Wine funds and art funds represent unique alternatives in investment portfolios, offering diversification through tangible assets with potential for appreciation over time. Wine funds focus on rare and vintage wines, leveraging market demand and rarity, while art funds invest in valuable artworks, capitalizing on cultural significance and artist reputation. Explore the distinct advantages and risks of each fund type to determine which aligns best with your investment goals.

Why it is important

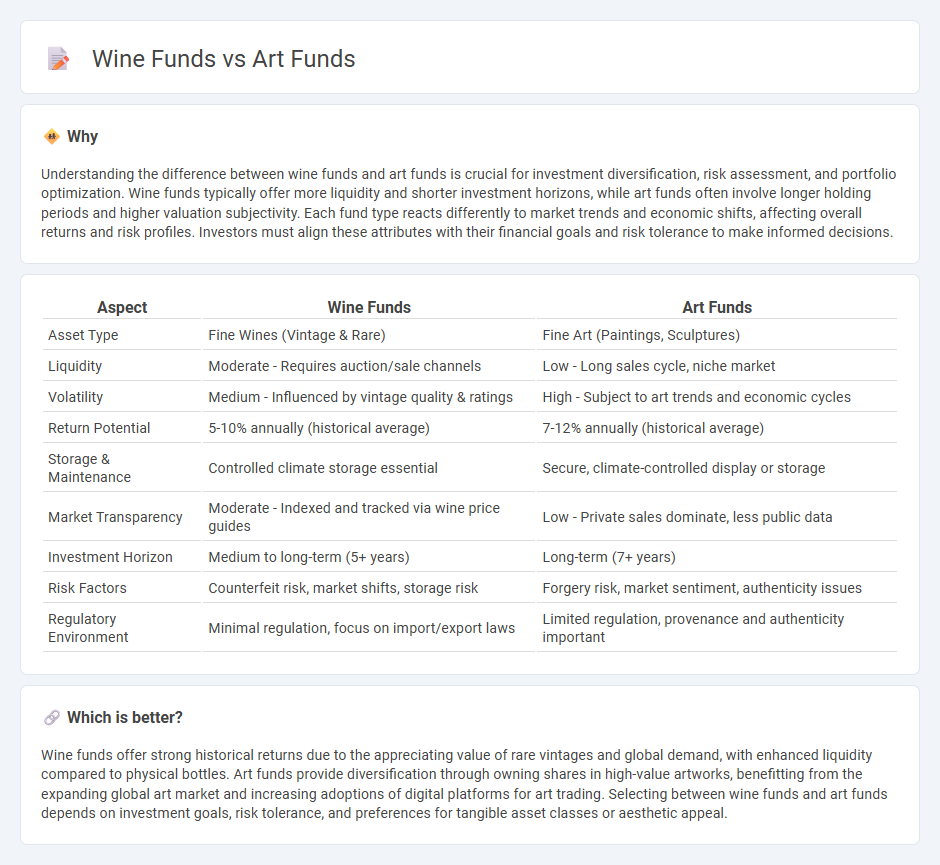

Understanding the difference between wine funds and art funds is crucial for investment diversification, risk assessment, and portfolio optimization. Wine funds typically offer more liquidity and shorter investment horizons, while art funds often involve longer holding periods and higher valuation subjectivity. Each fund type reacts differently to market trends and economic shifts, affecting overall returns and risk profiles. Investors must align these attributes with their financial goals and risk tolerance to make informed decisions.

Comparison Table

| Aspect | Wine Funds | Art Funds |

|---|---|---|

| Asset Type | Fine Wines (Vintage & Rare) | Fine Art (Paintings, Sculptures) |

| Liquidity | Moderate - Requires auction/sale channels | Low - Long sales cycle, niche market |

| Volatility | Medium - Influenced by vintage quality & ratings | High - Subject to art trends and economic cycles |

| Return Potential | 5-10% annually (historical average) | 7-12% annually (historical average) |

| Storage & Maintenance | Controlled climate storage essential | Secure, climate-controlled display or storage |

| Market Transparency | Moderate - Indexed and tracked via wine price guides | Low - Private sales dominate, less public data |

| Investment Horizon | Medium to long-term (5+ years) | Long-term (7+ years) |

| Risk Factors | Counterfeit risk, market shifts, storage risk | Forgery risk, market sentiment, authenticity issues |

| Regulatory Environment | Minimal regulation, focus on import/export laws | Limited regulation, provenance and authenticity important |

Which is better?

Wine funds offer strong historical returns due to the appreciating value of rare vintages and global demand, with enhanced liquidity compared to physical bottles. Art funds provide diversification through owning shares in high-value artworks, benefitting from the expanding global art market and increasing adoptions of digital platforms for art trading. Selecting between wine funds and art funds depends on investment goals, risk tolerance, and preferences for tangible asset classes or aesthetic appeal.

Connection

Wine funds and art funds are both alternative investment vehicles that diversify portfolios by allocating capital to tangible, non-traditional assets with potential for appreciation. These funds leverage market trends, rarity, and provenance to enhance asset value, appealing to investors seeking inflation hedges and low correlation with standard equities. The management of these funds requires specialized expertise in valuation, authentication, and market analysis to optimize returns and mitigate risks.

Key Terms

Asset Valuation

Art funds derive asset valuation primarily from expert appraisals, historical sales data, and provenance documentation, often complicated by subjective rarity and market trends. Wine funds rely on storage conditions, vintage reliability, and auction prices for valuation, with market demand influenced by aging potential and brand reputation. Explore the nuanced methodologies behind art and wine fund valuations to understand their investment potentials fully.

Liquidity

Art funds typically offer lower liquidity due to the niche market and longer holding periods required for asset appreciation, while wine funds often provide more frequent trading opportunities because of standardized auction markets and shorter investment horizons. Wine investments benefit from established secondary markets and faster transaction times, making it easier for investors to liquidate holdings compared to the more illiquid art sector. Explore detailed comparisons to understand which option aligns with your liquidity needs and investment strategy.

Provenance

Art funds emphasize detailed provenance histories to authenticate artwork and secure investments, utilizing documentation, expert appraisals, and ownership records. Wine funds rely heavily on provenance by tracking vineyard origins, vintage data, and storage conditions to ensure authenticity and maintain value. Explore the intricacies of provenance in art and wine funds to better understand their impact on investment security.

Source and External Links

Basics of Art Funds and their Managers - Art funds are private investment funds that generate returns by acquiring and selling artworks, using strategies like buy-and-hold, geographic arbitrage, investing in specific periods or emerging artists, leveraging, and distressed art buying among others.

VIA Art Fund - VIA Art Fund supports contemporary art through grants to artists, curators, and institutions, emphasizing artistic production, public engagement, and thought leadership since 2013.

Invest in Art - Own Shares in Masterpieces - Yieldstreet offers investors fractional ownership in a diversified pool of fine art, providing access to historical art returns and portfolio diversification through an art equity fund.

dowidth.com

dowidth.com