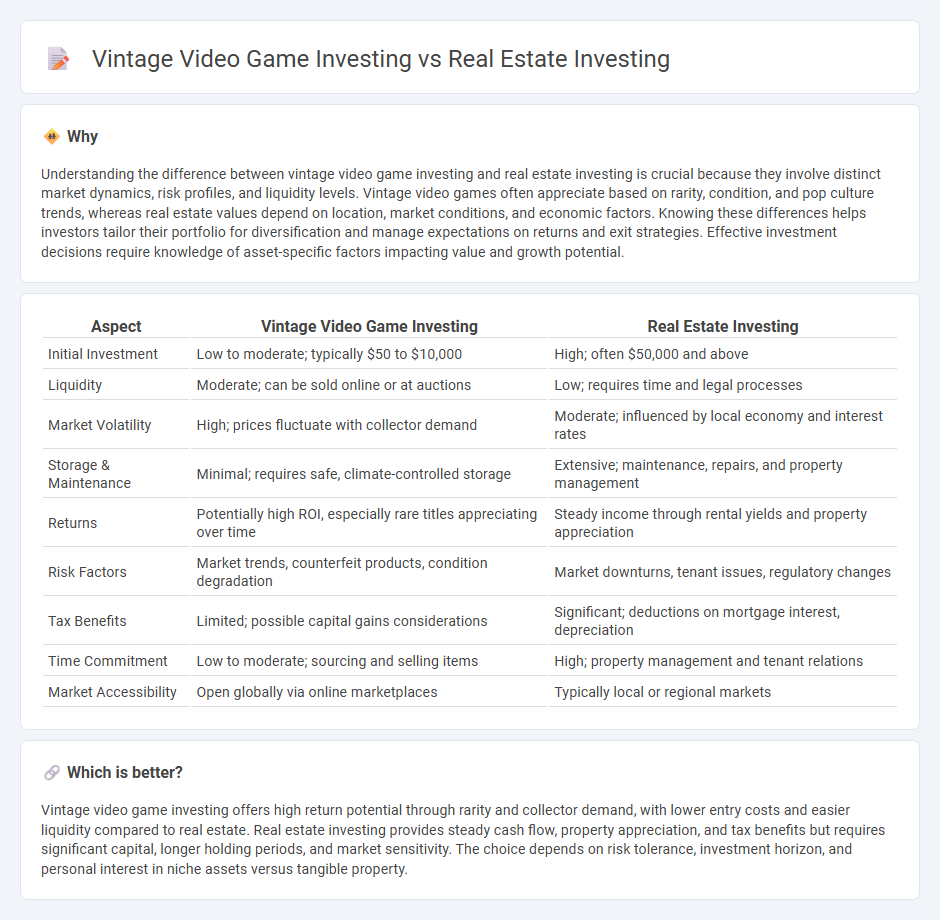

Understanding the difference between vintage video game investing and real estate investing is crucial because they involve distinct market dynamics, risk profiles, and liquidity levels. Vintage video games often appreciate based on rarity, condition, and pop culture trends, whereas real estate values depend on location, market conditions, and economic factors. Knowing these differences helps investors tailor their portfolio for diversification and manage expectations on returns and exit strategies. Effective investment decisions require knowledge of asset-specific factors impacting value and growth potential.

Comparison Table

| Aspect | Vintage Video Game Investing | Real Estate Investing |

|---|---|---|

| Initial Investment | Low to moderate; typically $50 to $10,000 | High; often $50,000 and above |

| Liquidity | Moderate; can be sold online or at auctions | Low; requires time and legal processes |

| Market Volatility | High; prices fluctuate with collector demand | Moderate; influenced by local economy and interest rates |

| Storage & Maintenance | Minimal; requires safe, climate-controlled storage | Extensive; maintenance, repairs, and property management |

| Returns | Potentially high ROI, especially rare titles appreciating over time | Steady income through rental yields and property appreciation |

| Risk Factors | Market trends, counterfeit products, condition degradation | Market downturns, tenant issues, regulatory changes |

| Tax Benefits | Limited; possible capital gains considerations | Significant; deductions on mortgage interest, depreciation |

| Time Commitment | Low to moderate; sourcing and selling items | High; property management and tenant relations |

| Market Accessibility | Open globally via online marketplaces | Typically local or regional markets |

Which is better?

Vintage video game investing offers high return potential through rarity and collector demand, with lower entry costs and easier liquidity compared to real estate. Real estate investing provides steady cash flow, property appreciation, and tax benefits but requires significant capital, longer holding periods, and market sensitivity. The choice depends on risk tolerance, investment horizon, and personal interest in niche assets versus tangible property.

Connection

Vintage video game investing and real estate investing share similarities in asset appreciation driven by scarcity and market demand. Both markets require careful evaluation of location or condition, with video games needing rarity and preservation, while real estate depends on geographic desirability and property maintenance. Diversifying investments across these tangible assets can enhance portfolio resilience against market volatility.

Key Terms

**Real Estate Investing:**

Real estate investing offers tangible asset appreciation, steady rental income, and potential tax benefits, making it a reliable wealth-building strategy. Market trends, location, and property condition significantly influence returns in real estate portfolios. Explore more to understand how real estate investing can secure your financial future.

Equity

Real estate investing offers tangible equity growth through property appreciation and mortgage principal repayment, providing a stable asset with potential passive income. Vintage video game investing revolves around the rarity, condition, and demand of collectible games, resulting in value fluctuations driven by market trends and nostalgia. Discover how equity develops differently in these investment types to optimize your portfolio strategy.

Cash Flow

Real estate investing often provides steady monthly cash flow through rental income, which can cover expenses and generate profit. Vintage video game investing relies on appreciation and occasional sales, offering less predictable cash flow but potential high returns from rare collectibles. Explore how these distinct cash flow dynamics shape your investment strategy.

Source and External Links

Real estate investing - Involves purchasing, owning, managing, renting, or selling property to generate profit or long-term wealth, with strategies and returns dependent on market analysis, valuation, and active or passive participation.

Real Estate Investing: 5 Ways to Get Started - You can invest in real estate directly through rental properties or flipping, or indirectly via REITs, real estate ETFs, or online platforms--options range from hands-on to passive and low-maintenance.

Real Estate Investing for Beginners: 5 Skills of Successful Investors - Successful real estate investing requires understanding property types, zoning, market analysis, risk assessment, and patience, as returns are not always immediate and risks vary by strategy and property.

dowidth.com

dowidth.com