Patent monetization involves leveraging intellectual property assets to generate revenue through licensing, sales, or litigation, offering high returns but requiring specialized expertise and market demand. Real estate investment focuses on acquiring, managing, and selling property to build wealth, providing tangible assets and potential passive income with varying risk profiles based on location and market trends. Explore how these distinct investment strategies can fit your financial goals and risk tolerance.

Why it is important

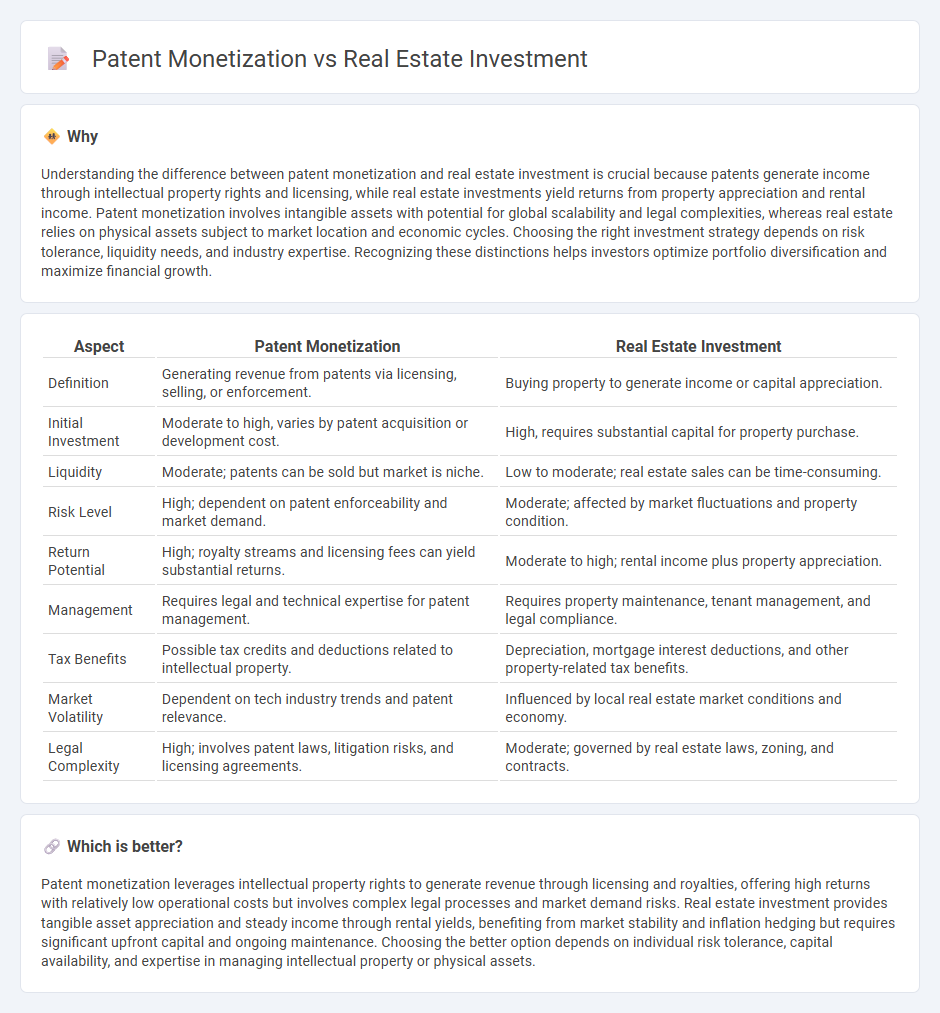

Understanding the difference between patent monetization and real estate investment is crucial because patents generate income through intellectual property rights and licensing, while real estate investments yield returns from property appreciation and rental income. Patent monetization involves intangible assets with potential for global scalability and legal complexities, whereas real estate relies on physical assets subject to market location and economic cycles. Choosing the right investment strategy depends on risk tolerance, liquidity needs, and industry expertise. Recognizing these distinctions helps investors optimize portfolio diversification and maximize financial growth.

Comparison Table

| Aspect | Patent Monetization | Real Estate Investment |

|---|---|---|

| Definition | Generating revenue from patents via licensing, selling, or enforcement. | Buying property to generate income or capital appreciation. |

| Initial Investment | Moderate to high, varies by patent acquisition or development cost. | High, requires substantial capital for property purchase. |

| Liquidity | Moderate; patents can be sold but market is niche. | Low to moderate; real estate sales can be time-consuming. |

| Risk Level | High; dependent on patent enforceability and market demand. | Moderate; affected by market fluctuations and property condition. |

| Return Potential | High; royalty streams and licensing fees can yield substantial returns. | Moderate to high; rental income plus property appreciation. |

| Management | Requires legal and technical expertise for patent management. | Requires property maintenance, tenant management, and legal compliance. |

| Tax Benefits | Possible tax credits and deductions related to intellectual property. | Depreciation, mortgage interest deductions, and other property-related tax benefits. |

| Market Volatility | Dependent on tech industry trends and patent relevance. | Influenced by local real estate market conditions and economy. |

| Legal Complexity | High; involves patent laws, litigation risks, and licensing agreements. | Moderate; governed by real estate laws, zoning, and contracts. |

Which is better?

Patent monetization leverages intellectual property rights to generate revenue through licensing and royalties, offering high returns with relatively low operational costs but involves complex legal processes and market demand risks. Real estate investment provides tangible asset appreciation and steady income through rental yields, benefiting from market stability and inflation hedging but requires significant upfront capital and ongoing maintenance. Choosing the better option depends on individual risk tolerance, capital availability, and expertise in managing intellectual property or physical assets.

Connection

Patent monetization and real estate investment intersect through the strategic use of intellectual property as collateral to secure financing for property acquisitions. Leveraging patents can enhance an investor's portfolio value, enabling access to funds or partnerships that facilitate real estate development and expansion. This approach integrates intangible asset management with tangible asset growth, optimizing overall investment returns.

Key Terms

Asset Valuation

Real estate investment centers on tangible asset valuation, where property location, market trends, and physical conditions heavily influence worth and potential returns. Patent monetization relies on intellectual property valuation, assessing factors such as patent scope, enforceability, market demand, and licensing potential to determine financial value. Explore detailed strategies on asset valuation for both domains to enhance your investment decisions.

Income Streams

Real estate investment generates income primarily through rental yields and property value appreciation, offering tangible asset security and potential tax benefits. Patent monetization yields revenue via licensing agreements, royalties, and outright sales, capitalizing on intellectual property rights with scalable long-term profitability. Explore detailed strategies and risk profiles to optimize your income streams effectively.

Liquidity

Real estate investments often suffer from low liquidity due to lengthy transaction processes and market volatility, making it challenging to quickly convert assets into cash. Patent monetization, through licensing or selling intellectual property rights, provides higher liquidity with potentially faster cash flow, especially in thriving innovation sectors. Explore how optimizing liquidity can influence your choice between real estate and patent portfolios.

Source and External Links

Real Estate Investing: 5 Ways to Get Started - You can start investing in real estate through REITs, real estate platforms, rental properties, or flipping properties, with REITs being popular due to their dividend payouts and accessibility via brokerage accounts.

Real Estate Investment Trusts (REITs) - REITs are companies that own and operate income-producing real estate, offering investors a way to earn income from commercial properties without owning them directly, with both publicly traded and non-traded options available.

Arrived | Easily Invest in Real Estate - Arrived offers a platform to invest in pre-vetted rental properties starting from $100, allowing investors to earn passive income from rental payments and potential property appreciation while Arrived manages the properties.

dowidth.com

dowidth.com