Farmland crowdfunding offers investors a tangible asset with the potential for steady income through agricultural production, while commodities trading involves speculative buying and selling of raw materials like gold, oil, and grains for profit. Farmland crowdfunding provides diversification and long-term growth by pooling resources to purchase and manage agricultural land, contrasting with the high volatility and liquidity of commodities markets. Discover detailed insights on how these investment strategies compare in risk, return, and market dynamics.

Why it is important

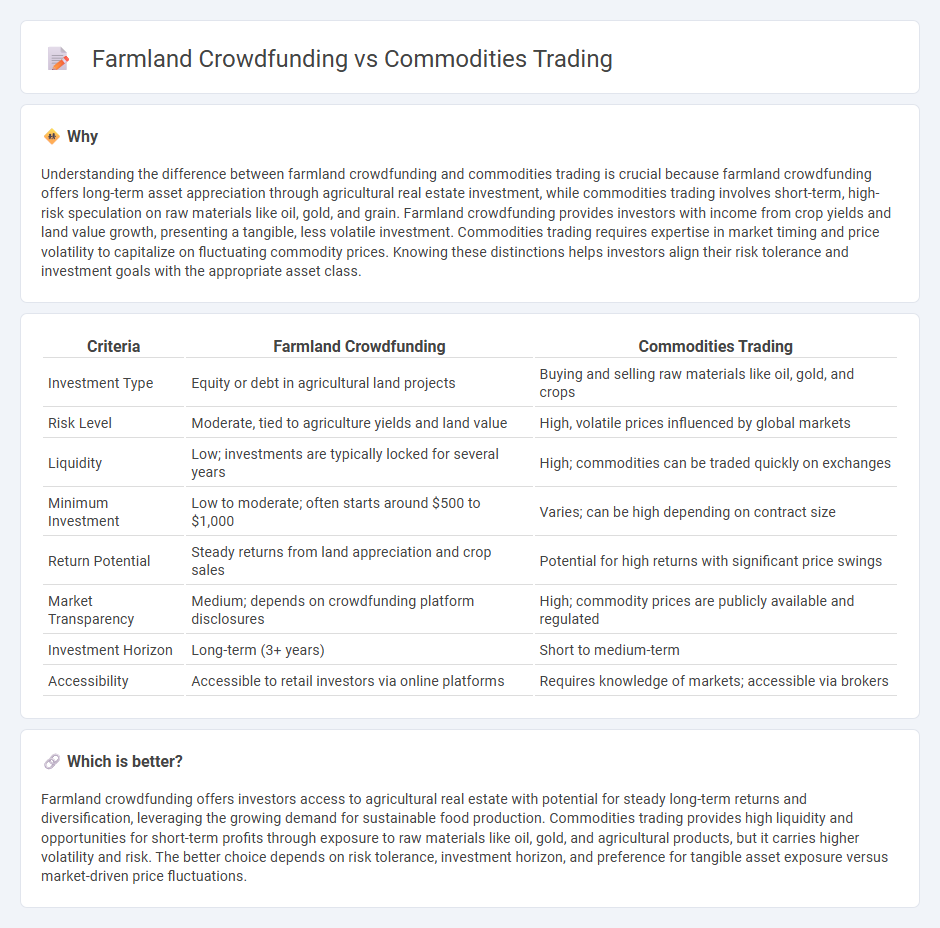

Understanding the difference between farmland crowdfunding and commodities trading is crucial because farmland crowdfunding offers long-term asset appreciation through agricultural real estate investment, while commodities trading involves short-term, high-risk speculation on raw materials like oil, gold, and grain. Farmland crowdfunding provides investors with income from crop yields and land value growth, presenting a tangible, less volatile investment. Commodities trading requires expertise in market timing and price volatility to capitalize on fluctuating commodity prices. Knowing these distinctions helps investors align their risk tolerance and investment goals with the appropriate asset class.

Comparison Table

| Criteria | Farmland Crowdfunding | Commodities Trading |

|---|---|---|

| Investment Type | Equity or debt in agricultural land projects | Buying and selling raw materials like oil, gold, and crops |

| Risk Level | Moderate, tied to agriculture yields and land value | High, volatile prices influenced by global markets |

| Liquidity | Low; investments are typically locked for several years | High; commodities can be traded quickly on exchanges |

| Minimum Investment | Low to moderate; often starts around $500 to $1,000 | Varies; can be high depending on contract size |

| Return Potential | Steady returns from land appreciation and crop sales | Potential for high returns with significant price swings |

| Market Transparency | Medium; depends on crowdfunding platform disclosures | High; commodity prices are publicly available and regulated |

| Investment Horizon | Long-term (3+ years) | Short to medium-term |

| Accessibility | Accessible to retail investors via online platforms | Requires knowledge of markets; accessible via brokers |

Which is better?

Farmland crowdfunding offers investors access to agricultural real estate with potential for steady long-term returns and diversification, leveraging the growing demand for sustainable food production. Commodities trading provides high liquidity and opportunities for short-term profits through exposure to raw materials like oil, gold, and agricultural products, but it carries higher volatility and risk. The better choice depends on risk tolerance, investment horizon, and preference for tangible asset exposure versus market-driven price fluctuations.

Connection

Farmland crowdfunding and commodities trading intersect through the agricultural commodities produced on crowdfunded farmland, where investors indirectly gain exposure to market fluctuations in crops like corn, wheat, and soybeans. The financial performance of farmland investments is influenced by commodity price volatility, supply-demand dynamics, and global trade policies affecting agricultural markets. By linking physical land assets with tradable commodity prices, both investment strategies provide diversified opportunities to capitalize on the agricultural economy.

Key Terms

Spot Price (Commodities trading)

Commodities trading revolves around the spot price, which represents the current market value of raw materials such as oil, gold, or wheat, reflecting immediate supply and demand dynamics. Unlike farmland crowdfunding, where returns depend on agricultural productivity and land value appreciation, commodities trading offers liquid, short-term investment options driven by global economic factors and geopolitical events. Explore the risks and benefits of spot price fluctuations to determine the best strategy for your investment portfolio.

Yield (Farmland crowdfunding)

Commodities trading offers volatile returns subject to market fluctuations, while farmland crowdfunding provides stable, long-term yield through agricultural income and land appreciation. Farmland crowdfunding yields typically range from 8% to 12% annually, driven by crop production, land leases, and government subsidies. Discover how farmland crowdfunding can diversify your portfolio with attractive, consistent yield opportunities.

Liquidity (applies differently to both)

Commodities trading offers high liquidity with assets traded on global exchanges, enabling quick buying and selling, whereas farmland crowdfunding involves longer-term investments with limited secondary market options, resulting in lower liquidity. The structured market dynamics and daily price fluctuations in commodities facilitate immediate access to capital, contrasting with the illiquid nature of farmland assets tied to agricultural cycles and regulatory constraints. Explore the distinct liquidity profiles of these investment types to align your portfolio strategy effectively.

Source and External Links

Commodity Trading via CFDs - FOREX.com - Commodities can be traded as futures or spot contracts, often via CFDs, allowing traders to profit from both rising and falling markets with varying margin requirements depending on the commodity.

What Are Commodities and How Do You Trade Them? - IG - Commodities trading involves buying and selling physical goods or derivatives like futures and options, influenced by factors such as supply disruptions and weather; popular commodities include gold, crude oil, silver, and agricultural products.

What is Commodities Trading? | OANDA Global Markets - Commodities are tangible goods traded often through derivatives, with pricing based on real-time data aggregated from liquidity providers; traders use platforms like MetaTrader 5 and tools to analyze market trends for trading decisions.

dowidth.com

dowidth.com